Which Currency Are You Holding?

omightycap

Publish date: Mon, 11 Apr 2016, 08:43 AM

We knew that last year was a big scare when ringgit was free falling against the US dollars from 3.6 early January 2015 to its peak nearing 4.5 in September that year. Around 6 months after it touched the peak we are currently looking at ringgit which continuously strengthened against other developed market currencies.

Well I guess it’s time to start thinking about diversifying our cash holdings since it is relatively a good opportunity with the ringgit strengthening.

Why Did Ringgit Strengthened Recently?

-

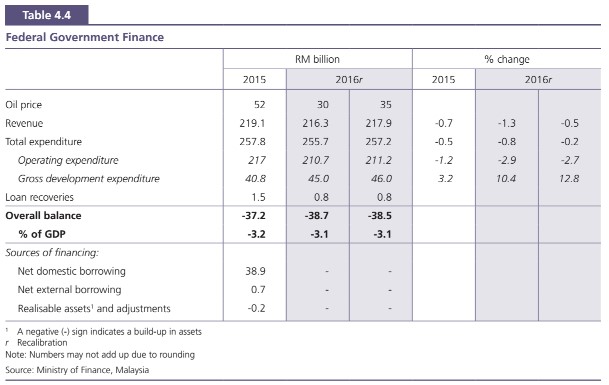

The oil price crash was closely tied to the ringgit crash but that was in 2014. At the current moment, the market learned that the government’s revenue isn’t that sticky to the oil price anymore. The latest Bank Negara Malaysia (BNM) Annual Report 2015 did show that GST collection were able to offset the loss in oil revenue.

Extracted from BNM’s Annual Report

Extracted from BNM’s Annual Report

It showed that even with oil price revision from $52 to $30, only a loss of RM2.8 billion in revenue would be realized. One thing in particular is that we know the government income don’t that to rely that much on oil royalties anymore.

-

The preliminary GST collection were estimated to be only RM27 billion for 2015 but the actual collection was actually more. GST was successful in squeezing out the shadow economy in this case. The real number isn’t out yet but investment houses estimated that it might collect another RM10 billion extra from the estimate bringing the total to RM37 billion easily covering the oil revenue.

-

The 1MDB non-sense already had the markets not caring much about it. We estimated that without the presence of 1MDB’s scandal, the ringgit would worth around 7.0% at the peak of the crisis. The liquidation of 1MDB assets and the ability to disperse its risk lowers the risk on the guarantor’s end which is the government.

- The dollar did weaken as well after Fed’s rate hike. Worse is that the original 4 rate hikes for this year had been reduced to only 2 at the current moment.

Why I Don’t Like the Ringgit Now

- Our BNM chief Tan Sri Dato’ Sri Dr. Zeti Aziz is leaving, simple as that! It’s not like I have no confidence for our next BNM Governor that would replace the incumbent’s place but I presume that we should see a lot of volatility in Ringgit when the next appointment is in office. I too believe that the next appointment would not be the so called ‘political appointment’ and I'm confident to cast my vote on Dato’ Sri Abdul Wahid Omar. I guess he is the best candidate now since he was a banker heading Maybank after the Global Financial Crisis and currently the country's Economic Minister.

- After 16 years of Zeti’s administration, we are kept to a very defensive monetary policy approach where growth rate over these few years are very healthy even if its slow and the economy doesn’t overheat due to overly aggressive monetary policy stance. It had been a fool proof mechanism.

- But the field of play in this era is a little different. Rates are going negative in Japan and Europe and US might even halt any rate hikes or even pass 1.00% in their Fed Funds Rate. Central bankers round the world are lowering interest rates to promote growth in a slowing world. Malaysia isn’t going to be excluded from this when our economy slows. Some of the research houses here in Malaysia had started calling for an OPR cut of 50 basis points before the end of this year.

It is definitely going to be a wild ride from here due to many uncertainties and the preference for holding ringgit fades with these unknowns ahead.

Consider British Pounds

I felt that GBP could have been beaten up badly up to the level where it turns a little undervalued compared to other currencies in the Special Drawing Rights (SDR). I like to hold SDRs since it’s the most common currency and central banks round the world are holding those currencies as foreign reserves.

Year-to-date GBP had weakened 15.03% against the Ringgit compared to USD at 10.25%. The reason for GBP weakening is highly tied to the Brexit case where the citizens would vote for the decision for Britain to remain in the European Union.

Markets are looking at a Brexit and assuming that voters would vote for an exit (probably that’s where they get the name Brexit not Brin). If Britain exits, then it would change the economy of the country where the ease of doing business with other members of the EU would be over. That is why the market is assuming that economic activity would go down and that directly reflects a lower value for the currency.

My conviction is that Brexit or Brin happens, the currency would rise in value.

- London’s properties is getting all the demand from foreigners from the Chinese and Middle Easterners. With a cheap currency, money would start to pour in again in the future. Britain is a country that sells services as exports. Services are usually sticky to a customer compared to physical products. Example would be banking services or insurance that are sticky to consumers compared to British branded clothes.

- If Britain isn’t tied to EU anymore, Bank of England is free to raise interest rates at its own will increasing the attractiveness of the currency. The disparity in interest rates can't be that huge at the current moment.

- If Britain chooses to stay, then all the speculation on selling the currency similar to what we see at the current moment turns into a mistake. An adjustment would be made to a fair level.

We can classify this being similar to what USD went through before the rate hike. Markets usually overbought or oversold before an event happens. It is likely similar this time round as well.

Based on all that, I guess GBP gives you the best risk to reward ratio and if everything fails then it’s time for a week’s holiday in London going on a shopping spree for branded goods.

Like our page to get more these https://www.facebook.com/omightycap/

Make the next post easily visible from your Facebook!

You can visit us at http://omightycap.wordpress.com