IPO - OB Holdings Berhad (Part 2)

MQTrader Jesse

Publish date: Fri, 04 Oct 2024, 04:48 PM

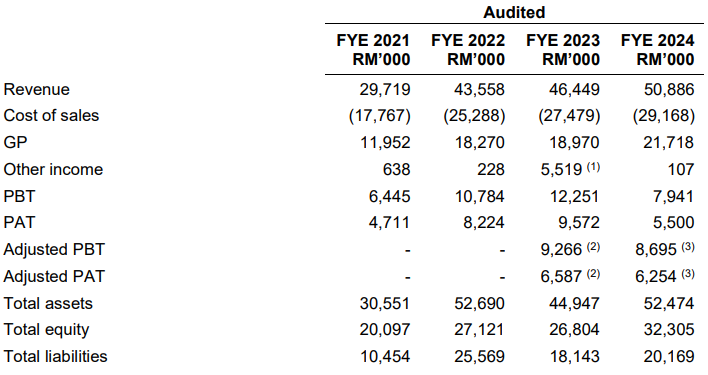

Financial Highlights

The following table sets out a summary of the company Group’s audited combined financial statements for the Financial Years Under Review:

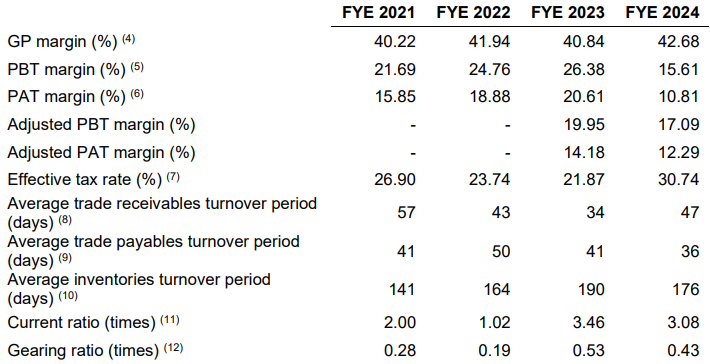

The key financial ratios of the company Group are as follow:

The revenue grew from RM 29 million in FYE 2021 to RM 50 million in FYE 2024, showing that the company is expanding its market share.

The GP margin rose from 40.22% in FYE 2021 to 41.94% in FYE 2022, then fell to 40.84% in FYE 2023 due to higher overheads from property depreciation and factory rental, and increased to 42.68% in FYE 2024 as certain company's cost are relatively fixed and not fluctuating with revenue growth.

The PAT margin increased from 15.85 % in FYE 2021 to 20.61% in FYE 2023, but subsequently declined to 10.81% in FYE 2024.

The gearing ratio is 0.43 in FYE 2024. The company's gearing ratio is within the benchmark, reflecting a good balance between debt and equity. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and suppliers

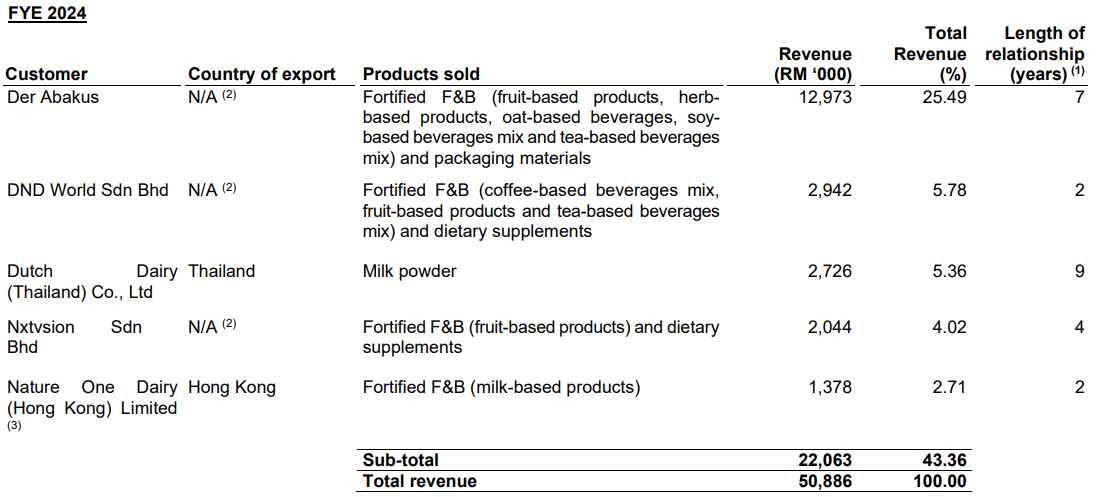

Major Customers

The company top 5 major customers and their respective revenue contributions for FYE 2024 are as set out below:

