IPO - Kawan Renergy Berhad (Part 2)

MQTrader Jesse

Publish date: Wed, 08 May 2024, 12:45 PM

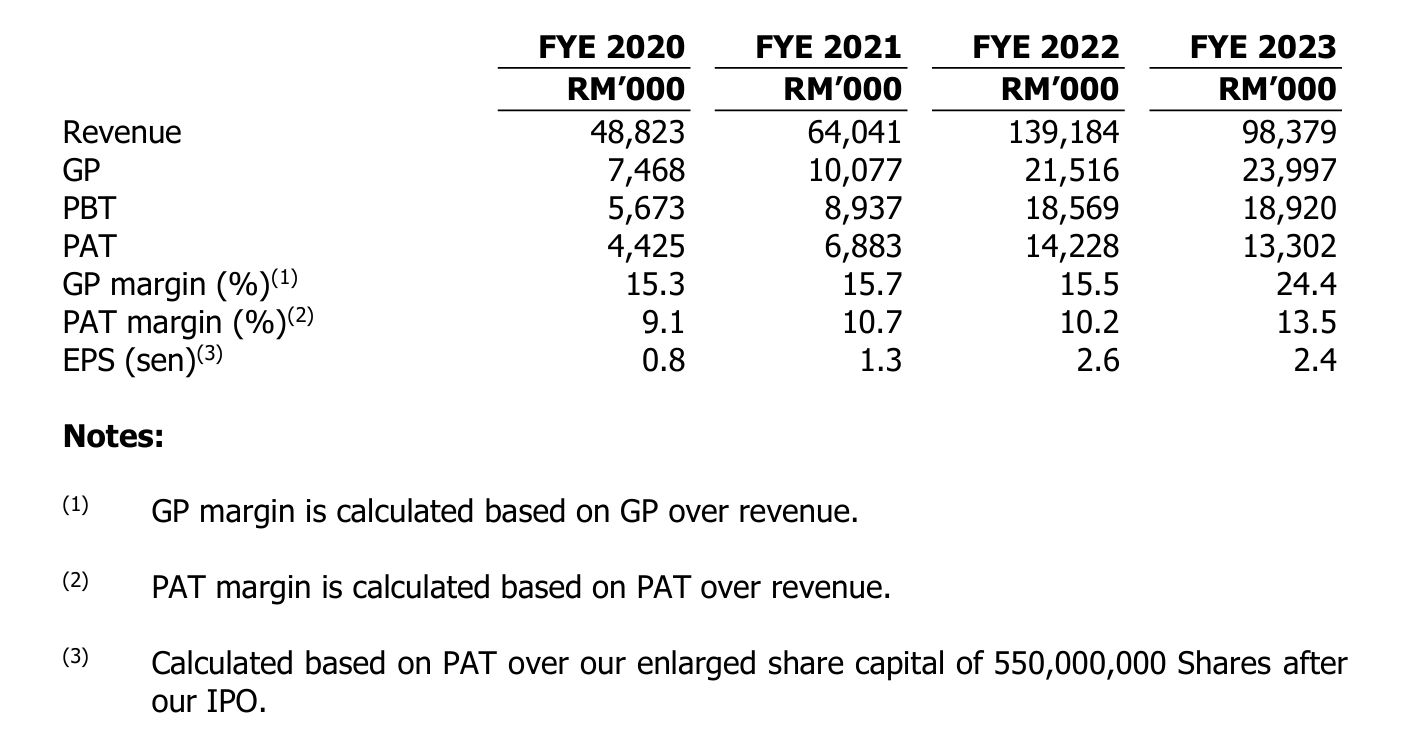

Financial Highlights

The following table sets out the financial highlights based on the combined statements of comprehensive income for FYE 2020 to 2023:

- The revenue grew from RM 48 million in FYE 2020 to RM 139 million in FYE 2022 and declined to RM 98 million in FYE 2023. The revenue decline in FYE 2023 is mainly due to the decrease in job orders for the design, fabrication, installation, and/or commissioning solutions for industrial process equipment, process plants, and renewable energy and co-generation plants, which decreased to 497 job orders in FYE 2023 (compared to 528 job orders in FYE 2022).

- The gross profit margin was maintained at 15% from FYE 2020 to FYE 2023. However, it reached 24.4% in FYE 2023. Management mentioned that the marginal improvement in the GP margin for this activity was mainly attributable to 3 niche projects: a chemical plant project, a calcium soap plant project, and an esterification plant project, which yielded a better GP margin. Lower GP margin projects, mainly contributed by 4 projects in FYE 2023, narrowed the improvement in GP margin. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin grew from 9.1% in FYE 2020 to 13.5% in FYE 2023.

- The gearing ratio was 0.2 times in FYE 2023, which is below the benchmark. This shows the liquidity of the company and also means that the company can still increase the debt ratio to maximize the distribution between debt and equity. (A good gearing ratio should be between 0.25 – 0.5).

