IPO - Jati Tinggi Group Berhad (Part 1)

MQTrader Jesse

Publish date: Tue, 05 Dec 2023, 10:30 AM

Company Background

The Company was incorporated in Malaysia under the Act on 21 December 2021 as a private limited company under the name of Jati Tinggi Group Sdn Bhd. Subsequently, on 7 October 2022, the Company was converted to a public limited company and assumed its present name of Jati Tinggi Group Berhad to embark on the Listing.

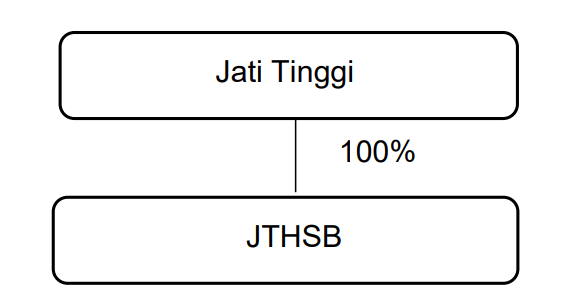

The Company is an investment holding company. Through the subsidiary, The company is predominantly involved in the provision of infrastructure utilities engineering solutions.

The Group structure as at the LPD is as follows:

Use of proceeds

- Repayment of bank borrowings - 38.81% (within 12 months)

- General working capital - 40.67% (within 18 months)

- Capital expenditure - 1.11% (within 12 months)

- Estimated listing expenses - 19.41% (Within 3 months)

Repayment of bank borrowings - 38.81% (within 12 months)

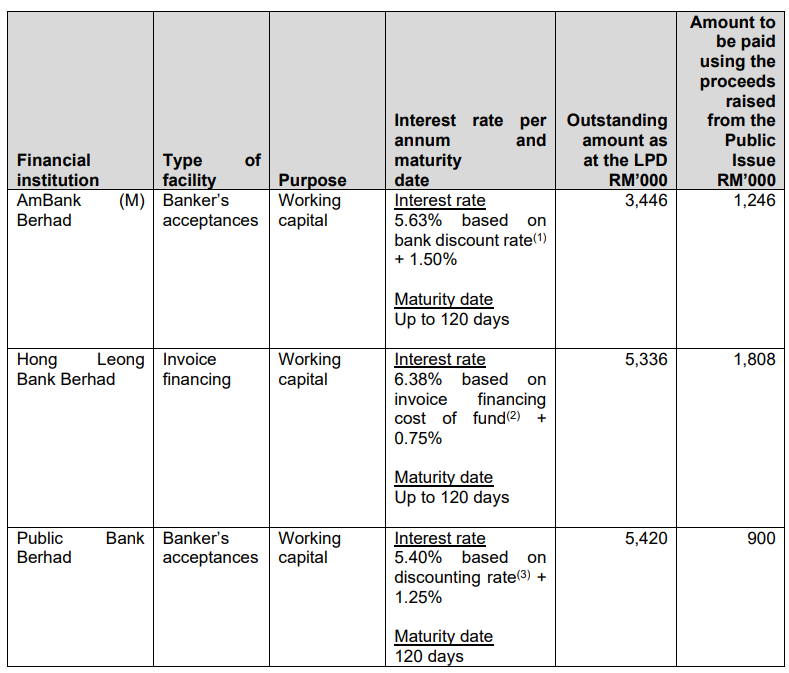

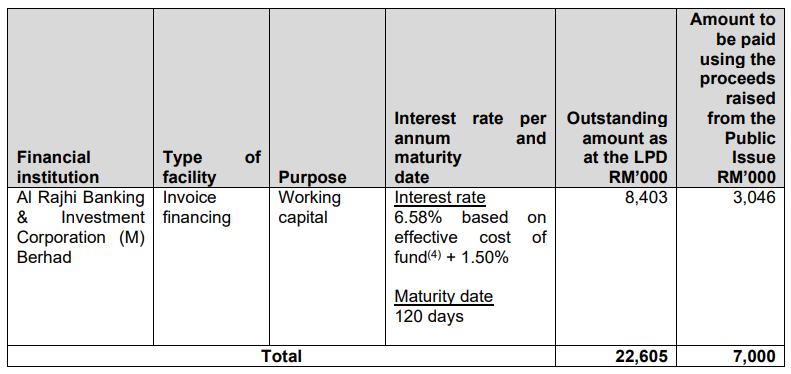

The company has allocated RM7.00 million of its gross proceeds from the Public Issue to pare down part of the Group’s outstanding bank borrowings. The details are as set out below:

The repayment of the borrowings as set out above is expected to have a positive financial impact on the Group with interest savings of approximately RM0.43 million per annum based on existing prevailing nominal interest rates (as set out in the table above) ranging from 5.40% to 5.63% for the banker’s acceptances and ranging from 6.38% to 6.58% for the invoice financing. However, the actual interest savings may vary depending on the applicable interest rates at the time of repayment. For the avoidance of doubt, the repayment of the above-mentioned borrowings will not result in any penalty or early settlement fee.

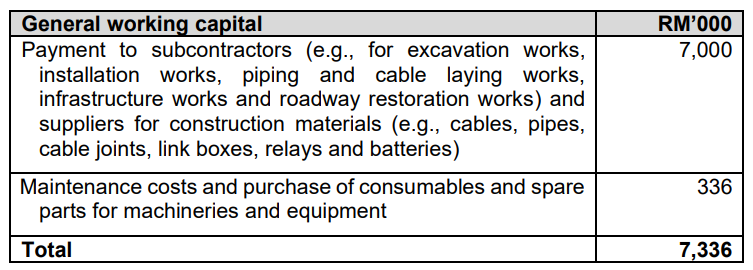

General working capital - 40.67% (within 18 months)

The company has allocated RM7.34 million of the gross proceeds from the Public Issue to supplement the general working capital requirements of which approximately:

1. 60% is intended to be allocated for new projects to be secured and 2 projects which were secured in August 2022.

The 2 projects (being the projects No. 10 and 11 as set out in the Section 7.5.5(i) of this Prospectus) which were secured in August 2022 are related to the provision of 132kV double circuit underground cable installation works in Penang, which has a total contract value of RM60.40 million. The progress of the said projects is set out in Section 7.5.5(i) of this Prospectus; and

2. 40% is intended to be allocated for existing projects.

The allocations of the proceeds are as set out below:

Capital expenditure - 1.11% (within 12 months)

To support the continuing expansion of the business, the company has allocated RM0.20 million of its gross proceeds from the Public Issue for the purchase of 2 units of winch machines (Note: a machine that is used to pull in (wind up) or let out (wind out) or otherwise adjust the tension of a cable or wire cable). Based on the management’s preliminary estimate, the cost for each winch machine is approximately RM0.10 million, which will cover all the costs associated with customisation for the Group’s usage and acquisition of machine.

Business model

The Group’s business model is as follows:

The Group delivers infrastructure utilities engineering solutions as follows:

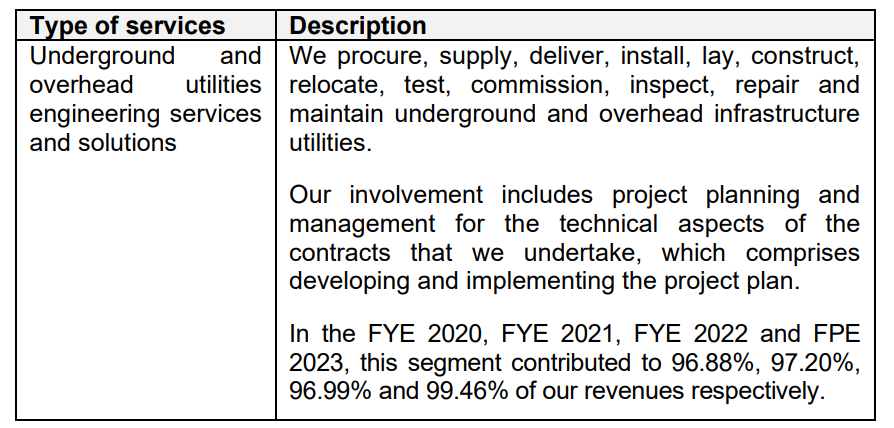

1. Infrastructure utilities engineering solution

The company principally undertakes the provision of utilities engineering services and solutions for underground and overhead utilities or product pipelines that form the overall utility system for the customers.