The company is not dependent on any of their customers as the company Group’s business is transacted on purchase order basis where the revenue contribution of major customers varies from year to year.

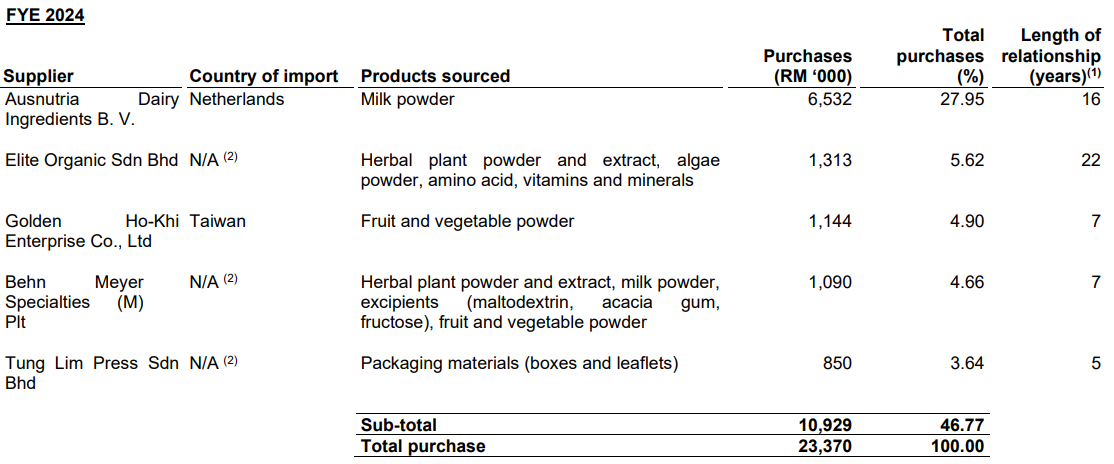

Major Suppliers

The company top 5 major suppliers and their respective purchase contributions for FYE 2024 are as set out below:

The company is not dependent on any of their suppliers as the raw materials, food ingredients and packaging materials that the company purchases are readily available and can be easily sourced from their list of alternative suppliers.

Industry Overview

Fortified F&B and dietary supplements are products intended to supplement daily nutritional intake. In Malaysia, fortified F&B manufacturers are considered food product manufacturers and are thus guided by the Food Safety and Quality Division Ministry (“FSQD”) in accordance with the Food Act 1983, Food Regulations 1985 and Food Hygiene Regulations 2009. In contrast to the manufacturing of fortified F&B, the pharmaceutical industry in Malaysia, which includes the dietary supplements industry, is highly regulated by the National Pharmaceutical Regulatory Agency (“NPRA”), an executive body established under the Control of Drugs and Cosmetics Regulations 1984 (“CDCR 1984”). The FSQD and NPRA are governed under the Ministry of Health Malaysia (“MOH”) and were established to protect the public against health hazards and provide consumers assurance on the quality and safety of the products, thereby enabling consumers to make informed choices and not be misled and defrauded by false claims and statements.

