Petron Malaysia Refining and Marketing - A Gem in the Rough?

Azentius

Publish date: Thu, 18 Feb 2016, 11:06 AM

The tumult of Shell Refining Berhad and its stock price in recent weeks has thrust upon several perplexing questions waiting to be answered. Some of the questions revolve around the profitability of downstream oil refining industries in Malaysia and to a certain extent the doubt on the prospect of this industry as a whole going forward. Likewise, in this coverage on the downstream oil refining industry in Malaysia, we will walk through the industry dynamics for this specific industry segment and also highlight one of the undervalued oil refiners in Malaysia.

Industry Dynamics of Downstream Oil Refining Industry

The refining industry is plagued by two main drivers in which it require significant capital outlay and investment to sustain their operations (due to the need to introduce better grade petrol with less Sulphur) and face the challenging industry fundamental of narrow margin and significant exposure to stockholding losses. Two elements actually in play in determining the profitability of downstream oil refining industry which are the refining margin and the stockholding gain/losses. For the former factor, it is determined by the demand in the market (which in Malaysia case, based on the regional benchmark - Singapore Complex Refining Margin) while the latter factor, it largely depends on the volatility of crude oil price.

The single most important factor that forms the demand in the market is actually the level of crude oil price. This can be further explained by two underlying aspects of which on one hand lower crude oil price (and thus petrol) induce consumers to travel more and spend more on petrol while on the other hand it also encourages more nations to further enlarge their strategic oil reserves as part of respective nation’s national security agenda. On the surface of it, the refining margin is influenced by this two factor and yet it is much more complicated than that. For an instance, there are actually various underlying forces that exert influence over the refining margin namely the refining capacity and utilization, economic condition, the imbalances in the demand for a particular oil fuel and even the influence of government policy.

Refining Capacity and Utilization

There is no doubt that the refining margin has been squeezed in recent years due to overcapacity in worldwide refining capacity. Nevertheless, we need to aware that not every refinery is configured in equal term and the economics of refinery is vary from each to the next. For an instance, those refineries in the Middle East that build in recent years is configured to middle distillates that tend to produce more of those oil fuels like jet fuel and diesel and this eventually leads to a supply glut for these oil products. As it stands, the concern of overcapacity is actually relieved by the closures of several refinery in Japan, Taiwan and China.

Economic Condition

Many people have expressed their view that economic condition imposes a significant influence over the demand for petrol and thus the refining margin. Rather, we felt their view has been somewhat misguided as the demand for petrol is relatively stable regardless of the state of the economy. What the economic condition really influence is rather the indirect demand for all those by-products in producing petrol. As all these oil products is mostly consumed commercially, the state of the economy will definitely affect the demand and subsequently the margin for all these products.

The Imbalances in the Demand for a Particular Oil Fuel

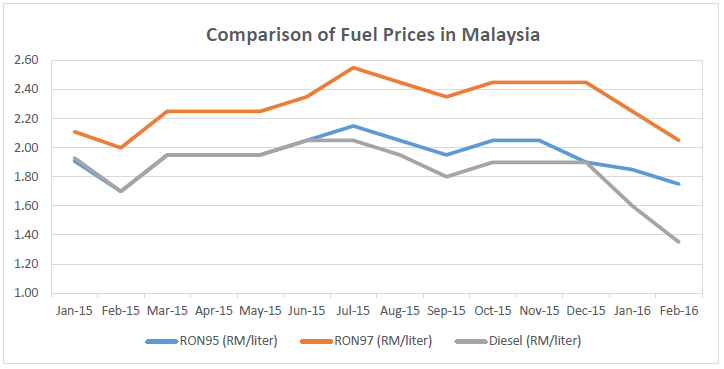

What we observed in the current oil fuels market is a divergent oil fuel demand characterized by the inherent imbalances that build up in the supply chain nearly a decade ago. For many years, European refiners have put emphasis in seeking higher diesel output while depressing the production of gasoline in order to satisfy the growing demand for Diesel in the region. However, Europe is a shortage of gasoline of late as consumers started to switch to gasoline based vehicles. This can be partly attributed to the scandal of Volkswagen of which overturned their long ill perception that high-quality Diesel is environmentally friendly. This help to explain the recent monthly announcement of price change of which resulted in the different quantum of decrease between RON 95, RON 97 and Diesel respectively. The larger reduction in diesel signifies that the market is flushed with diesel as compared to a more resilient demand seen in gasoline (RON95).

