IPO - Kawan Renergy Berhad (Part 1)

MQTrader Jesse

Publish date: Wed, 08 May 2024, 12:45 PM

Company Background

The Company was incorporated in Malaysia under the Act on 26 October 2022 as a private limited company under the name of Kawan Renergy Sdn Bhd. On 28 July 2023, the company converted into a public limited company and adopted its present name.

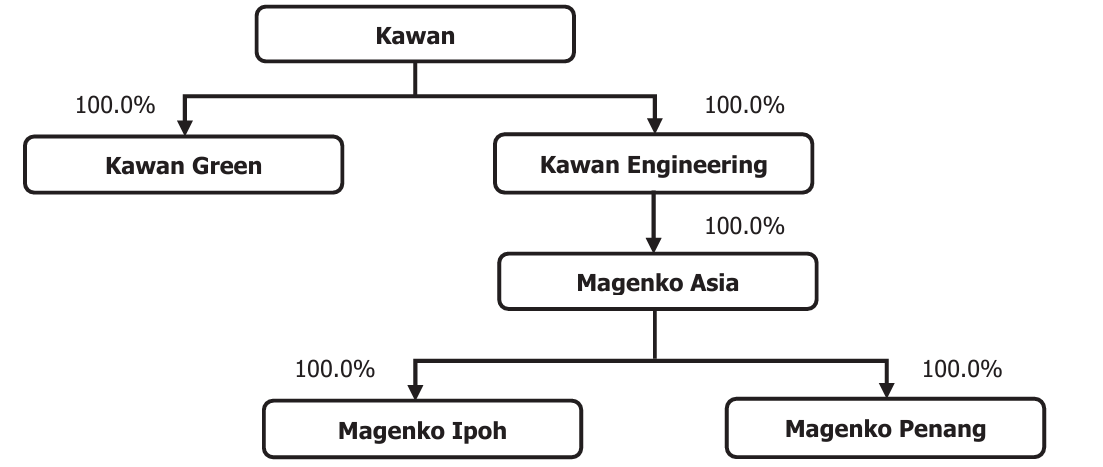

The principal activity is an investment holding company. The Group structure as at LPD is as

Through its subsidiaries, the company is an engineering solutions provider, principally involved in the design, fabrication, installation and/or commissioning of industrial process equipment, process plants as well as renewable energy and co-generation plants (“design, fabrication, installation and/or commissioning solutions”).

Use of proceeds

- Working capital - 45.5% (within 24 months)

- Investment into a new 2 MW power plant - 15.1% (within 36 months)

- Improvement of Bercham Plant output - 7.6% (within 15 months)

- Purchase of additional machinery - 1.5% (within 12 months)

- Repayment of bank borrowings - 18.2% (within 3 months)

- Estimated listing expenses - 12.1% (within 1 month)

Working capital - 45.5% (within 24 months)

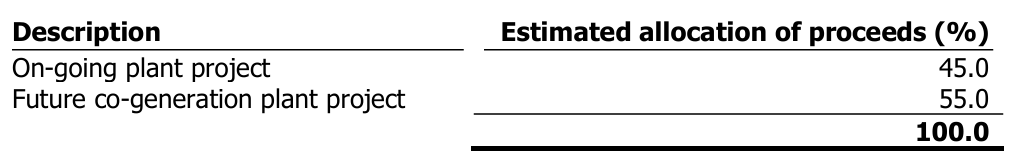

The group’s working capital requirements are expected to increase in tandem with the expected growth in the scale of its business. Therefore, the Group intends to allocate proceeds for the working capital requirements of the ongoing and future co-generation plant projects. The company has allocated approximately RM15.0 million from the gross proceeds raised from Public Issue for this purpose to be utilised over 24 months from the date of the Listing.

The preceding breakdown has yet to be determined at this juncture and will depend on the operating and funding requirements at the time of utilisation. Nevertheless, based on internal management estimates, the allocation of the proceeds to be utilised for the ongoing and future co-generation plant projects are as follows, subject to the operating and funding requirements of the Group at the time of utilisation:

Investment into a new 2 MW power plant - 15.1% (within 36 months)

The company intends to construct a new 2MW biomass power plant to grow its power generation and sale of electricity business segments and diversify its income base to include more recurring income.

