EFRAME Achieves Record-High Revenue and Profit in Q4 FY2023

LV Trading Diary

Publish date: Sun, 29 Oct 2023, 05:05 PM

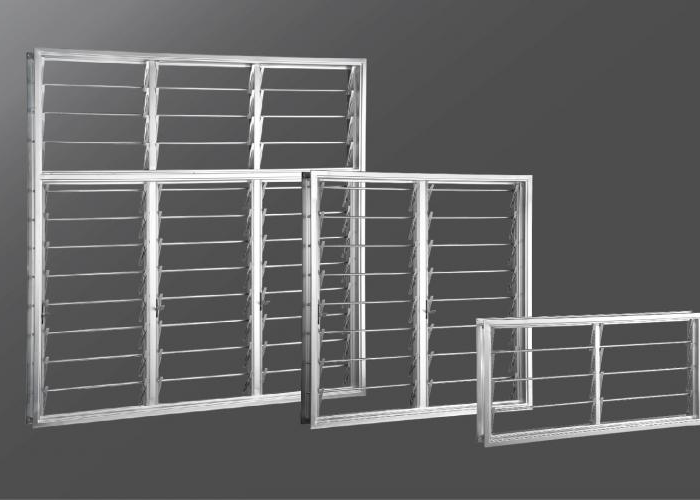

Econframe Berhad (EFRAME, 0227), Malaysia's sole publicly listed comprehensive door frame system supplier, recently announced outstanding quarterly results, marking historic highs in both revenue and profit.

Without further ado, let's delve into the highlights of EFRAME's latest performance.

Revenue Comparison (YoY +28.79%, QoQ +7.29%)

For the fourth quarter ending on August 31, 2023, the company reported a revenue of approximately RM21.02 million, representing a significant increase of about 28.79% compared to the same period in the previous year when it was RM16.32 million. This growth can be primarily attributed to increased sales orders for metal door frames and fire-resistant door sets.

Of the total revenue, around RM17.31 million was generated from the manufacturing segment, reflecting a year-on-year growth of approximately 28.07%. The remaining RM3.71 million came from the trading segment, showing a similar increase of around 32.06% year-on-year. Looking at the quarterly breakdown, metal door frames and fire-resistant door sets accounted for roughly 78.00% and 74.00% of total revenue for the quarter.

Likewise, in comparison to the previous quarter, the company's revenue increased by approximately RM1.43 million or 7.29%.

In summary, for the fiscal year 2023, EFRAME achieved a total revenue of about RM75.90 million, a growth of approximately 27.80% compared to the previous fiscal year in 2022. Management has indicated that this growth is driven by increased sales orders and higher selling prices for metal door frames and fire-resistant door sets.

Net Profit Comparison (YoY +36.70%, QoQ +15.66%)

Due to robust business income and the high gross profit margins in the manufacturing segment, EFRAME posted a net profit of approximately RM4.06 million for the quarter, showing significant year-on-year and quarter-on-quarter increases of about 36.70% and 15.66%, respectively.

In total, the company achieved a net profit of about RM13.06 million for the entire fiscal year of 2023, marking a 16.19% increase compared to the net profit of approximately RM11.24 million in the fiscal year of 2022.

It is worth noting that EFRAME remains a net cash company. The company currently holds approximately RM28.48 million in cash and cash equivalents, reflecting an increase of about 19.90% year-on-year.

Outlook

The property market faces various challenges, including the impact of macroeconomic factors like slowing economic growth. However, the government has implemented several economic stimulus measures, including stamp duty exemptions for first-time homebuyers, which are expected to continue benefiting the real estate market.

Furthermore, the acquisition of Lee & Yong Aluminium Sdn Bhd earlier this year has enhanced EFRAME's competitiveness in offering comprehensive door system solutions and expanded its product range.

Overall, the company is expected to maintain its growth trajectory and solidify its position in the industry. So, readers, what are your thoughts on EFRAME, with a current P/E ratio of approximately 24.81 times?

———————————————————————————————————————————————————

Disclaimer: The above is purely for educational purposes and reflects personal opinions. It does not constitute any buying or selling recommendations.

If you are interested in opening a CGS-CIMB trading account, please sign up using the following link:

https://forms.gle/kZVCyDxUurxChMcg9

———————————————————————————————————————————————————————————

More articles on LV 股票分享站

Created by LV Trading Diary | Jun 08, 2024