The Influence of Government Policy

In another instance, the latest policy measure imposed by the China government also bode well in supporting the refining margin as they put a floor on the crude oil at a price of $40 per barrels for their domestic markets and since then it has been more profitable for local refiners in China to cater to their domestic demand rather than exporting their products.

The reasoning behind the notion of burgeoning downstream oil and gas industry when the crude oil price is low

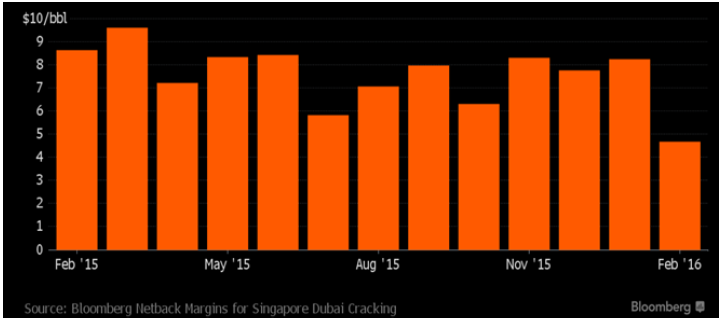

This is largely centred on the basis of stimulated demand for various oil fuels such as gasoline, diesel, aviation fuels and naphtha. On one front, lower crude oil price helped to lower overall input cost and this, in turn decreases the working capital required and subsequently generate significant savings through interest cost savings or reduced commitment fees (assuming refiners financed their working capital through revolving credit facilities) and contribute to a better cash flow position. In a typical manufacturing environment, higher utilization will translate to better margin and this economics of scale notion do apply to the refining industry as well as higher volume will help to dilute the fixed cost and in turn generate a more favourable fixed cost coverage. Apart from fetching higher margin from higher volume, refiners in Malaysia also benefited from a higher refining margin benchmark as set in Singapore. This benchmark has trended upward for the most of 2015 and recorded a margin as high as USD8 per barrels in the last month of Dec 2015.

On the concern of elevated margin for Malaysia refiners are not sustainable

In our view, there is no doubt that the crude oil price will trend upward in the next few quarters or so but we believe there is a catch in this expectation. The potential impact of the fundamental shift in the dynamics of crude oil market has been understated so far. The expectation of straightaway recovery for crude oil price will likely fall short as we felt the shale gas oil is the game changer in the supply and demand of crude oil. The future movement of crude oil price will largely characterize by constant upward struggle due to the influence of shale gas oil (which acts like a supply side disruptive producers). As long as the crude oil stays above the price of USD 40 per barrels, we foresee any disruption in the supply of crude oil going forward will be able to offset by an increase in shale gas oil.

We believe a sustained low crude oil price era is here to stay for the next 2 years or even more attributed to the 3 main factors as outlined below:

1). Oversupplied Crude Oil Market Still Largely In Play

The Iranian oil flooding the world crude oil market is just another reason to dampen the view on the already oversupplied crude oil market. There is no doubt that the demand will catch up with the supply one day, but the day to be reckoned by definitely not around the corner yet.

2). Lacking Idle Storage Capacity to Further Absorb Excess Supply

Capacity replenishment has actually supported the crude oil market for the past few months as respective nations take advantage of low crude oil as well as pursue their own national safety agenda through filling up their strategic oil reserves. And with the dissipating support from China and others nation for this cause (due to constrained storage capacity), it is hard to see how the crude oil market can achieve sustainable recovery in the near future.

3). The Influence of Flexible Shale Gas Oil Industry in U.S

The fear of shale oil lies in their flexibility to produce oil (acts as a counter weight) rather than the sheer quantity of oil they managed to produce. This is due to the fact that shale gas oil well required a modest amount of development cost of USD5mio and thus, the upfront capital outlay is relatively small. Those shale gas producers will be able to leave their oil well in idle mode when the worldwide crude oil price is at a depressed level and jumpstart their oil well when the price is favourable again. Thus, we believe the counterweight economics of shale gas oil will continue to exert significant pressure on the worldwide crude oil price going forward.

