How to Calculate a DCF Growth Rate

Tan KW

Publish date: Tue, 10 Jun 2014, 06:45 PM

A DCF can be easy or as difficult as you make it.

The easiest way is to simply start off with the latest Free Cash Flow and then apply a single stage with a DCF growth rate.

DCF isn’t a 100% sure thing.

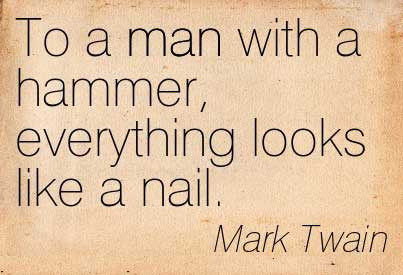

The easiest problem to fall into is to try and use a DCF for every single stock you look at without really thinking about the inputs.

You don’t want to fall into the hammer and nail problem.

It’s very tempting though because when you just get into valuing companies, you get excited and want to test it out on every stock you come across.

That’s where you need to know the pros and cons of a discounted cash flow.

Bruce Greenwald is clear that he doesn’t like DCF’s.

That’s why he came up with his Earnings Power Value method to value stocks.

However I like using DCF’s because I try to keep all my inputs realistic and make sure I have a big picture in my mind of what I’m trying to model.

And DCF growth rates is an important part of that.

Stock Valuation Preparation is Important

My wife is into ceramics and I was looking at a youtube video on how to make a pot.

Looked like a fun hobby so I began researching how to start.

Turns out, there is a lot to do before you even get a chance to have fun on the throwing wheel.

The right clay has to be chosen.

It has to be mixed and formed properly.

Only after several hours or days when the clay is ready, can you play on the throwing wheel and try to make something.

Getting the growth rates, normalizing data and understanding the inputs is a lot like getting the clay ready.

There’s a lot to think about before you can get to a real valuation.

Calculating DCF Growth Rates

Since I show a lot of valuations and intrinsic value numbers when I write about stocks, you should know how I get my numbers.

The DCF valuation method I use in the Old School Value Stock Analyzer is similar to a 3 stage DCF.

Instead of just taking one growth rate and extrapolating it linearly, I’ve applied a decay rate to simulate a business cycle.

And instead of just using an analyst growth rate estimate I normalize FCF growth to remove one time good/bad years to come up with something more usable.

This isn’t a precise method.

There is no precise way of doing things when you try to project, calculate or regress growth.

Valuation = art + science.

It’s just a matter of finding that right balance because you don’t want to skew towards one side.

Art and science should balance.

Easy Method

The easiest way to calculate growth is to subtract the beginning value from its ending value, and then divide that result by the beginning value.

Growth rate = (End value – Start value)/(Start value)

Easy.

But this method is only useful if you find stocks that look like those crappy clip art images.

Fantasy Growth Rates

It doesn’t factor in time and the ups and downs a business goes through.

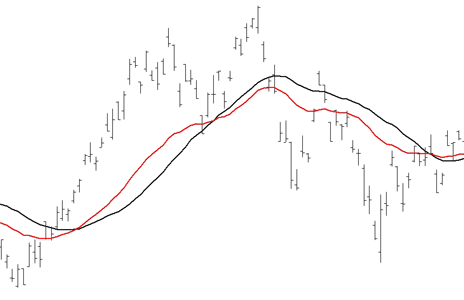

A real business looks like this.

Real business trends

By just taking the start and end values, you miss out on all the middle stuff that goes on.

The Old School Value Method of Calculating DCF Growth Rates

I’ll confess something first.

I copied this method from F Wall Street and tweaked it.

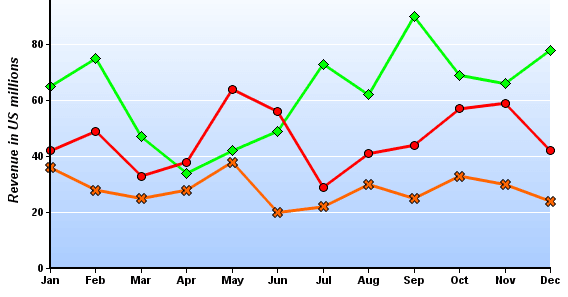

The growth I use in the Stock Analyzer is similar to a moving average to calculate the growth rate. I just call it a rolling median as it is more simplified than a moving average.

I’m sure you’ve seen moving averages before.

Moving Averages

Yes “those” moving averages used for technical analysis.

But instead of applying it to the stock price, I’m applying the concept to free cash flows.

Here’s how.

I like to look at both 10 years and 5 years worth of data. It provides enough history to make projections easier and more trustworthy.

Value investors are called fools a lot of times for anchoring on past data as a guide, but that’s all there is to work with.

There is no such thing as accurate future data.

Since FCF and owner earnings for the majority of companies are volatile, I calculate the growth rates for multiple periods and then calculate the median of all the periods.

Something like this.

- 2008-2012 (4 year period)

- 2009-2013 (4 year period)

- 2008-2011 (3 year period)

- 2009-2012 (3 year period)

- 2010-2013 (3 year period)

- 2008-2010 (2 year period)

- 2009-2011 (2 year period)

- 2010-2012 (2 year period)

- 2011-2013 (2 year period)

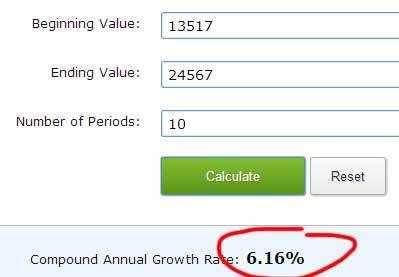

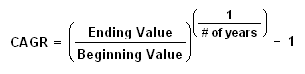

Since I’m dealing with time, instead of using the growth rate formula shown above, the Compounded Average Growth Rate (CAGR) is what I use.

CAGR Formula

If you aren’t comfortable with doing the math, just use the convenient CAGR calculator.

Then take the median of all those time periods to get the median growth rate to use in your DCF.

For MSFT, here’s what it looks like.

Compare the growth rate of 11.5% by using the rolling median method with a single CAGR calculation below.

Summing Up – Calculating Growth

Most of the times, a simple growth calculation is all that you need, but when you’re trying to model or calculate intrinsic value, you need to use a number that isn’t distorted by one time effects.

Don’t just rely on analyst growth estimates. I showed you last time that analysts easily get things wrong.

If you are a member of Old School Value, go to the DCF valuation section check it out.

If not, follow my example above and try doing it by hand.

It’s not that difficult and will help you calculate better growth rates.

More articles on OldSchool.com - Jae Jun

Created by Tan KW | Oct 23, 2018

Created by Tan KW | Jun 14, 2018

Created by Tan KW | Apr 20, 2018