AFG Best Performing Bank Q1 2016

omightycap

Publish date: Mon, 11 Apr 2016, 12:27 PM

This post appeared on omightycap.wordpress.com first

As reported by CIMB Research today, the award for best performing bank for Q1 2016 goes to Alliance Financial Group (AFG).

This isn’t some rowdy stock price overbought situation but the huge rally comes with good fundamentals to back it up making it a star performer last quarter.

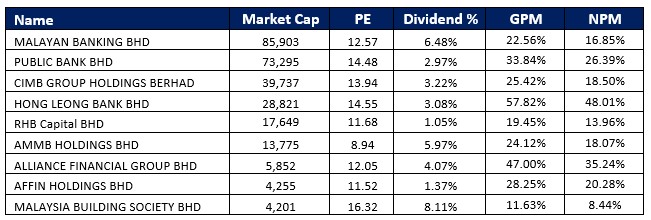

The table above shows the basic PE and profit margins where we see that AFG comes in second for profitability after HLB. Note that this table was my draft on 7th March 2016.

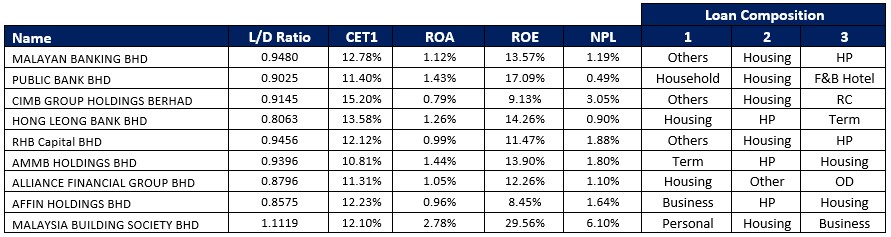

From table two, we see that indeed it is not the strongest bank out there, doesn’t provide the best return on its assets and in fact not the best in terms of NPL percentage.

To be exact, I rate this as mediocre. But in reference to the PE that I am paying for, it could be considered a bargain. Why so?

1. We axed out higher PE candidates first, then we are left with RHB, AMM and Affin.

2. None of the candidate could match the profitability of AFG

3. The 3 banks with lower PE have NPL higher than AFG which could eat up the profitability margins further.

4. Disparity in CET1 isn’t that high comparing all four.

5. Would still prefer home loans compared to business loans or other types of financing as primary.

Basically, comparing with lower PE banks AFG comes up on top and the next step would be comparing with Maybank and CIMB. I would not compare with Public Bank since the stock price itself scares away many retail investors.

Immediately, I do not like the NPL ratio for CIMB which is higher than average. Knowing that the possibility for high NPLs to come back and haunt you in the future keeps me awake at night.

We are left with Maybank where we originally started with and still remain invested in it.

The problem is I have no idea how I’ve missed AFG badly and got the stock at RM3.70. The rally from way down in Feb turned into a waste if I would to realize the basic fundamentals for this stock.

To be honest, at times we are blinded by a stock when it is mediocre where it is natural for us to search for the best neglecting up and coming good ones. I would try my best to refrain from making the same mistake again in the future.

Like our page to get more these https://www.facebook.com/omightycap/

Make the next post easily visible from your Facebook!

You can visit us at http://omightycap.wordpress.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|