Petron Malaysia – The Undervalued Oil Refiners

We valued Petronm in the view that they have a high level of operational flexibility (its refined products (total throughput of 49K barrels per day vs. sales volume of 80K barrels per day) which attributable to roughly 60% of total sales volume and the rest is made up of purchase from open market). Its business model is significantly differ from other refiners in the region as its profit contribution is more diverse from the retailing segments and not solely rely on the refinery operations only.

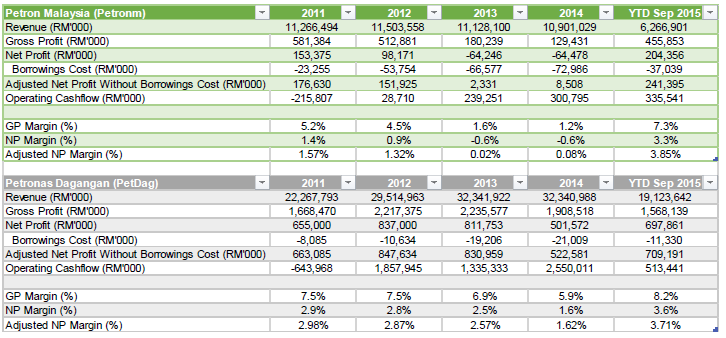

For the financial results ended Sep 2015, Petronm has racked up Gross Profit and Net Profit of RM 456mio and RM 204mio which translate into a commendable margin of 7.3% and 3.3% respectively. This margin position is in line with PetDag that stands at 8.2% and 3.6% concurrently and if we were to strip out the borrowings cost, Petronm would have even outperformed PetDag on the adjusted net margin of 3.85% vs 3.71% that of PetDag. In fact, we can observe that Petronm has achieved immense improvement in its operational efficiency as evidenced from its improving margin. There is no doubt that the improvement in margin is aided by stronger demand for oil products through lower crude oil price, but we suspect that the improvement in margin also coincides with the completion of strategic projects in 2014 which have helped to streamline Petronm operational efficiency. To put that into perspective, Petronm margin has never come close to match those of PetDag in those years (2011 - 2012) that refiners also enjoy strong margin as shown in the comparison above.

In terms of improvement in operational efficiency, what we can observe from its financial metrics is shown in the comparison of margin over the years. The margin in Petronm has been lagging behind PetDag for the most part of the years and we assert this scenario can be attributed to the disparity between efficiency level and lower contribution from the commercial segment (which tends to fetch more stable margin) for Petronm. Indeed, we believe the stronger margin as seen in Petronm also contributed by its burgeoning commercial segment as its commercial segment grew 32% in 2014 underpinned by 11% growth in LPG and 100% growth in aviation fuels. In another instance, it is true that Petronm has recorded losses in 2 out of the past 5 years, but if we were to exclude any borrowings cost from its financial metrics, we can assert that the negative earnings are likely to be reversed. Likewise, we believe strong balance sheet and low level of debts is much needed to instil some level of stability into the business model of refiners. In fact, Petronm has utilized the opportunity of reduced working capital requirement along with strong cash flow generation capability (RM 336mio cash flow generated from operations ) to pare down its debts through repaying long-term borrowings of RM 441mio and this has helped to generate interest cost savings of RM 16.5mio for the 9 months ended 2015. This should be viewed as favourable as we believe a low gearing / debts free business model is imperative for refiners to deliver healthy margin and thus profits to shareholders going forward.

Likewise, all these factors augur well for Petronm as we are more likely to see it continue racking solid profit q-o-q for the next 2 years. Refiners might even make a windfall profit in the event the crude oil market trend upward gradually as refiners will be able to realize higher earnings through the positive differential of selling price and input cost. There hasn’t been any case in corporate history that refiners will suffer in stockholdings losses when oil climb from low point to high point. We are not implying that the refining industry is without any challenges going forward. Rather, we assert that the upside potential for the industry clearly outweighs any downside risk in view of sustained weakness in crude oil price and imbalance between gasoline and diesel production in Europe which will lend support to crack spreads in Asia market. In the short run, we felt there is even some upside potential towards earnings for local refiners in the event of a short-run spike in oil price. This is attributed from the facts that refiners will be able to sell their inventory at a relatively higher price than their input cost of which further boosting their margin.

