MERSEC Unveils Q3 FY2023 Financial Performance Before Listing

LV Trading Diary

Publish date: Sun, 17 Sep 2023, 07:24 PM

Mercury Securities Group Berhad (MERSEC, 0285), which received an oversubscription of 45.45 times, recently released its latest quarterly results, showcasing impressive financial performance and a strategic vision for future growth. Without further ado, let's delve into the company's newly disclosed performance ahead of its official listing on September 19th.

Revenue Comparison (YoY = N/A, QoQ = N/A)

As this is the first quarterly report released by MERSEC before its listing, there are no year-over-year or quarter-over-quarter comparisons available.

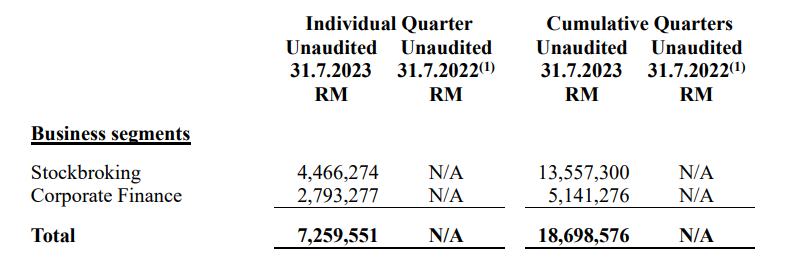

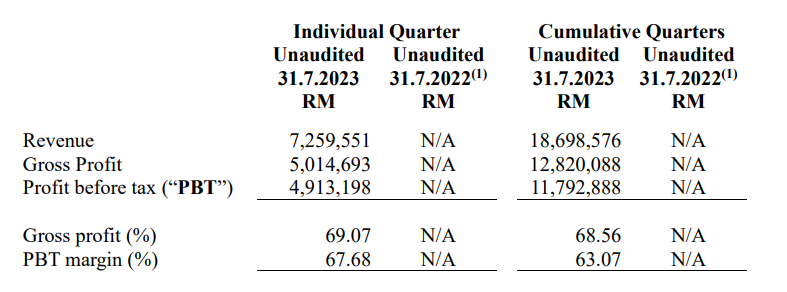

For the third quarter of the fiscal year 2023 (Q3 FY2023) ending on July 31, 2023, the company reported approximately RM7.26 million in revenue. Of this, approximately 61.52% or RM4.47 million was generated from stockbroking services, while approximately 38.48% or RM2.79 million came from corporate finance services.

(Note: MERSEC's fiscal year ends on October 31 each year.)

Looking at the quarterly report, the company achieved a cumulative revenue of approximately RM18.69 million. In the cumulative quarters, stockbroking services and corporate finance services contributed approximately RM13.55 million and RM5.14 million in revenue, respectively.

Net Profit Comparison (YoY = N/A, QoQ = N/A)

In this quarter, MERSEC achieved approximately RM3.73 million in net profit. This was attributed to strong performances in stockbroking and corporate finance services, coupled with gains from proprietary trading and other income sources, including interest income related to repo funds with financial institutions and realized gains from foreign exchange.

It's worth noting that the company's gross profit margin and pre-tax profit margin reached as high as 69.07% and 67.68%, respectively. This signifies that MERSEC offers high-value products and services and possesses excellent cost control capabilities.

Furthermore, MERSEC carries no bank loans and holds substantial cash reserves, totaling approximately RM50.61 million.

Outlook

The company is set to expand its stockbroking services, which include providing margin financing services, underwriting and placement services, nominee and custodian services, and related offerings.

Additionally, the company will continue to strengthen its online trading platforms to enhance the online trading experience for clients. As a result, it will leverage digital technology to access real-time market data and information more efficiently, continue to improve the efficiency of its stockbroking services, and attract new clients.

Lastly, what do readers think about MERSEC's stock price on the day of its listing?

More articles on LV 股票分享站

Created by LV Trading Diary | Jun 08, 2024