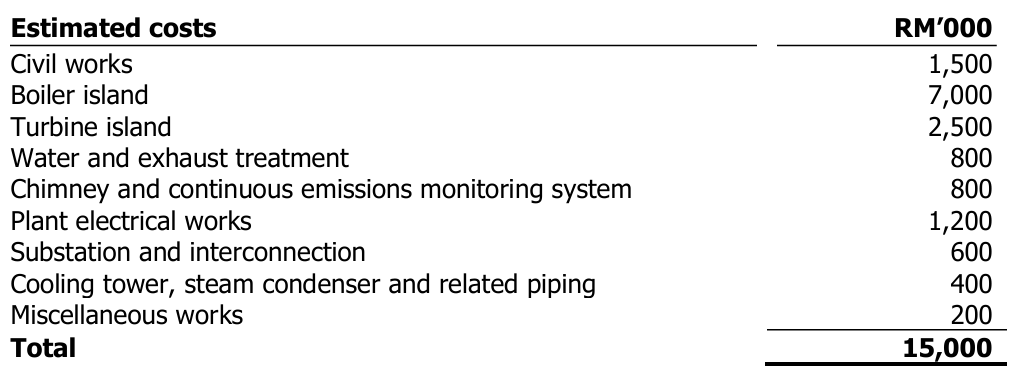

The total estimated cost for the construction of the new biomass power plant is RM15.0 million which was derived based on the quotation by contractors as well as internal management estimates. The company intends to allocate RM5.0 million for the construction of the new 2MW biomass power plant from the Public Issue proceeds whilst the remaining RM10.0 million is financed via bank borrowings and/or internally generated funds.

The details of the estimated costs for the new 2MW biomass power plant is set out as follows:

The company expects to complete the construction of the new 2MW biomass power plant within 18 months from the date of SEDA’s approval on the proposed quota. As at LPD, the company is in the midst of preparing for a bid application to SEDA for 2 MW of quota, with the bid application expected to open in the second quarter of 2024.

Improvement of Bercham Plant output - 7.6% (within 15 months)

The Bercham Plant has an installed capacity of 1.2MW and a net export capacity of 1MW, and is operating under the FiT mechanism. As such, the company is licensed to sell up to 24MWh of electricity per day (i.e. 1MW multiplied by 24 hours). Under the FiT mechanism, they are allowed to sell the electricity produced from its plant to the distribution licensee at a predetermined rate of RM0.3880/kWh until 2032. As at LPD, the electricity generated for sale is approximately 1.5MWh per day which is 6.3% of its maximum allowable electricity sales of 24MWh per day, due to blockages in the gas piping caused by polymers present in the landfill in which methane gas is extracted as feedstock for the Bercham Plant.

To improve the production output of the Bercham Plant as well as to increase the revenue from the power generation and sale of electricity business, the company will use agricultural waste (used in anaerobic digestion system) as additional feedstock on top of landfill gas, in accordance with the Feed-In-Approval, pursuant to the consultation with SEDA. As at LPD, the company is in the midst of conducting a feasibility study of the new system and material. The feasibility study entails carrying out design calculations to determine the feasibility of the new system required (i.e. anaerobic digestion system) to be installed for the additional feedstock as well as conducting prototype testing by constructing a pilot testing plant for the new system at Bercham Landfill. Thereafter, the company will purchase and install an anaerobic digestion system, which will be connected, and will supply gas directly to the Bercham Plant.

The amount of gas produced by the anaerobic digestion system is expected to be able to generate up to 24MWh of electricity per day. With the combination of landfill gas and gas produced from the anaerobic digestion system, the company expects to be able to generate approximately 24MWh of electricity per day which is expected improve the revenue of the power generation and sale of electricity business to approximately RM3.4 million (i.e. 24MWh multiplied by RM0.3880/kWh and 365 days) per year from the estimated RM0.2 million a year.

Purchase of additional machinery - 1.5% (within 12 months)

