IPO - Supreme Consolidated Resources Berhad (Part 2)

MQTrader Jesse

Publish date: Wed, 06 Nov 2024, 11:32 AM

Financial Highlights

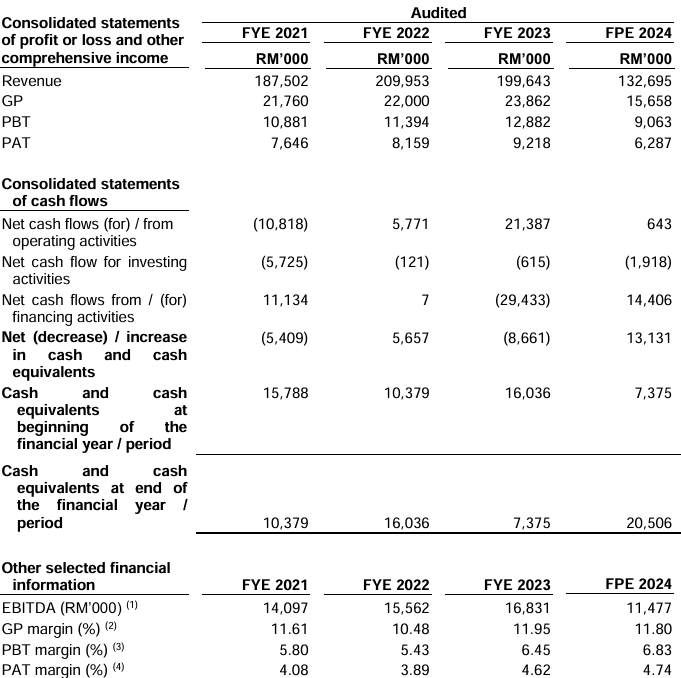

The following table sets out a summary of the consolidated financial information of the company Group for the Financial Years Under Review and FPE 2024:

- The revenue rose from RM 187 million in FYE 2021 to RM 209 million in FYE 2022, but declined to RM 199 million in FYE 2023. This is due to lower festive sales and reduced out-of-home consumption, driven by rising living costs following an increase in the OPR rate.

- The gross profit margin decreased from 11.61% in FYE 2021 to 10.48% in FYE 2022, impacted by higher product purchase prices and a weaker RM against USD, partially offset by lower freight rates for imported purchases. It then rose to 11.95% in FYE 2023.

- The PAT margin fell from 4.08% in FYE 2021 to 3.89% in FYE 2022, and increased to 4.62% in FYE 2023.

- The gearing ratio is 0.33 in FYE 2023, which is within the healthy range of 0.25 - 0.5, indicating a good balance of debt and equity.

Major customers and suppliers

Major Customers

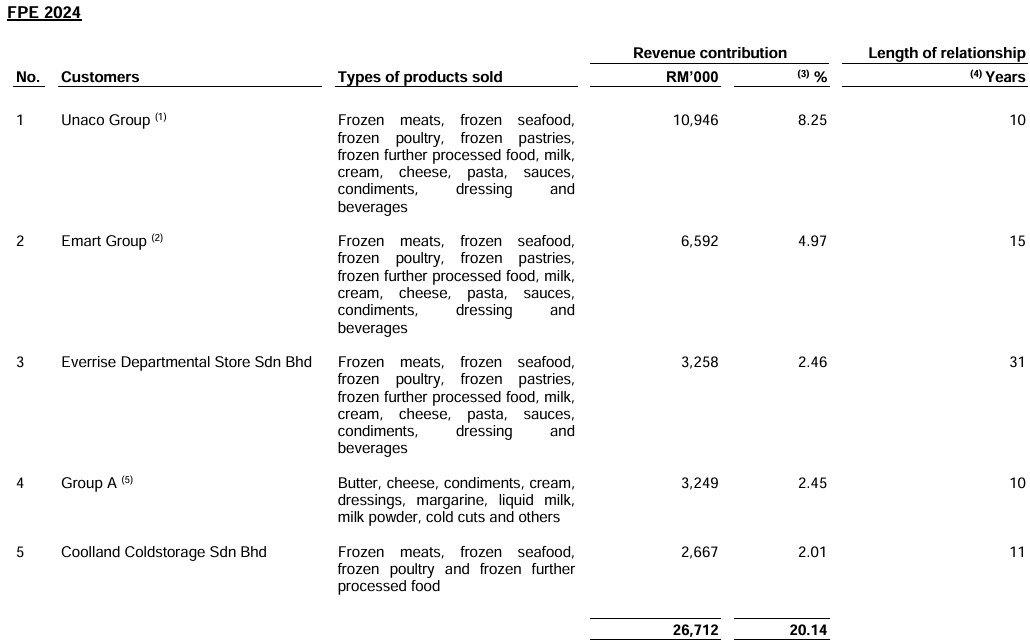

The company group’s top 5 customers for FPE 2024 are as follows:

The company is not dependent on any of its customers as non of their major customers contributed 10.00% or more of the company total revenue.

