The Skyscraper Bubble – Tanjong Pagar Centre (Part 1)

omightycap

Publish date: Fri, 11 Mar 2016, 10:14 PM

Introduction

It could be merely coincidence or a plausible fact that skyscrapers could be one of the best leading indicator to an economic downturn or a market crash. This concept was first brought up by Andrew Lawrence who is a property analyst at Dresdner Kleinwort (now Commerzbank) in 1999.

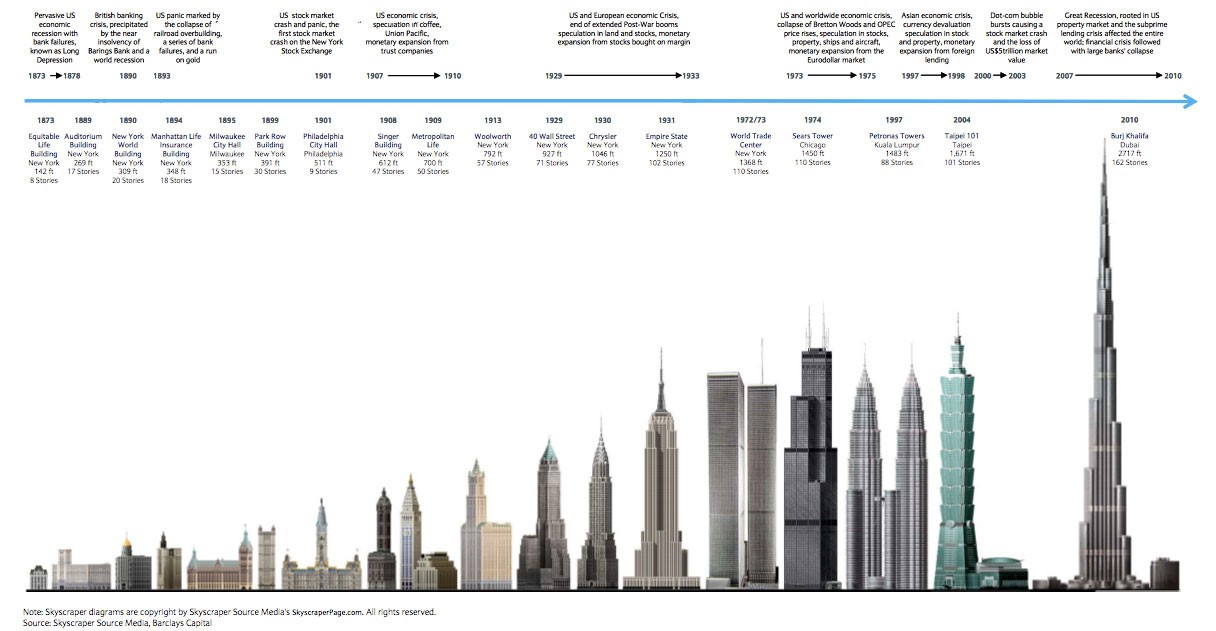

His findings were amazing where it evidently showed that from the famous Empire State Building leading to the 1929 Wall Street Crash to our very own Petronas Twin Towers followed by the 1997 Asian Financial Crisis. Indeed you could call it coincidence but the fact is that it happened over and over again.

Taipei 101 was next where at time of completion, Taiwan suffered its very own tech bubble after it hit the NASDAQ in 2000. Then the ultimate was Burj Al Khalifa in Dubai where the completion was closely followed the Global Financial Crisis. You could see the whole series of skyscrapers and their market crashing links in the picture below. Sorry I didn’t made the picture and it is not that clear.

While the list shows one building after another to be tallest in the world, how about some of the buildings which doesn’t get into the record books but still causes a stir? The KL Tower was completed in September 1994 and KLCI peaked in that month. It declined 34% after that where it recorded the lowest closing in January the next year.

What’s Up This Year?

