Fiscal QE in The Process? (Part 1)

omightycap

Publish date: Fri, 17 Jun 2016, 03:45 PM

Borrowed the term ‘Fiscal QE’ from Credit Suisse which I’ve referenced this article for a few good points to build an outlook of the world economy going forward. The evidence is really clear that moving towards zero benchmark interest rates would put major economies round the world with only a handful of choices that they could make. The likelihood of increased fiscal spending to avoid/recover from a recession seems to be the only choice thus the term Fiscal QE.

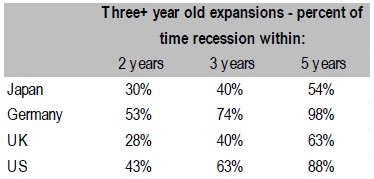

The numbers are clear that the expectation of a recession increases in probability over the next 5 years. It’s nearer than ever since the last recession which occurred due to a financial crisis. In some ways, the GDP growth decline in developed countries could be tied to disruptive technology that removes some participating agents in the economy. For example, hardcopy prints. Making things available online had made some businesses round the world obsolete and no longer part of the GDP number.

China’s GDP decline is also a good example that it is moving up the supply chain meaning that from manufacturing it moves to services. GDP number might show a decline but the quality of the job improvement might have improved one’s welfare significantly.

Why Conventional QEs Don’t Work?

1. Low debt cost causes the investment into unprofitable projects by corporates to reduce the amount of tax to be paid. Unprofitable projects suffer in the long term which could turn into a problem in the future.

2. Lowering interest rates affects the Net Interest Margin (NIM) for banks. Banks could be considered the bloodline for the economy and making them unprofitable isn’t beneficial in the long term. The operating environment for banks should be a complement for economic growth and not competing heavily for businesses just to stay alive.

3. The problem with QE as we had all experienced is that real estate prices round the world had overinflated due to cheap financing. This creates finance imbalances within the economy where the gap between the higher income and lower income increases in a short period of time.

4. QE with lower interest rate might have an adverse effect where consumers are saving even more although their cash isn’t yielding much. The lower interest rate might lead to declining sentiment within the economy that induces people to save foreseeing a rainy day ahead.

Evidence That Fiscal QE is Possible

At the moment, most of the developed economies round the world had their government bonds/securities at all time low yields. Eventually this would go zero (had already begun) and this would mean that the government financing is technically free of interest.

With zero interest rate financing for the government, infrastructure investment would seem to create the best payoff for everyone in the country. Central banks issuing government bond/securities would swap into long term holdings where the central bank itself is holding the government’s debt and not an external party. Central banks no longer need to inject money into the banking system hoping for people to get loans but utilize the funds; lending it to the government.

The monetary system isn’t flooded with too much liquidity and this allows a country to minimize the volatility on their exchange rate.

What Major Economies Would Do?

Japan

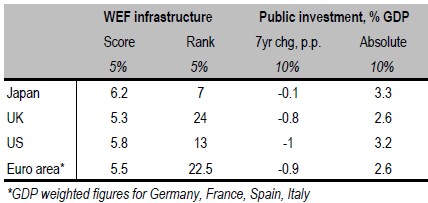

Japan isn’t likely to take on more infrastructure development. Based on the World Economic Forum infrastructure score, japan ranks the highest among major economies at 6.2% or 7th place. Japan already went through major spending in the last decade and that’s how the saying “building a bridge to nowhere” came by.

A tax cut is more likely getting the consumer more disposable income to spend again. This is a high savings nation and adjusting the interest rate alone isn’t going to help much where people still continue to save although interest are at zero.

United Kingdom

The infrastructure spending outcome is most likely since UK ranks at the bottom among developed economies for infrastructure score. Much of it would likely fall on improving current system since a couple of cities in the UK had aged and see only minor improvements to infrastructure.

United States

It has already been proven that monetary QE doesn’t work. Similar to the UK, the most likely outcome would still be infrastructure investment or more towards public spending which consist of public services and military.

Like our page to get more these https://www.facebook.com/omightycap/

Make the next post easily visible from your Facebook!

You can visit us at http://omightycap.wordpress.com