IPO - MYMBN Berhad (Part 2)

MQTrader Jesse

Publish date: Tue, 04 Jul 2023, 04:22 PM

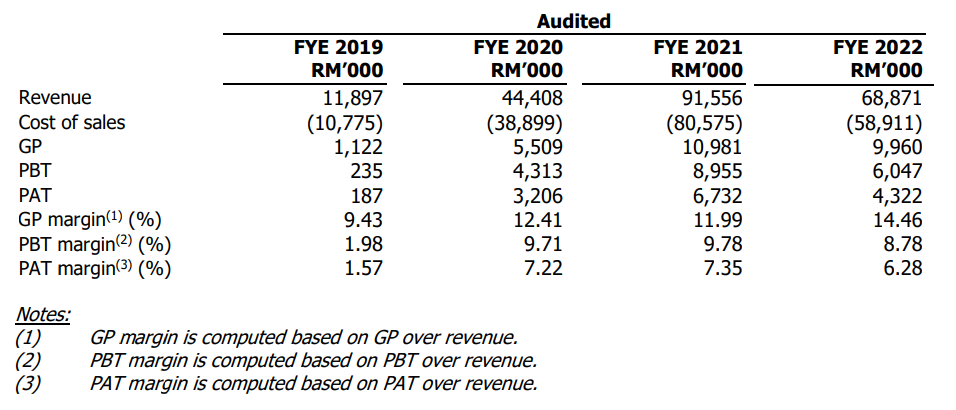

Financial Highlights

The key financial highlights of the historical audited combined and consolidated statements of comprehensive income for FYE 2019 to FYE 2022 are set out below:

- The revenue increased from RM 11 million (FYE 2019) to RM 91 million (FYE 2021) and decreased to RM 68 million (FYE 2022). The management mentioned that the decrease in sales is due to the Zero-COVID Measures resulting in a slowdown and the decrease of the selling price according to the prevailing market prices of raw bird’s nests. This shows that the business is easily affected by external factors.

- The gross profit margin is growing from 9.43% (FYE 2019) to 14.46% (FYE 2022). Although the GP margin is growing, it is still below the benchmark, which shows that the bargaining power of the company is considered weak. (Generally, a GP margin of 20% is considered high/ good).

- PAT margin increased from 1.57% (FYE 2019) to 6.28% (FYE 2022).

- The gearing ratio is 0.29 times. The gearing ratio is within the benchmark, which also means that the company leverages its resources within a healthy range. (A good gearing ratio should be between 0.25 – 0.5).

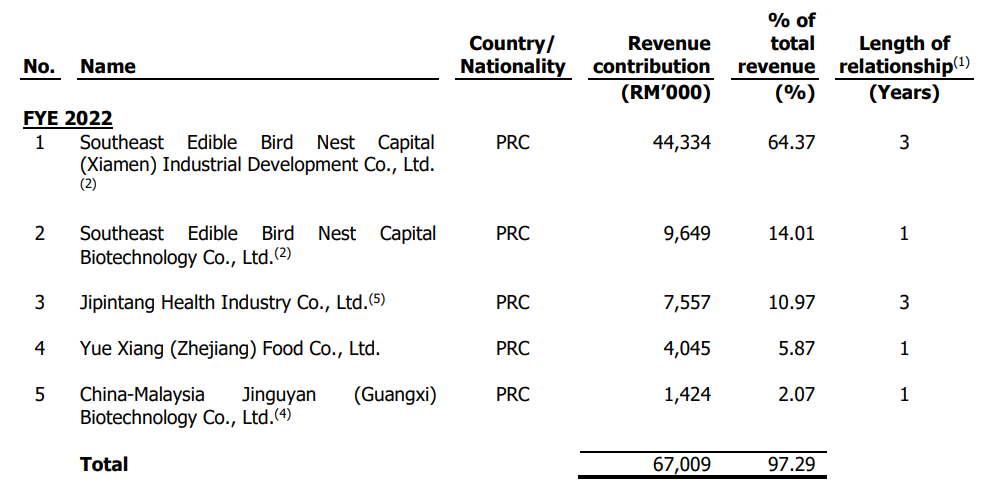

Major customer and supplier

Major Customers

The table below sets out the Group’s top five (5) customers for FYE 2022 Under Review as follows:

The top 5 major customers contribute 97.29% of the company's revenue. The top 1 customer contributes 64.37% of the company's revenue. The company is highly dependent on the top customer, which also means it is exposed to a high concentration of customer risk. This is also the reason why the bargaining power regarding price is weak and causes a low margin. Additionally, the length of the relationships with the top 5 customers ranges from 1-3 years, which is too short to demonstrate a stable relationship between the company and its customers.

