IPO - MYMBN Berhad (Part 1)

MQTrader Jesse

Publish date: Tue, 04 Jul 2023, 04:22 PM

Company Background

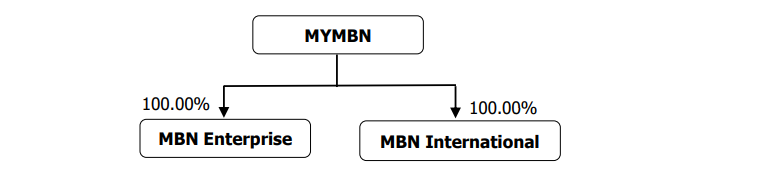

The Company was incorporated in Malaysia under the Act on 31 March 2022 as a private limited company under the name of MYMBN Sdn Bhd. The company subsequently converted the status of the Company to a public limited company on 6 July 2022 for the Listing.

The Company is an investment holding company and through its Subsidiaries, the Group is principally involved in the processing and sale of EBN (Edible bird’s nest).

The corporate Group structure is as follows:

Use of proceeds

- Business expansion - 43.41% (within 24 months)

- Purchase of the New Facility to expand processing capacity - 13.63% (within 24 months)

- Renovation and fit-out works of the New Facility - 15.55% (within 24 months)

- Setting up of three (3) bird’s nest collection centres in East Malaysia - 8.16% (within 24 months)

- Expansion into the processing and sale of RCEBN - 6.07% (within 24 months)

- Purchase of raw bird’s nests for RUCEBN - 32.07% (within 6 months)

- Working Capital - 9.94% (within 12 months)

- Estimated listing expenses - 14.58% (within 3 months)

Business expansion - 43.41% (within 24 months)

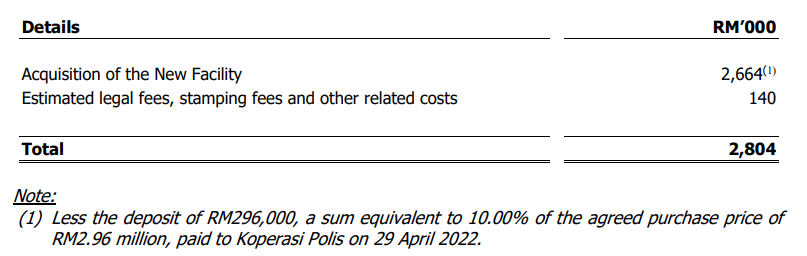

a. Purchase of the New Facility to expand processing capacity - 13.63% (within 24 months)

The company intends to allocate RM2.80 million, or 13.63% of the funds raised from the IPO proceeds for this purpose and they expect the plan to be implemented within twenty-four (24) months from the date of Listing.

b. Renovation and fit-out works of the New Facility - 15.55% (within 24 months)

The company intends to allocate RM3.20 million or 15.55% of the funds raised from the IPO proceeds for the renovation and fit-out works of the New Facility and they expect the plan to be implemented within twenty-four (24) months from the date of Listing.

The details of the renovation and fit-out works of the New Facility are as follows:

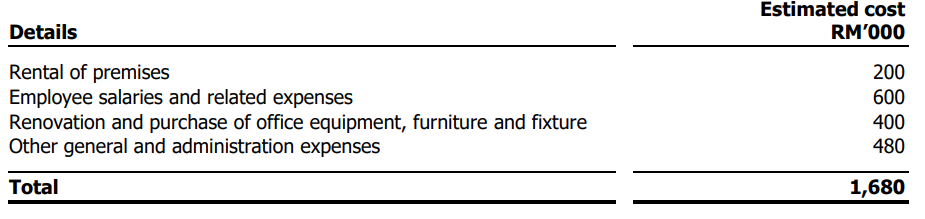

c. Setting up of three (3) bird’s nest collection centres in East Malaysia - 8.16% (within 24 months)

The company intends to allocate RM1.68 million or 8.16% of the IPO proceeds to finance the renovation costs and twenty-four (24) months of operating expenses required for the business operations of the bird’s nests collection centres and they expect the plan to be implemented within twenty-four (24) months from the date of Listing

The details of setting up the three (3) bird’s nests collection centres in East Malaysia are as follows:-

d. Expansion into the processing and sale of RCEBN - 6.07% (within 24 months)

The company intends to allocate RM1.25 million or 6.07% of the funds raised from the IPO proceeds for expansion into the processing and sale of RCEBN and they expect the plan to be implemented within twenty-four (24) months from the date of Listing.

The details of the cost for the expansion into the processing and sale of RCEBN are as follows:-

Purchase of raw bird’s nests for RUCEBN - 32.07% (within 6 months)

The company intends to allocate RM6.60 million or 32.07% of the funds raised from the IPO proceeds for the purchase of raw bird’s nest for RUCEBN and is expected to be implemented within six (6) months from the date of Listing.

