Debt in These Times

omightycap

Publish date: Tue, 23 Feb 2016, 07:12 PM

One of our followers on our Facebook page asked to explain about this article.

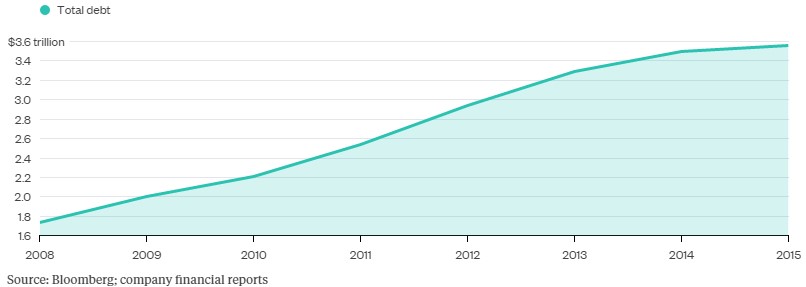

How a commodity rout caused an overall increase in commodity related company’s gearing from about $1.7 trillion to $3.6 trillion from 2008.

So… What caused the debt levels to mount up?

1. Obviously inside the article, using 2008 as the base period isn’t the best since data from 2008 is likely distorted with the Global Financial Crisis in place. Using the base year from 2008 might have overly dramatized the situation.

2. But debt amounts for major commodity companies definitely went through some highly inflated phase post 2008 crisis. A very good reason for this is how cheaply debts are priced with central banks round the world maintaining low interest rates up till the recent increase from Federal Reserve. The debt instrument is the best in this era of low interest compared to any other period of time.

3. Demand growth from global financial crisis recovery fueled the growth for commodity companies to invest heavily in their operations. Knowing that governments round the world are pushing for growth after a major shock had them packaging fiscal stimulus programs to push the economy out from a slump of such magnitude. Reacting to this, commodity companies are comfortable investing for higher output due to the external stimulus push and finance their investments with dirt cheap borrowing rates then.

4. China and India are two countries with the biggest population in the world. These two countries are undergoing major development where it contributes a healthy demand for basic commodities. The market looks upon these two giants to buy up everything from the market and placed a high price on those commodities.

5. Continuous Quantitative Easing from the Federal Reserve placed pressure on the dollar and major fears round the world have people shifting their money into commodities. The high demand for commodities pushes price higher which alleviates the confidence of commodity companies suggesting that they could improve in revenue even output numbers were maintained.

But then you might ask… Why commodity prices decrease and still they are borrowing heavily?

This the where the real problem comes in. The outlook for higher interest rates are fading with economies round the world slowing down. In basic economic terms, lower growth equals low interest rates to boost spending.

Companies now are still betting on low interest rates to continue playing this game. Many of the mining giants are still producing and if we refer to oil companies, the recent crash in oil price still had many producing and eventually reporting losses last year.

The giants of the industry do not care about the commodity prices and the quest to guard their market share is more important for the survival in the long term.

A rapid rise for commodity prices in the future might still be possible. Since that’s the case, having invested in the development of a new mine beats doing nothing and missing out the next commodities rally.

Furthermore, giants in the industries tend to buy up smaller competitors during this time due to how cheap the valuations currently are. Since this is a long term game, buying out weak competitors using current ‘cheap money’ is a good way to expand the business.

In conclusion, the high levels of debt aren’t anything to be worried about since it’s quite clear that at the current moment, interest rates aren’t going anywhere for what I estimate to be 3-5 years. The debt problem becomes dangerous when commodity prices maintains at current loss making price for another 2 years.

That said, if crude maintains $30 for over 2 years, we would likely see smaller producers facing bankruptcy if the gearing is high. Bigger firms who are highly leveraged on the debt might be seen selling off their assets.

In the meantime, be cautious and slowly gather data to any major changes in defaults and bankruptcy.

Like our Facebook for more (here) for more !!!