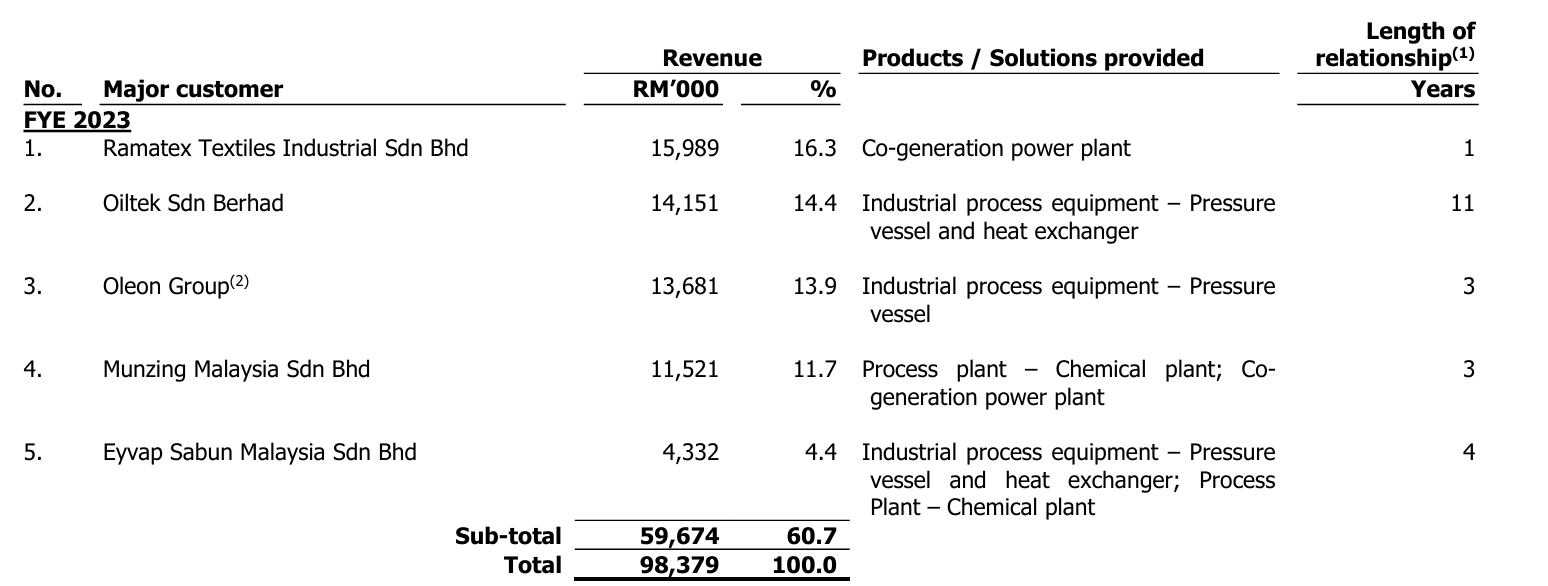

Major customers and suppliers

Major Customers

The top 5 major customers for FYE 2023 are as follows:

The top 5 customers contribute 60.7% of the company's revenue. The management mentioned that due to the nature of the business, the company is not dependent on any of these major customers because their design, fabrication, installation, and/or commissioning solutions are project-based. Therefore, they do not have any long-term agreements with the customers.

In this case, the company will be more concerned with sustainability and its ability to secure new projects and customers rather than focusing on existing clients who provide high revenue.