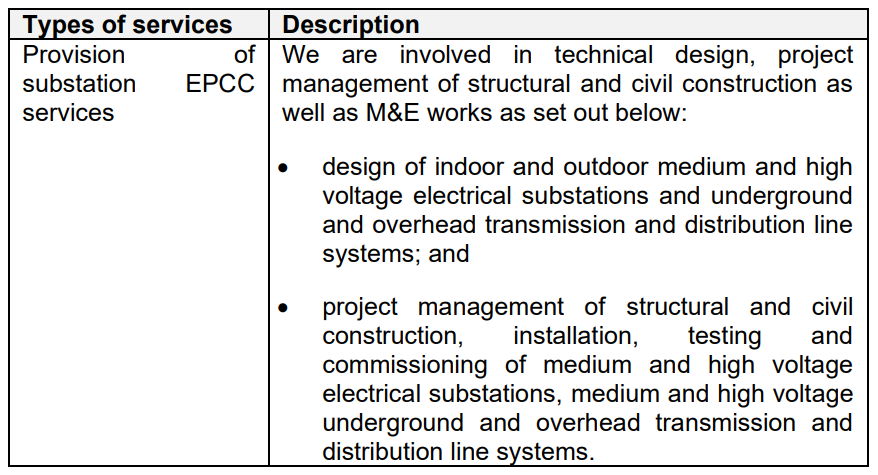

Others

The company also involved in the provision of substation EPCC services, trading of equipment for substations as well as Street Lighting Services, as and when the opportunities arise or we secure such contracts.

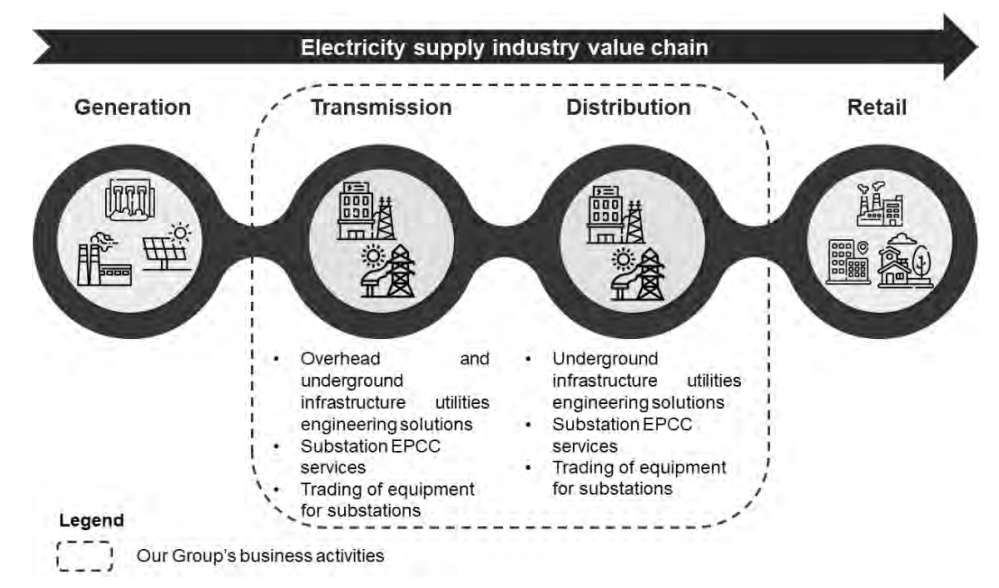

The major customers comprised mainly the main contractors appointed by TNB, a major utility company in Malaysia. These main contractors are mainly involved in electricity supply projects that require the services and solutions to enable the transmission and distribution of electricity to specific locations and/ or premises. Thus, the Group’s positioning within the electricity supply industry is as depicted below:

Click here to continue the IPO - Jati Tinggi Group Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)