Upcoming IPO: Minox International Group Berhad - A Stainless Steel Parts Distributor

LV Trading Diary

Publish date: Wed, 11 Oct 2023, 08:16 AM

As per the information available on the official MINOX website, the company was founded in 1998 and is headquartered in Puchong, Selangor, Malaysia. Initially established as MST Stainless Steel Enterprise, it later rebranded itself as Minox International Group Berhad (MINOX, 0288).

MINOX primarily engages in the distribution of their in-house brand "MINOX," specializing in stainless steel sanitary-grade valves, pipes, fittings, installation components, equipment, and rubber hoses. Additionally, the company distributes related products from third-party brands. For reference, over 90.0% of their revenue is generated from their in-house brand, with stainless steel pipes and fittings (Tube & Fittings) comprising approximately 73.1% of the company's 2022 fiscal year revenue. Valves account for 14.4%, installation components and equipment represent 5.6%, rubber hoses make up 4.6%, and other related products contribute the remaining 2.6%.

Today, MINOX boasts over 25 years of experience and has garnered more than 1,700 active and recurring customers worldwide, hailing from the food and beverage, pharmaceutical, and semiconductor manufacturing sectors. According to the prospectus, the majority of the company's market revenue comes from Malaysia, accounting for approximately 36.1% of the 2022 fiscal year turnover. Following that are Indonesia (32.4%), Singapore (17.2%), Thailand (9.4%), and other countries* (4.9%). Strictly speaking, the company derives most of its revenue from overseas markets.

*Other countries include Bahrain, Cambodia, Denmark, Germany, India, Japan, South Korea, Myanmar, Sri Lanka, Spain, Taiwan, the Philippines, the United Arab Emirates, and Vietnam.

To provide professional and efficient service to their customers, MINOX has regional offices in Malaysia, Indonesia, Singapore, and Thailand, as well as representative agents in Taiwan, the Philippines, and Vietnam. Furthermore, MINOX operates a total of three warehouses in Malaysia, four in Indonesia, three in Singapore, and two in Thailand. As of August 21, 2023, the company has amassed a product portfolio of approximately 7,480 Stock-Keeping Units (SKUs), enabling them to cater to diverse customer demands and ensure swift and timely deliveries.

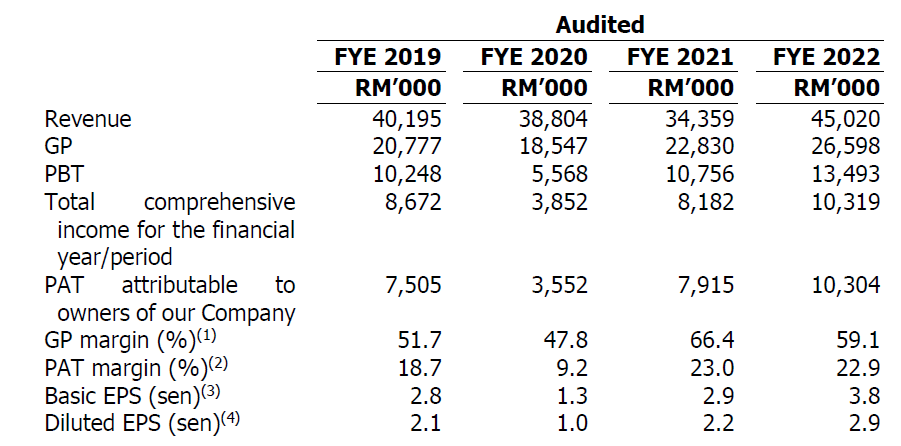

In financial terms, MINOX has demonstrated remarkable performance over the past few years, especially post-pandemic. According to data disclosed in the prospectus, MINOX achieved approximately RM40.19 million, RM38.80 million, RM34.35 million, and RM45.02 million in revenue for the fiscal years 2019, 2020, 2021, and 2022, respectively.

The company's net profit has also shown an upward trend post-pandemic, with net profits of RM7.50 million in 2019, RM3.55 million in 2020, RM7.91 million in 2021, and RM10.30 million in 2022. Notably, over the past four years, MINOX has consistently maintained a gross profit margin of over 50.00%, indicating the company's strong pricing power, top-tier product quality, and global brand recognition.

In terms of valuation, MINOX's IPO price is set at RM0.250, with a price-to-earnings (PE) ratio of approximately 10.68 times. Since there are no publicly listed companies in Malaysia directly comparable to MINOX, this valuation appears reasonable. If a comparison is made with the steel industry (due to product characteristics), the valuation seems justified.

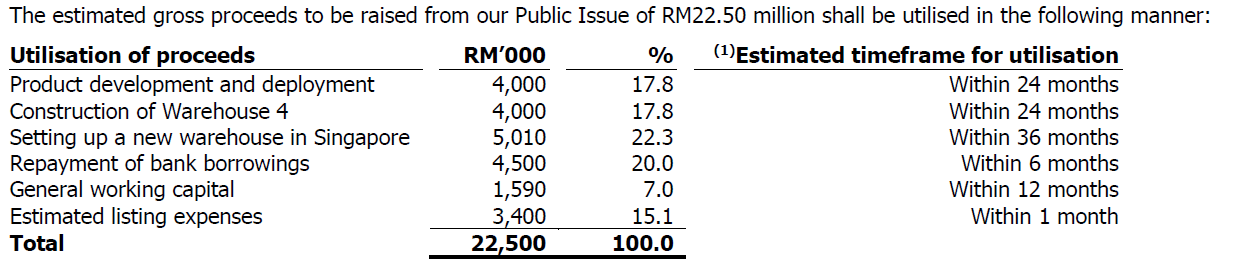

Looking ahead, MINOX plans to further expand its business in Singapore, with a focus on penetrating the semiconductor industry in the country. To achieve this, the company intends to utilize approximately RM5.01 million, or 22.3% of the IPO funds raised, to establish a warehouse in Singapore.

Additionally, the company will allocate approximately RM4.00 million, or 17.8%, to build a fourth warehouse in Puchong, Selangor. Furthermore, funds of around RM4.00 million will be earmarked for product development and deployment. The remaining funds will be used for loan repayment, working capital enhancement, and covering IPO expenses.

(Note: The company will publicly issue approximately 90 million new ordinary shares, expected to raise around RM22.50 million).

Despite the promising growth momentum of MINOX, it is not without its risks. The company's performance is closely tied to its industrial end-customers in the food and beverage, semiconductor, and pharmaceutical industries. The food and beverage sector, in particular, accounts for the majority of MINOX's revenue. Based on research, the food and beverage industry contributed approximately 88.8% of the company's revenue for the 2022 fiscal year, while the semiconductor and pharmaceutical industries each represented around 6.7% and 4.7%, respectively. If these industries experience adverse trends or economic downturns, the demand for MINOX products may decrease significantly, impacting the company's financial performance.

Besides that, MINOX is also highly dependent on third-party manufacturers and suppliers to produce its products. Since MINOX is primarily a distributor, it does not have its own manufacturing facilities.

In conclusion, it is worth noting that MINOX's initial public offering (IPO) received an oversubscription rate of 143.76 times. So, will MINOX create a buzz on its first day of listing on October 17?

———————————————————————————————————————————————————

Disclaimer: The above is purely for educational purposes and reflects personal opinions. It does not constitute any buying or selling recommendations.

If you are interested in opening a CGS-CIMB trading account, please sign up using the following link:

https://forms.gle/kZVCyDxUurxChMcg9

———————————————————————————————————————————————————————————

More articles on LV 股票分享站

Created by LV Trading Diary | Jun 08, 2024