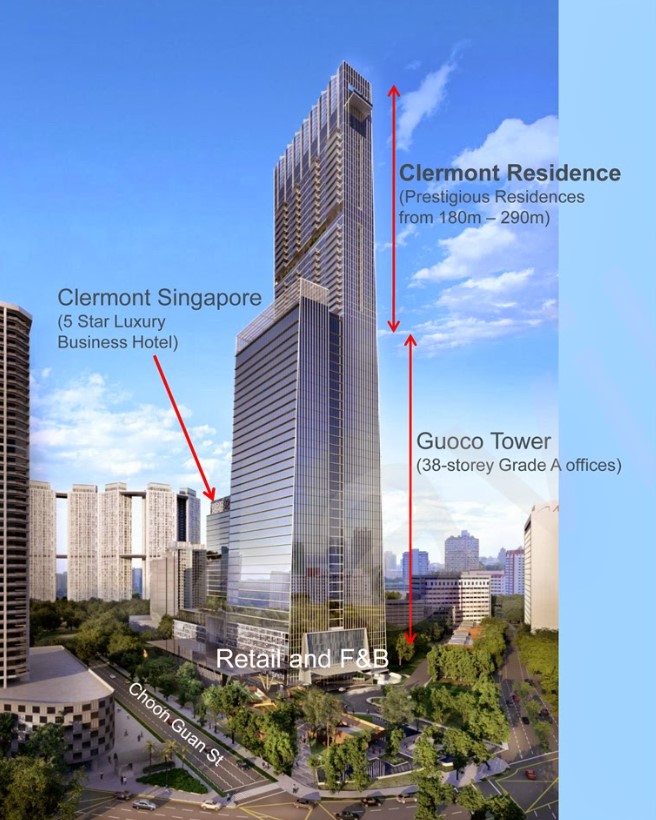

This had me looking at the Tanjong Pagar Centre which is going to be the Singapore’s tallest building at 64 storeys standing 240m. Immediately the signs are back where the completion estimated to be this year might start a recession for Singapore.

Evidence?

The GDP growth for Singapore in 2015 shockingly to a 2% versus 3.3% in 2014. The manufacturing sector saw a 5.2% contraction as well. Sign are already showing and with China slowing down further, the economic relationship between these two countries might lead to us seeing negative growth doubt as ‘recession’ in economist’s terms.

Today, governments round the world and central bankers do not like to use the word recession. In a way, you can’t escape the truth that a country’s economy is slowing down but officially declaring it dwarfs sentiment causing a spiraling effect to the economy.

What’s next? The unemployment rate is still fine or we could say that its stable but major companies had stated that they are not adding personnel at the current moment or at least another 6 months. What we know is that companies like Keppel Corp had already reduced the headcount by 6,000 last year. The NPL ratio is also rising (0.9% from 0.6%) but still excellent compared to other countries.

The sign are clear and once again the completion of the tallest building in the lion city would seem to be another indicator that things might be turning from bad to worse in quarter to come.

Really a Coincidence? Merely a Joke?

Economist called the Skyscraper Bubble Theory a whimsical theory but looking deep into the science and statistics might show that the maybe be a reason for such a thing to happen.

Just a brief walkthrough, the government come equipped with monetary policy and fiscal policy to manipulate the economy. Monetary policy is limited to reducing rates to promote growth. But there is a limit to what it can reduce to protect the strength of its currency. When it runs out of things to manipulate the economy, fiscal stimulus steps in.

This meant that the government could only buy itself out by spending and that continuously promote growth in the economy. This led to putting money on infrastructure and some might get spilled to the private sector where exemptions could be given to ensure that development is in place and that builds up sentiment as well.

In the end, instead of building a bridge to nowhere, property developers come up with skyscrapers knowing that the returns is somehow guaranteed in the long term. Again it might be a natural coincidence but the factors that led to plans on building skyscrapers couldn’t be phased out as well.

Physical Evidence

Funny that those building approvals come when the GDP growth rate is at its peak. Again, knowing that the economy might not grow at that rate anymore, it is best to be selling units of the building at that particular period of time to leverage on the public sentiment that is sky high. The government is happy to approve major projects during these times hoping to spur the economy. Unfortunately, that is when the happiness ends.

GuocoLand unveils the Tanjong Pagar Centre in 2 May 2013 (link here) and the GDP growth rate for Singapore peaked in Q4 2013 at 5.7%. Another coincidence? You be the judge…

In Part 2, I would talk about our very own KL118 also known as Menara Warisan Merdeka which would replace the top spot currently held by the Petronas Twin Towers. Similar to the analysis of Singapore, we would see if there are already signs that might lead to a recession or crisis ahead.

Like our page to get more these https://www.facebook.com/omightycap/

Make the next post easily visible from your Facebook!

omightycap

Part 2 would be completed on Monday...

2016-03-11 22:20