Major Suppliers

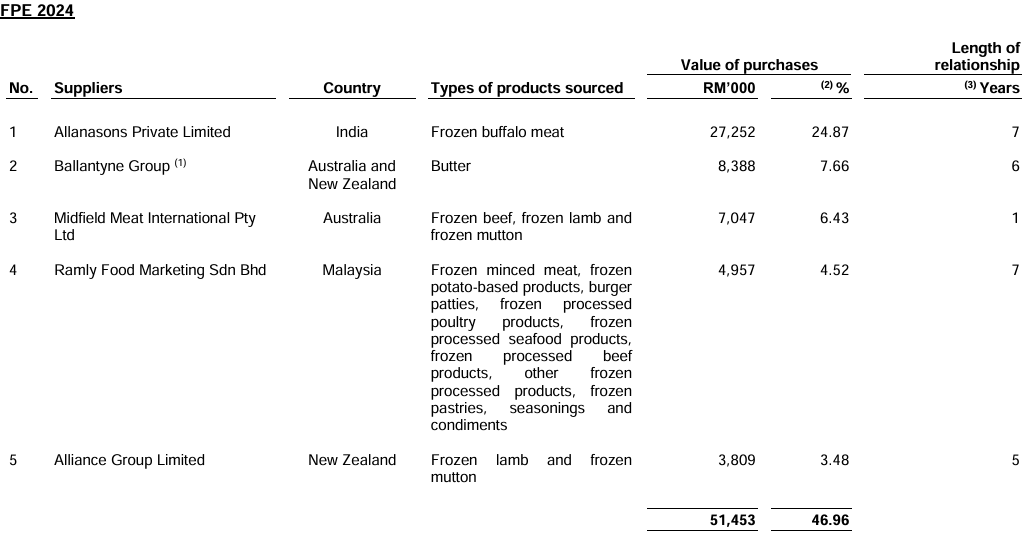

The company group’s top 5 suppliers for FPE 2024 are as follows:

The company is not dependent on any of its major suppliers as the products they purchase from these major suppliers are readily available in the market and they have alternative sources of supply.

Industry Overview

Distribution services are activities involving the efficient movement of goods and services from manufacturers to customers and end consumers. Distributive trade is the intermediary stage comprising all linkages and activities that channel consumer packaged goods for resale or to end consumers or users. Goods passing through the distributive trade are typically sold either without processing or with minimal processing. Operators within the distributive trade may physically breakbulk, sort, grade, mix, pack or repack. Additionally, distributive trade operators may sell directly to end consumers or users and/or other intermediaries who subsequently resell to end consumers or users. In some situations, manufacturers, producers and processors may also sell their goods directly to end consumers or users.

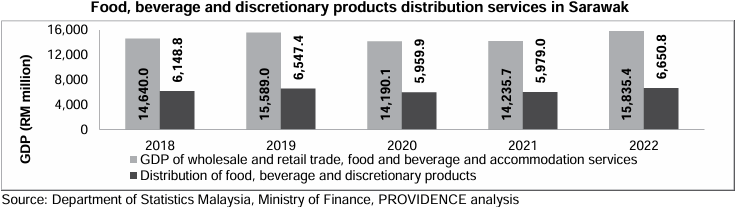

According to the research from PROVIDENCE, the food, beverage and discretionary products distribution services industry in Sarawak, based on the gross domestic product (“GDP”) of wholesale and retail trade, food and beverage and accommodation services, increased from RM14.6 billion in 2018 to RM15.8 billion in 20221 at a compound annual growth rate (“CAGR”) of 2.0%. Based on PROVIDENCE’s findings from primary and secondary research, the distribution of food and beverage products comprised approximately 35.0% while the distribution of discretionary products comprised approximately 7.0% of the GDP of wholesale and retail trade, food and beverage and accommodation services in 2022. For clarity, the distribution of non-food and beverage products such as household and commercial cleaning products fall under discretionary products. Thus, the industry size of the distribution of food, beverage and discretionary products increased from an estimated RM6.1 billion in 2018 to an estimated RM6.7 billion in 2022 at a CAGR of 2.0%.

In 2020, the food, beverage and discretionary products distribution services industry in Sarawak, as indicated by the GDP of wholesale and retail trade, food and beverage and accommodation services, was RM14.2 billion, a contraction of 9.0% from the RM15.6 billion in 2019. This contraction is attributable to the COVID-19 pandemic which affected economic and business activities throughout the state. Nonetheless, in line with improving vaccination rates and the gradual reopening of the economy, the food, beverage and discretionary products distribution services industry in Sarawak began showing signs of recovery in 2021 and 2022 respectively. In particular, the food, beverage and discretionary products distribution services industry in Sarawak registered a year-on-year growth rate of 11.2% in 2022 compared to 2021.

The key drivers in this industry:

- Long-term economic growth supports positive consumer sentiment and spending on food, beverages as well as discretionary products

- Foreign investment and domestic investment growth drive demand for food, beverages as well as discretionary products

- The growing halal food industry supports the demand for food and beverage distribution services

The key risks and challenges in this industry:

- The industry players' business is subjected to shipping disruptions and fluctuation in shipping and freight rates

- The industry players are subject to the risk of fluctuation in the price and availability of commodities

- The industry players may face the risk of inflation which may reduce demand for the products

Future plans and strategies for SUPREME CONSOLIDATED RESOURCES BERHAD

A summary of the company's business strategies is set out below:

- The company intends to expand its product range to meet consumer demands

- The company intends to expand its distribution network and strengthen their distribution reach in Sarawak and Sabah

- The company intends to expand its warehouse capacity to meet the growing needs of the Group

MQ Trader View

Opportunities

- The company has a wide range of third-party brands and products for distribution

- The company has a wide distribution network

Risk

- The company is reliant on third-party brands of Frozen and Chilled Food Products, Ambient F&B Products and Non-F&B Products

- The company is subject to the risk of disruptions to warehousing and cold storage facilities as well as vehicles

- The company is subject to the risk of product liability

Click here to continue the IPO - Supreme Consolidated Resources Berhad (Part 1)

Looking for 3x cash & 2x shares trading limit? Get started now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)