Upcoming Listing of an Accounting Software Company: Autocount Dotcom Berhad

LV Trading Diary

Publish date: Mon, 24 Apr 2023, 11:12 AM

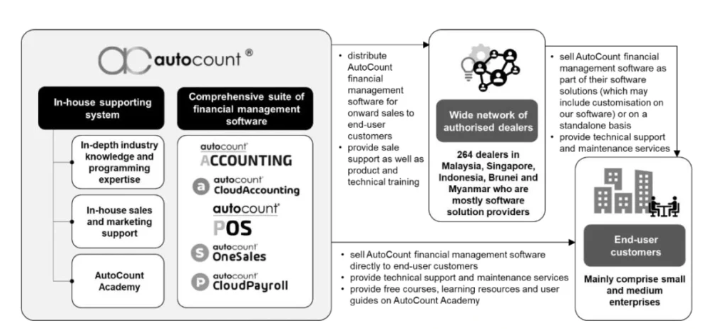

Autocount Dotcom Berhad (ADB, 0276) is a financial management software developer founded in 1996 that focuses on providing financial management software and solutions for small and medium-sized enterprises, according to their official website.

The company's software products, including Autocount Accounting, Autocount Point of Sales (POS), Autocount One Sales, and Autocount CloudPayroll, aim to improve the financial efficiency and accuracy of businesses, enabling them to achieve better financial management. With 27 years of software development experience, ADB is now one of Malaysia's leading financial management software suppliers, serving approximately 200,000 enterprises and companies.

It is worth mentioning that all Autocount software is internally developed and sold to end-user customers through the company's authorized dealers, direct sales, and marketing teams. Currently, the company has approximately 250 authorized dealers in Malaysia, Singapore, Indonesia, Brunei, and Myanmar.

According to the prospectus, the company's main source of revenue comes from the sales of Accounting software, contributing approximately RM26.74 million or 69.05% of the total revenue in the 2022 fiscal year. Next is POS software (11.37%), technical support and maintenance (9.29%), payroll software (7.60%), and other businesses* (2.69%).

*Other business revenue comes from reselling computer hardware, third-party software license fees, and selling Autocount accounting software course training materials to educational institutions.

ADB's main market is Malaysia, which accounted for approximately 80.65% of the total revenue in the 2022 fiscal year. The next largest markets are Singapore (18.72%) and other countries* (0.63%).

*Other countries include Indonesia, Brunei, Myanmar, Hong Kong, Vietnam, and Australia.

