O'Mighty Capital Articles Archive

OM's Growth Fund on Federal Furniture Holdings

omightycap

Publish date: Wed, 06 Apr 2016, 02:55 PM

Added to OM’s Growth Fund last month is the small cap furniture maker worth around RM82.7 million in market value and rapidly growing with one of the biggest brand in the world.

The brand I’m referring to is Starbucks.

The unique feature about this furniture maker is the relationship that it had with Starbucks Malaysia. Later in time, the influence spreads across the whole of South East Asia. At the moment, being the sole supplier in the Asia Pacific region for Starbucks, we just love stocks of this nature due to unlimited growth possibilities.

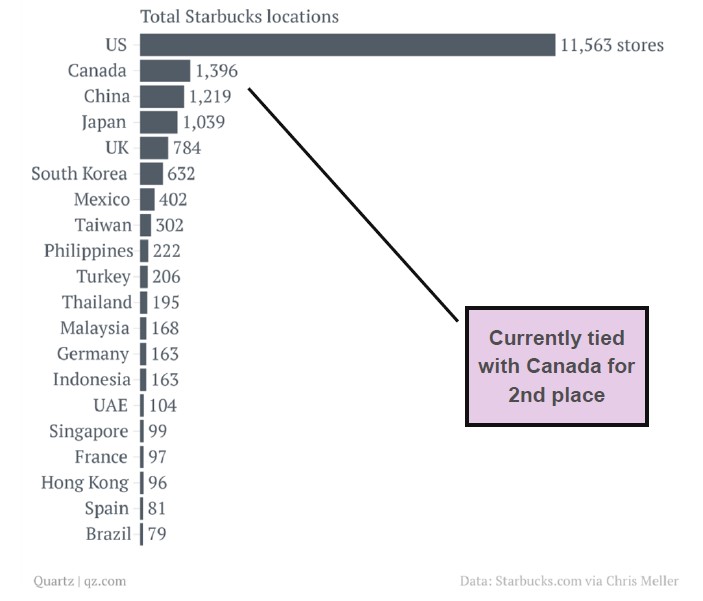

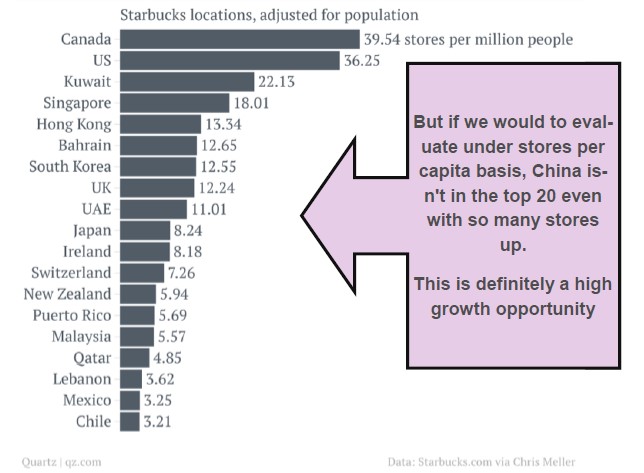

Moving forward, the most intriguing part for the future of this company would be its involvement in supplying furnitures to Starbucks China. China is currently the 2nd biggest market for Starbucks after the US but the penetration is still low with many cities to cover. This is a good macroeconomic indicator where it creates a healthy buffer for holding the stock knowing that there are still plenty of growth potential ahead.

The country with the most Starbucks stores in the world is still the United States where it exceeds by a huge number compared to second in place of Canada or China. Would it be potential that Starbucks in developing markets would catch up to the number that the United States has? The answer would be that it is unlikely. But to catch up to at least half in terms of number of stores US has? That is very likely.

Looking at the management style of Starbucks, growth is definitely their top priority since the had already achieve good brand name and were able to maintain quality around the globe. Now it would be the case of execution to newer markets generally frontier markets like some of the nations in South East Asia.

Going back to our stock pick, by referring to both tables including the one from the previous page, we can see that the penetration for Starbucks in China is much lower since the population is huge. Although based on number of stores, it sits at 2nd place but to be exact, it haven't made its mark in China yet.

Since that’s the case, with the stock trading at just 13 times forward earnings, it’s relatively more expensive compared to its peers but the known growth ahead compensates for it.

Overall, it comes with a healthy balance sheet and somewhat started to form backlogs on its products had been achieved. It is good for producers like these to have backlogs instead of ready inventory. Earnings would be more predictable with backlogs and raw material prices risk would remain low.

Rising Income Disposable Income

As we all know, Star-bucks targeting strategy focuses on mid to higher level class of the population. Unlike in the US where a cup of coffee cost around $4.00, the affordability of Starbucks in Emerging Markets is much lower. The rapid rise of disposable income for Chinese nationalities had became a major game changer.

The demand for better products and a better life-style image had propelled the rich’s spending power in China. Over the last few years, brands carried by LVMH and Kering derived al-most half of their revenue from China alone. Considering Starbucks cater for the mid to higher class. We should see this factor pushing for higher growth in number of new stores.

Like our page to get more these https://www.facebook.com/omightycap/

Make the next post easily visible from your Facebook!

Make the next post easily visible from your Facebook!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on O'Mighty Capital Articles Archive

Discussions

Be the first to like this. Showing 0 of 0 comments