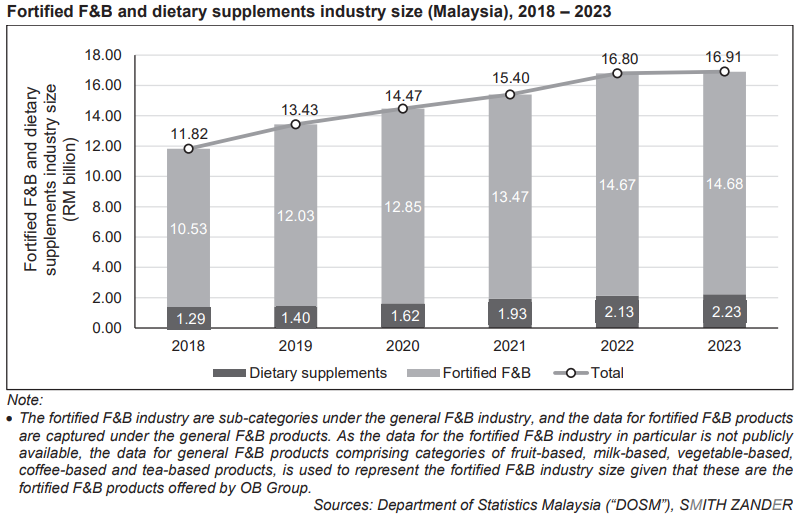

According to the research from SMITH ZANDER, the fortified F&B industry in Malaysia grew from RM10.53 billion in 2018 to RM14.68 billion in 2023, at a compound annual growth rate (“CAGR”) of 6.87%; and the dietary supplements industry in Malaysia grew from RM1.29 billion in 2018 to RM2.23 billion in 2023, at a CAGR of 11.57%. As such, cumulatively, the fortified F&B and dietary supplements industry in Malaysia grew from RM11.82 billion in 2018 to RM16.91 billion in 2023, registering a CAGR of 7.43%.

The growth of the fortified F&B and dietary supplements industry in Malaysia from 2018 to 2023 is largely driven by the increase in health awareness arising from increasing rates of chronic diseases, increasing disposable income of the population, urbanisation and growing ageing population, prevalence of social media marketing as well as growing popularity and usage of e-commerce platforms. Additionally, the growth from 2020 to 2022

was also influenced by the outbreak of the COVID-19 pandemic, which led to an increased demand by consumers for fortified F&B to supplement daily nutritional intake and dietary supplements to maintain and improve general health conditions. In 2023, cumulatively the fortified F&B and dietary supplements industry in Malaysia experienced a year-on-year (“YOY”) growth of 0.65%, as consumer demand and market conditions normalise post-COVID-19 pandemic. However, notwithstanding the exceptional circumstances of the COVID-19 pandemic, moving forward the aforementioned factors are expected to continue driving the growth of the fortified F&B and dietary supplements industry.

The key drivers in this industry:

Increasing rates of non-communicable diseases (“NCDs”) and infections drives health awareness and thus, the demand for fortified F&B and dietary supplements

Economic growth and increasing disposable income of the population signifies growth potential for fortified F&B and dietary supplements

Urbanisation and ageing population to drive the continued demand for fortified F&B and dietary supplements

Prevalence of social media marketing to drive awareness on the benefits of fortified F&B and dietary supplements

The key risk and challenges in this industry:

Vulnerability to product liability claims and recalls which could affect consumer confidence

Failure to meet changing consumer preferences could compromise industry competitiveness

Changes in regulations governing dietary supplements could lead to non-compliance

Future plans and strategies for OB HOLDINGS BERHAD

The company Group’s business strategies and future plans are set out below:

Construct New Serendah Factory to improve manufacturing efficiency and to cater for increasing demand in anticipation of future expansion

Purchase new machines in line with the company future expansion plan

Set up a new laboratory for product development activities in their New Serendah Factory and undertake a clinical trial on its house brand product

MQ Trader View

Opportunities

The company experience and expertise in the industry enable them to provide customised formulations of fortified F&B and dietary supplements to suit their customers needs

The company provide end-to-end solutions to customers from development of product formulations to manufacturing as well as a wide range of product offerings

The company have developed a multi-channel distribution platform and a portfolio of customers with longstanding business relationships

Risk

The company business’ reputation, market competitiveness and financial performance may be adversely affected by the sales of counterfeit products

The company may be liable for its marketing agents’ actions and conduct in marketing their house brand products

Click here to continue the IPO - OB Holdings Berhad (Part 1)

Eager to explore more trading opportunities? Apply margin account now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)