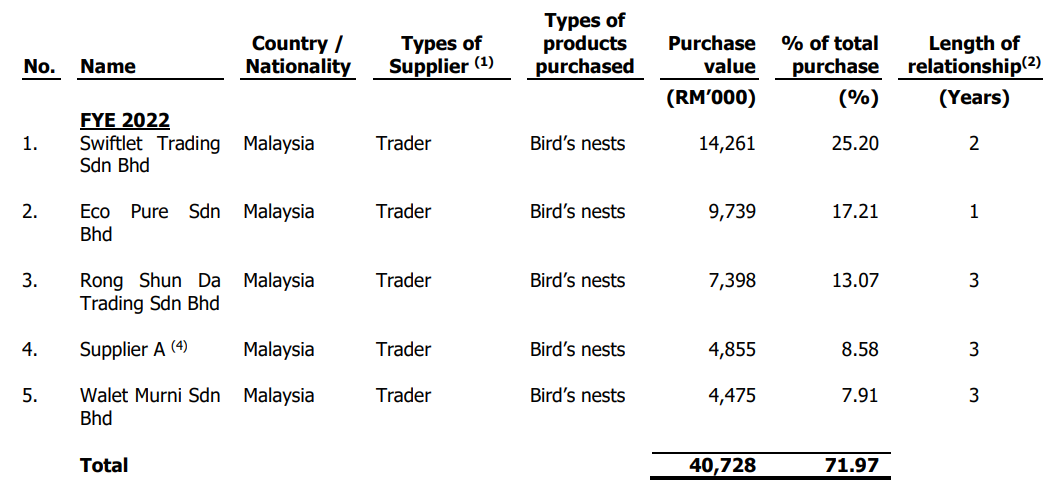

Major Suppliers

All of the Group’s suppliers are based in Malaysia. The Group’s top five (5) suppliers for FYE 2022 Under Review are as follows:

Based on the table, the top 5 suppliers account for approximately 71% of the company's total. The company has mentioned that they are not dependent on any of its major suppliers, as they have the ability to source raw bird's nests from any of the 18 Approved Suppliers.

Industry Overview

Prospects and Outlook of EBN Industry in Malaysia

According to the research of Protégé Associates, Following an economic contraction in 2020, Malaysia’s gross domestic product (“GDP”) expanded by 3.1%

despite a resurgence in COVID-19 cases and lockdown measures in 2021. Malaysia’s economy further expanded by 8.7% in 2022 following the announcement of the transition of COVID-19 into an endemic phase during the year by the Malaysian Government, whereby all economic sectors were allowed to operate without restriction. The EBN industry in Malaysia had remained resilient during the pandemic and registered positive growth during the past three years. In 2022, the value of exports of EBN in Malaysia grew by 30.0% to RM1,446.7 million, up from RM1,112.9 million in the previous year.

Factors boosting the growth within the EBN industry are likely to come from the increasing demand for EBN from international and local markets. In particular, there has been a rapid rise in demand for Malaysian EBN in China in recent years, where more cities have been increasing their consumption of EBN. This trend has also bolstered by the growing middle-income in the country, making EBN more affordable to a larger pool of consumers. At the same time, the growing affluence of consumers has also bolstered demand for local EBN. The growing disposable income has led to EBN being accessible to a larger pool of consumers. As more consumers become aware of the benefits of consuming EBN, it is also expected to drive higher demand for EBN going forward.

On the supply side, the development of the local EBN industry is expected to be supported by the Malaysian government’s initiatives. The Malaysian Government had established an EPP for boosting the production of EBN within the country, as well as push for further exports of EBN via collaboration with the authorities of other countries. The Ministry of Agriculture and Food Industries ("MAFI”) had also announced it would intensify efforts to increase the export potential of EBN to China going forward.

Overall, exports of Malaysian EBN are expected to continue expanding going forward. The market of the local EBN industry is forecast to grow at a CAGR of 34.0% from RM1,880.7 million in 2023 to RM6,246.8 million in 2027.

Overview and Prospect of the EBN Industry in China

China is the largest consumer of EBN in the world, consuming more than 60% of total EBN production. As China’s climate is generally not suitable for the farming of swiftlet nests, the country’s domestic production of EBN is negligible. As such, the country relies on imports to fulfill its demand for EBN.

In recent years, the Chinese EBN industry has experienced rapid growth, mainly due to its health and beauty benefits. The country’s growing demand for EBN has continued to drive production and exports from several countries. According to the China Chamber of Commerce for Importers and Exporters of Medicines and Health Products, the top three exporters of EBN into China are Indonesia, Malaysia and Thailand. To be an exporter of EBN to China, countries need to obtain approval from the Chinese Government. Some of the few countries that have gotten approval to export EBN to China include Singapore, Indonesia, Malaysia and Thailand. In addition, bird’s nest producers are also required to obtain the approval of the GACC before they can export to China. The GACC only began taking on the responsibility of approving the trade of bird’s nests in 2018. In Malaysia, registration with the GACC involves a three-step process, starting with Pre-Registration, whereby an Application for Registration of Overseas Manufacturers of Imported Bird’s Nest and Bird’s Nest Products is submitted to DVS. This is followed by Online Registration where a legal representative of the company will fill up all required information in the China International Trade Single Window System. The last step involves the inspection of the processing plant by a GACC auditor. EBNs that are imported into China are also certified by the Chinese Academy of Inspection and Quarantine, which is the national public institute for food quality. The certified EBNs are labeled with an anti-counterfeiting code and a QR code, which allows consumers to access information on the quality and origin of the product.