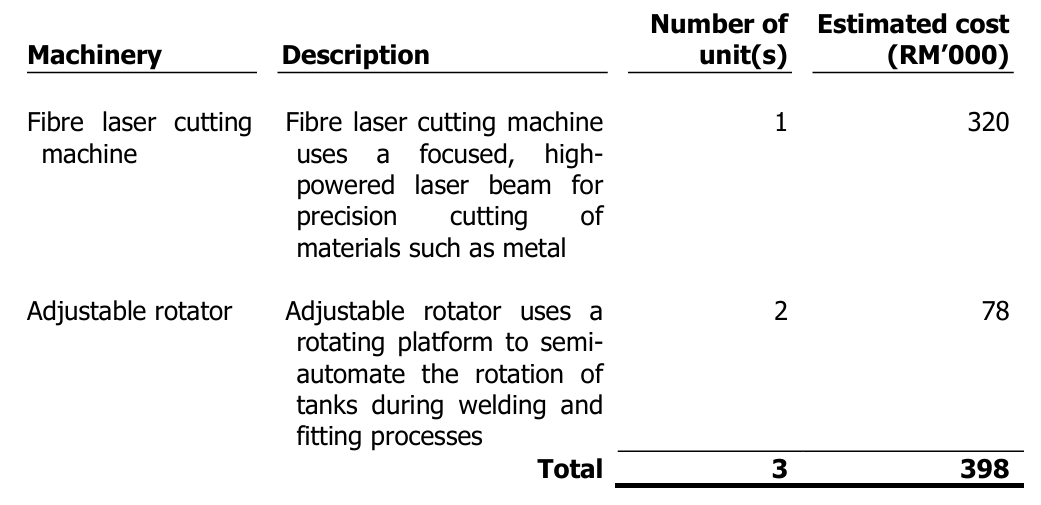

The company intends to upgrade some of its production processes by purchasing additional machinery at Factory 1 and Factory 3 to improve its production efficiency.

The company intends to purchase the following machinery for Factory 1 and Factory 3:

Repayment of bank borrowings - 18.2% (within 3 months)

The company has allocated RM6.0 million to repay 2 of its term financing which were drawn down to finance the working capital and the purchase of Factory 3. As at 31 October 2023, these term financing amounts to RM0.3 million and RM6.0 million respectively.

They have decided to prioritise the repayment of these term financing from Malayan Banking Berhad as they carry higher effective interest rates of 3.50% and 4.25% respectively, for FYE 2023 compared to the other term financing.

Business model

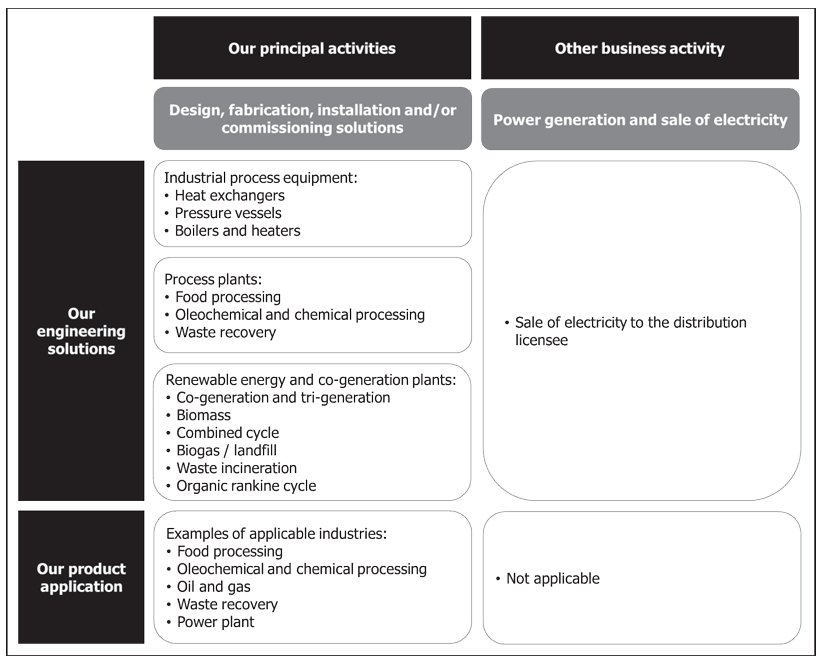

The Group’s business model, by business activities, is as illustrated below:

The company is an engineering solutions provider, principally involved in the design, fabrication, installation and/or commissioning of industrial process equipment, process plants as well as renewable energy and co-generation plants (“design, fabrication, installation and/or commissioning solutions”). As an engineering solutions provider, these solutions encompass the Group’s technical capability to analyze the customer’s needs and proactively propose suitable design solutions which are customised to meet their customers’ engineering requirements. In addition to proposing design solutions, the Group’s solutions also include the capability to provide in-house fabrication, installation and/or commissioning of the industrial process equipment, process plants as well as renewable energy and co-generation plants.

Click here to continue the IPO - Kawan Renergy Berhad (Part 2)

Interested to start trading? Send your inquiry now! https://bit.ly/mqtatrade

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)