According to the IMR Report, the demand for EBN has been increasing over the years, particularly in the PRC. Traditionally, demand for EBN in the PRC was mainly in coastal provinces such as Guangdong and Fujian. Currently, consumers in landlocked areas such as Chengdu, Inner Mongolia and Anhui, PRC have also been increasing their consumption of EBN. The growing middle-income class in the PRC is making EBN more affordable to a larger pool of consumers. Aside from that, the growing affluence of consumers has also bolstered demand for EBN.

The best-known use of EBN was as a Chinese delicacy, known as bird’s nest soup. It is believed that EBN can stimulate cell division and growth, hasten tissue regeneration and boost the immune system. There has been an increasing trend in health awareness among consumers, as more consumers are becoming aware of the benefits of consuming EBN, the demand for EBN is expected to grow moving forward.

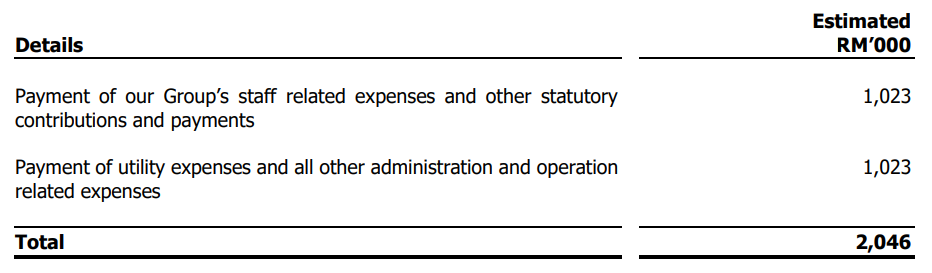

Working Capital - 9.94% (within 12 months)

The Group’s working capital requirements are expected to increase in tandem with the expected growth in the RUCEBN business. The company intends to allocate RM2.05 million or 9.94% of the funds raised from the IPO proceeds, to be used to supplement the general working capital purposes over twelve (12) months from the date of Listing.

The general working capital includes payment of administration and operating expenses as follows:

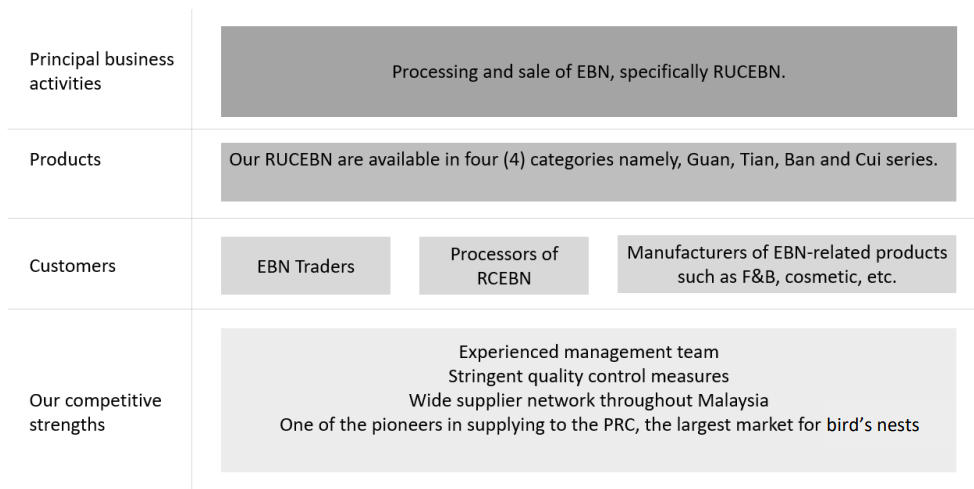

Business model

The business model is as illustrated below:

RUCEBN (Raw unclean edible bird’s nest.)

The Group is principally involved in the processing and sale of EBN, specifically the RUCEBN.

EBNs are processed nests of swiftlets, which are made from strands of swiftlets’ saliva. In the Chinese community, a bird’s nest is believed to provide health and medicinal benefits. It can be prepared in several ways, either in savory soups, or desserts, or added with medicinal herbs. It is also used as an ingredient in food and beverages and skincare products.

EBN can be grouped into two (2) main categories, namely RUCEBN and RCEBN, with the major distinguishing factors being the extent to which these EBN are processed. RCEBN products are EBN that have undergone processes such as grading and sorting, trimming, soaking, picking of feathers and impurities, molding, drying, heat treatment, packaging and weighing.

The RUCEBN products are generally sold to manufacturers of bird’s nest-related products such as food and beverages, processors of RCEBN and traders of EBN products. The products are mostly exported to the PRC, with the remaining being sold to customers in Malaysia.

The company’s RUCEBN products are available in four (4) categories namely the Guan “官系列”, Tian “天系列”, Ban “般系列” and Cui “翠系列” series, according to the quality which is determined by their shape, color and amount of feathers and impurities in the bird’s nests.

Click here to continue the IPO - MYMBN Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)