Previously, Malaysian EBN was banned from entering China due to nitrite contamination in 2011. The ban was subsequently lifted in 2014. China later imposed a temporary ban on Malaysian EBN from March 2017 to June 2017 following an outbreak of H5N1 avian flu in Kelantan in March 2017.

As seen in Figure 7 below, demand for EBN in China has been expanding at a rapid pace as shown by the increase of imports over the years. A CAGR of 86.4% had been recorded for the period from 2015 to 2022. In the year 2022, imports of EBN reached 451.6 tonnes, of which 291.8 tonnes came from Indonesia and 159.8 tonnes came from Malaysia.

Over recent years, there has been a transitional trend among EBN consumer demographics. While traditionally EBNs were mainly consumed by women, it has since evolved into a product suitable for people of all ages. In particular, EBN consumption among highly educated younger generations has been increasing rapidly in recent years. In 2019, over 60% of EBN purchases on JD.com (a Chinese e-commerce platform) were made by people aged between 16 and 35. The rise of e-commerce platforms in China had also helped drive consumption of EBN

With the use of big data technology and e-commerce, EBN has now become easily accessible to the mass population. As the younger Chinese generation tends to spend a lot of time on digital platforms, in particular e-commerce platforms, the sales of EBN products on these platforms have also been on the rise. In particular, there has been a significant increase in sales of EBN products on two of the most popular e-commerce platforms in China, namely Tmall and JD.com.

In addition, the demand for EBN in China has also been boosted by the growing spending power of the population. China’s adjusted net national income per capita has increased from USD801 in 2000 to USD 9,015 in 2021. As disposable income increases, consumers have a greater propensity to spend on discretionary products, including EBN.

Going forward, the prospect of the EBN industry in China remains positive. The EBN industry will continue to expand with more EBN products driving consumption by a larger pool of customers, greater access to EBN being enabled by the rise of e-commerce platforms, as well as the growing spending power of the population. Accordingly, major EBN exporting countries such as Malaysia are expected to benefit from the rise in demand.

Prospect of EBN Industry in Vietnam

According to the Asian Development Bank, Vietnam’s economy grew by 8.0% in 2022 (2021: 2.6%) as the removal of COVID-19 restrictions and the achievement of nationwide vaccine coverage boosted growth, particularly in services. While growth in the country is forecast to be constrained in 2023 by the global slowdown, continued monetary tightening and the war between Russia and Ukraine, the reopening of China is expected to be positive for the country despite such headwinds. Accordingly, Vietnam’s economy is forecast to grow by 6.5% in 2023.

Along with China, consumers in Vietnam are highly appreciative of bird’s nests and demand is expected to increase in tandem with a rapidly rising middle-income class and increasing disposable income. In addition, consumers in Vietnam are becoming increasingly willing to spend on healthcare. Accordingly, Malaysia’s export of bird’s nests to Vietnam expanded from approximately 38kg in 2016 to 34,652kg in 2021. Malaysia, having an established reputation as a major exporter of bird’s nests along with a well-regulated EBN industry is well-placed to cater to the growing demands for EBN in Vietnam.

Source: Protégé Associates

Business strategies and prospects for MYMBN BERHAD.

The company intends to expand its presence by increasing the types of products to cater to the wider market. The following subsections detail the Group’s future plans.

- Expanding the headquarters and processing facility.

- Exploring expansion into the processing and sale of RCEBN in the PRC through acquisition.

- Setting up of three (3) bird’s nest collection centres in East Malaysia.

- Diversifying the reliance on the PRC market by expanding into Vietnam.

- Expansion of business into HALAL ready-to-drink bird’s nest products.

MQ Trader View

Opportunities

- The company has a wide supplier network throughout Malaysia. Since the commencement of the operations in January 2017, the company has built a wide supplier network to source raw bird’s nests for processing operations. The supplier network consists of bird’s nest farmers, traders and agents located throughout Malaysia. As at the LPD, the company has 18 Approved Suppliers with 224 swiftlets houses, whom they source the raw bird’s nest from.

- One of the pioneers in supplying RUCEBN to the PRC, the largest market for bird’s nests. The company is one of the pioneers in supplying RUCEBN to the PRC. In 2019, they became the first company in Malaysia approved by the GACC, to export RUCEBN to the PRC. Within the same year, they shipped The first shipment of 150 kg of RUCEBN to the customer in Qinzhou in the PRC. In 2020, they exported the largest single shipment to the PRC, weighing 1,010 kg of RUCEBN.

Risk

- The company is highly dependent on approval from the GACC to export to the PRC. The company's sales to the PRC market contributed RM 67.87 mil (98.55% of its revenue in FYE 2022). The ability to export EBN products to the PRC is dependent upon approval from the GACC. Therefore, its business is highly dependent on approval from the GACC in order for us to operate and export the RUCEBN products to the PRC.

- The company is highly dependent on certain major customers based in the PRC. The top 5 major customers contribute 97.29% of the total revenue for FYE 2022.

Click here to refer the IPO - MYMBN Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)