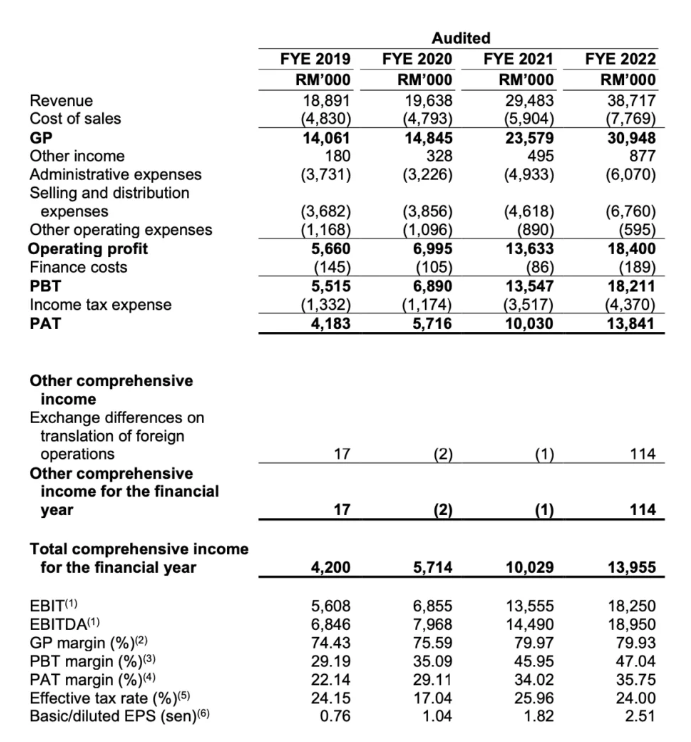

ADB has performed exceptionally well in terms of finances in recent years. According to the data released by the company, it achieved approximately RM18.89 million, RM19.64 million, RM29.48 million, and RM38.72 million in revenue in the 2019, 2020, 2021, and 2022 fiscal years, respectively, showing a year-on-year growth trend.

The company's net profit has also been increasing year-on-year, reaching RM4.18 million in 2019, RM5.72 million in 2020, RM10.03 million in 2021, and RM13.84 million in 2022. This indicates that the company's business is continuously developing and achieving outstanding performance.

It is noteworthy that ADB's gross profit margin has remained above 74.00% over the past four years. This indicates that the company has a very high pricing power, and its brand awareness and quality recognition are also outstanding.

Although ADB is a leader in the Malaysian financial management software market, it still faces competition from other software companies. In Malaysia, there are other software companies that provide similar financial management software and solutions, such as SQL, MYOB, Sage, and Xero. These companies have a certain competitive advantage over Autocount Dotcom Berhad in terms of market share and brand awareness. According to a market research report by Smith Zander International Sdn Bhd, ADB's market share in Malaysia is only about 13.76%. Therefore, ADB needs to continuously improve its product quality and service level to maintain its competitive advantage and market position.

Additionally, Autocount Dotcom Berhad's closest listed competitors are Ifca MSC Berhad (IFCAMSC, 0023), which is listed on the ACE Market, and Cuscapi Berhad (CUSCAPI, 0051) and Ramssol Group Berhad (RAMSSOL, 0236), which are both listed on the Main Market. Based on the comparison of price-to-earnings ratio ("PE"), Autocount Dotcom Berhad has a PE of around 13.13 times the IPO issue price of RM0.33, while Ramssol has a PE of around 21.40 times. As IFCA and CUSCAPI have recently been in a loss-making position, Autocount Dotcom Berhad's valuation is currently considered to be undervalued.

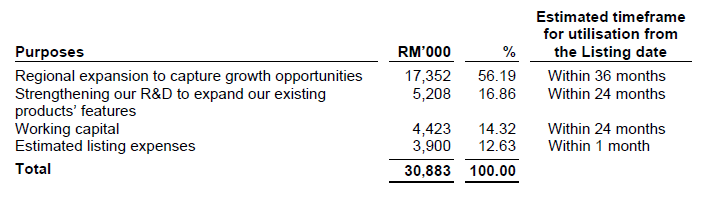

Looking ahead, Autocount Dotcom Berhad plans to expand its business into Thailand, Indonesia, Vietnam, and the Philippines, while continuing to expand its business in Singapore. As such, the company will allocate the RM17.35 million or 56.19% raised from the IPO to establish offices to promote its brand awareness and localization in those countries.

In addition, Autocount Dotcom Berhad will use approximately RM5.21 million or 16.86% of the funds raised to strengthen its research and development capabilities, to enhance its existing software and develop new software.

It is worth noting that the biggest cost for Autocount Dotcom Berhad comes from employee expenses. Therefore, the company will use approximately RM4.42 million or 14.32% of the funds raised to improve its working capital.

Finally, the company will use approximately RM3.90 million or 12.63% of the funds raised to pay for the expenses related to the IPO.

(Note: The company will publicly offer and sell approximately 137.6 million ordinary shares and expects to raise approximately RM30.88 million.)

So, are readers looking forward to the upcoming listing of Autocount Dotcom Berhad on the ACE Market on May 9th?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on LV 股票分享站

Created by LV Trading Diary | Jul 28, 2024

Created by LV Trading Diary | Jun 08, 2024

.png)