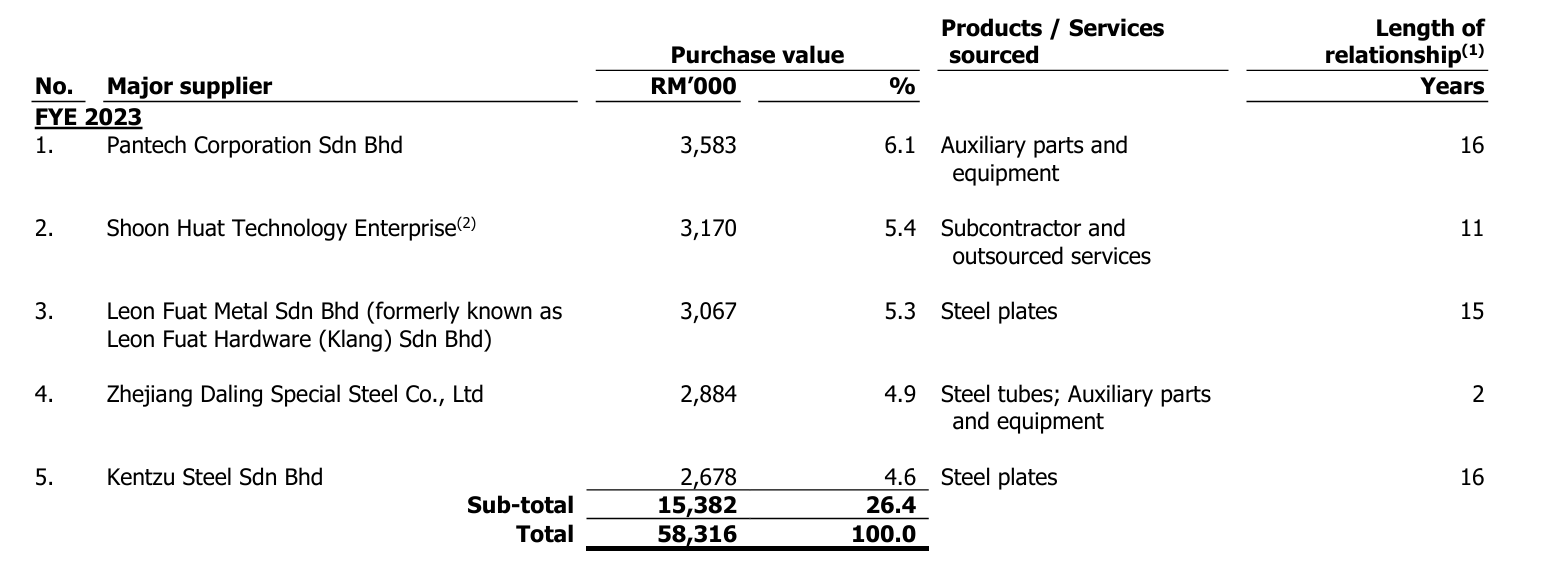

Major Suppliers

The top 5 major suppliers for FYE 2023 as follows:

The top 5 suppliers account for 26.4% of the purchases. The management disclosed three points regarding the current supplier status: (i) they do not enter into any long-term contracts with their major suppliers; (ii) they have not experienced any material supply disruptions or delays from their major suppliers from FYE 2020 to FYE 2023; (iii) they are not dependent on any of their major suppliers as they can source similar supplies from alternative suppliers.

Industry Overview

According to Smith Zander's research, the industrial process equipment industry in Malaysia is competitive and fragmented due to the large number of industry players including public listed companies, large private companies as well as small to medium enterprises. Industry players may design and/or fabricate industrial process equipment as standalone products to be sold to customers or as part of the provision of design, fabrication, installation and commissioning services of industrial facilities where multiple integrated equipment are sold to customers.

Further, industry players who manufacture certain types of industrial process equipment such as boilers and pressure vessels in Malaysia are subject to stringent regulations and safety standards, whereby such industry players must be registered as a competent firm with the Department of Occupational Safety and Health (“DOSH”), granting them the approval to manufacture steam boilers, unfired pressure vessels, unfired pressure vessels (seamless pipe) and/or fired pressure vessels, in Malaysia. As at 4 April 2024, based on publicly available information, there were approximately 101 companies in Malaysia registered as competent firms and granted approval by DOSH to manufacture steam boilers, unfired pressure vessels, unfired pressure vessels (seamless pipe) and/or fired pressure vessels, with their approvals being in effect as of that date.

Key Industry Drivers

- The demand for industrial process equipment is driven by the growth of process industries that utilise such equipment

- Growth in foreign direct investment (FDI) drives the growth of the industrial process equipment industry

Key Industry Risks and Challenges

- Exposure to global steel price fluctuations

- Reliance on sufficient skilled personnel

Industry/Market Share

In 2023, the industrial process equipment industry size in Malaysia was recorded at RM23.50 billion. For the financial year end 31 October 2023, Kawan Group’s revenue derived from the provision of design, fabrication, installation and/or commissioning of industrial process equipment, process plants as well as renewable energy and co-generation plants was recorded at RM98.20 million, and thereby Kawan Group captured a market share of 0.42% in the industrial process equipment industry in Malaysia.

Source: Smith Zander

Future plans and strategies for KAWAN RENERGY BERHAD.

The company's business objectives are to maintain sustainable growth and create long-term shareholder value. To achieve its business objectives, the company will implement the following business strategies:

- The company intends to improve the output of Bercham Plant

- The company intends to construct a new 2MW biomass power plant to grow its power generation and sale of electricity business segment

- The company intends to upgrade some of its production processes by purchasing additional machinery

MQ Trader View

Opportunities

- The company can offer engineering solutions for a wide range of industries, primarily comprising food, chemicals, oil and gas, waste recovery, energy, and utilities. This can diversify the concentration sector risk of the company and increase the company's market reach, capturing more business opportunities across a wide range of industries.

- The company has an experienced management team with substantial industry experience. From the financial results in FYE 2023, we can ascertain the capability of the management team. Despite a 29.3% decline in revenue, the gross profit margin grew by 8.9% (from 15.5% to 24.4%). Additionally, the Profit Before Tax (PBT) still increased compared to FYE 2022 (FYE 2023: RM 18.920 million; FYE 2022: RM 18.569 million). From this case, we can infer that the management is able to efficiently manage the company and improve operations even in a negative environment.

Risk

- The project-based nature of the group’s business may result in the fluctuation of its group’s performance. The company’s sales are derived based on purchase orders whereby the customers will purchase the products on a project-to-project basis. The project-based nature of the Group’s business may result in the fluctuation of its company’s sales and result in uncertainties over its overall financial performance.

Click here to refer the IPO - Kawan Renergy Berhad (Part 1)

Interested to start trading? Send your inquiry now! https://bit.ly/mqtatrade

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)