The Upcoming Listing of Mercury Securities Group Berhad - Malaysia's First Stockbroking Company to IPO in Nearly Two Decades

LV Trading Diary

Publish date: Fri, 01 Sep 2023, 10:48 PM

Have you ever wondered which company provides the stock trading platform you use? Today, I would like to introduce a company deeply involved in stock trading. That company is Mercury Securities Group Berhad (MERSEC, 0285).

From its official website, we learn that MERSEC was founded in 1984 under the name Sebarang Securities, later renamed Mercury Securities in 1992. MERSEC is a licensed 1+1 broker, offering stockbroking and corporate finance advisory services. What does it mean to be a 1+1 broker? Essentially, it means that since acquiring PTB Securities' business and CMSL* in 2003, MERSEC operates with two licenses – its own CMSL and the one acquired, allowing it to establish branches.

*CMSL stands for Capital Market Services License, a license issued by the Securities Commission Malaysia that permits entities or individuals to legally provide specific financial services related to the capital market, such as investment advisory, asset management, and fund management.

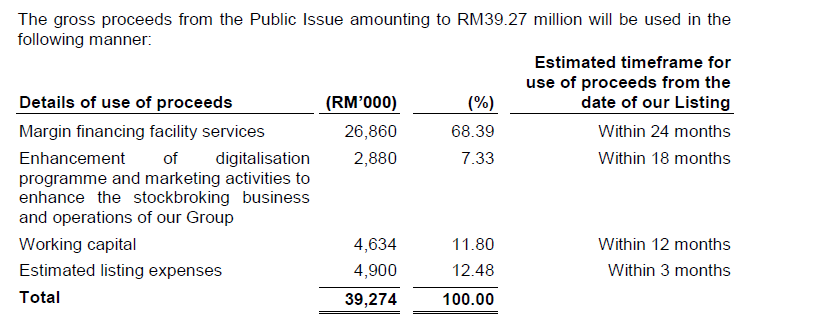

MERSEC's core businesses include stockbroking and corporate finance services. According to available information, the company's stockbroking services also include a trading platform for investors. Generally, there are three types of accounts in the stock market: Cash Upfront Account (primarily using cash), Collateralized Trading Account (using cash or stocks as collateral for a higher trading limit), and Margin Account (similar to a Collateralized Trading Account but allows for longer stock holding with interest payments, which also contribute to MERSEC's revenue). The prospectus reveals that interest rates for Margin Accounts can range from 4.50% to 18.00%, therefore, the funds raised from the company's IPO will be invested in the Margin Account to increase the revenue growth of this business.

Corporate Finance activities encompass fundraising, IPOs, additional share issuances, and mergers and acquisitions (M&A). Many well-known listed companies have sought MERSEC's services, such as Equities Tracker Holdings Berhad's LEAP IPO, CE Technology Berhad (a prominent cleanroom glove manufacturer) also with a LEAP IPO, ICT Zone Asia Berhad (another company linked to SkyWorld), Senheng New Retail Berhad's Mainboard IPO, PT Resources Holdings Berhad's ACE IPO, and Malaysia's first company to transfer from LEAP to ACE, Cosmos Technology International Berhad. Additionally, the upcoming IPO of Evergreen Max Cash Capital Berhad is also serviced by MERSEC.

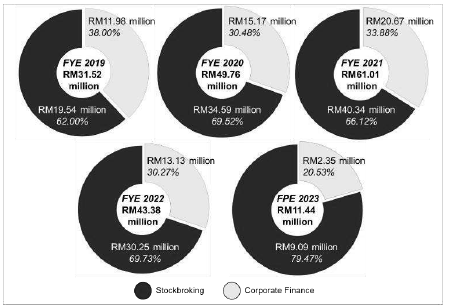

According to the prospectus, MERSEC's primary revenue is derived from stockbroking, contributing approximately RM30.25 million or 69.73% of the turnover in the 2022 fiscal year. The remaining 30.27% of the revenue comes from the corporate finance segment. With its main market being Malaysia, the company has operational offices in Kuala Lumpur, Penang, Melaka, Johor, and Sarawak.

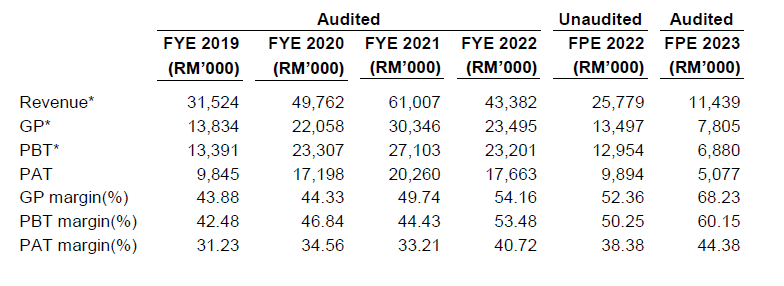

Financially, the company has shown impressive performance over the past few years. According to MERSEC's published data, the company reported approximately RM31.52 million, RM49.76 million, RM61.00 million, and RM43.38 million in revenue for the fiscal years 2019, 2020, 2021, and 2022, respectively. Net profits have also increased year by year, reaching RM9.84 million in 2019, RM17.19 million in 2020, RM20.26 million in 2021, and RM17.63 million in 2022.

Notably, MERSEC has maintained a gross profit margin of over 43.00% in the last four years, indicating that the company's services carry high added value in the market, justifying clients paying higher fees. Moreover, the company's management, led by Mr. Chew, has emphasized that the company has been consistently profitable every year since its inception in 1992.

However, it's crucial to recognize that the financial performance of MERSEC's stockbroking business is highly dependent on the performance of the securities market and overall market conditions. According to an industry overview report, average daily trading value and volume decreased by 40.30% and 48.70% in 2022, respectively, compared to 2021, amounting to RM2.20 billion and 3.0 billion shares. This decrease is primarily attributed to the normalization of retail trading to pre-pandemic levels. It's evident that this decline is the reason behind the reduction in MERSEC's revenue and net profit for the fiscal year 2022.

That said, MERSEC still holds a significant market share in both its Stockbroking and Corporate Finance Advisory businesses. According to IMR data, MERSEC's 2022 market total trading value for Stockbroking was RM531.00 billion. For Corporate Finance Advisory, its market share is approximately 9.00% in terms of Equity Fundraising and 32.00% when considering Takeovers and M&A activities, with Main, ACE, and LEAP markets accounting for 20.00%, 8.00%, and 40.00%, respectively. As the process of transitioning from LEAP to ACE becomes smoother, it is expected that more private companies will consider going public. With its relatively high market share in the LEAP market, MERSEC could benefit from this trend.

MERSEC's IPO price is RM0.250, with a PE ratio of approximately 12.63 times. Compared to recently listed companies like M&A (7082), MERSEC's IPO seems reasonably priced considering its licenses and financial performance. It's worth noting that the subscription period for MERSEC's IPO ends on September 5th. Interested investors may want to keep an eye on it.

Through this IPO, MERSEC expects to raise RM39.27 million. RM26.86 million of the funds raised will be invested in expanding the Margin Financing business and promoting the Stockbroking business. Additionally, 7.33% of the IPO proceeds will be dedicated to enhancing its electronic capabilities, reflecting the shift toward online trading. The remaining funds will be allocated to working capital and IPO expenses.

So, dear readers, are you looking forward to the listing of Mercury Securities Group Berhad on the ACE Market of Bursa Malaysia on September 19, 2023?

More articles on LV 股票分享站

Created by LV Trading Diary | Jun 08, 2024