On a comparative basis, PetDag is expected to earn 0.9 EPS for the full year 2015 while Petronm is likely to net in 1.00 EPS. Whereas in terms of valuation, PetDag is valued at 25x PE while Petronm only saw to be worth 7x PE. This led us began to ponder why there is such a stark difference in terms of valuation assigned to both companies as they operate in the same industry? If there is a notion of premium valuation assigned to the market leader or Petronas-linked company, we think this is partly justified but it is definitely not until such a huge disparity. We felt there is a strong case for re-rating of Petronm even after run-up in its stock price for the past few months and we assigned a target price of RM 18 (based on 18x PE, 28% discounted to PetDag 25x PE) which represents an upside potential of 168%. Even though the local refining margin will be continued undermined by a global capacity overhang, the undemanding valuation and stable business model of Petronm convinced us that there is a strong catalyst for this stock.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

just don't take people to holland , that's all.

in an environment of falling crude prices , refineries in the West and in Malaysia are suffering ( Shell refinery is sold for a song, Warren Bufett just bought out a huge but failing refinery)

In China, refineries are having a happy year, so much so they have money to buy Shell Refinery.

You know why?

In Malaysia ( and in the West) product prices are adjusted to the lastest crude prices plus a margin.....but the refined were produced from higher priced raw materials bought several months earlier....How not to die?

In China, they practically fixed the product prices...in an environment of cheaper and cheaper crude prices, how not to make super profits?

ok.....so Petron has petrol stations and a refinery....the petrol stations buffer the losses.....but to call Petron $10........sure you not taking people to Holland?

Looking at chart above, I will say a fair price would be $ 4 - $5.

readers...be warned.

2016-02-18 12:40

Other than the TP which i think is a bit exaggerated, due to the unfavorable industry....I feel the article highlighted the upside of the entity, but it would be better that the editor of this article do include the negative side as well. Btw DESA20201956, u need to really do your homework before giving out facts, especially the part where " produced from higher priced raw materials bought several months earlier ", and by looking at the chart you can easily come up with a fair price, that i really gotta give it to ya.. Love to know the reasoning behind it, cheers

2016-02-18 13:04

produced from higher priced raw materials bought several months earlier ",......in an environment of falling crude prices......that is exactly what happens and caused Shell Refinery and other big refineries in the West to go bankrupt recently.

The selling/ product prices are adjusted to the latest prices while their raw materials were purchased at a higher price.....of course they go bankrupt.

Why you don't believe looking at the charts can tell the fair price? The fair price.....at best will be the average price of the last 5 years.....in view of their operating environment.

2016-02-18 13:13

Please do take a look at the inventory days of Shell, Petdag and PetronM before coming up with your own conclusion...And as for the fair price based on charting, that is quite "unique"...Anyway, like my boss would always end his sentence "stock price will eventually justify all arguments". And Desa, i noticed that your comments throughout every forum are fairly negative. :-)

2016-02-18 13:37

Please take note that Shell is not Bankrupt...in fact it make EPS Rm 0.85 for 9 mths loh....!!

FYI the takeover of rm 1.80....is a pakat tho cheap minority shareholder loh....!!

Shell is trading at PE of 2X now loh....!!

It should go back to Rm 6.00 to 10.00 within say 5 yrs loh...!!

Remember some investor offer Rm 4.00....but the parent of Shell refuse to sell....but instead sold to the china party cheaply loh...!!

2016-02-18 13:37

BTW THE HIGHEST MSIAN BIDDER IS RM 4.00....MUCH HIGHER THAN THE GO RM 1.80 LOH.....!!

WHY SHELL SOLD FOR A SONG AND NOT THE BEST PRICE WINS ?

1. CONFLICT OF INTEREST LOH.....!! DESPITE SELLING THE REFINERY SHELL WANTS TO KEEP THE RETAIL PETROL STATIONS, THEREFORE THEY NEED TO PAKAT WITH THE NEW REFINERY OWNER LOH....!!

2. SHELL REFINERY IS A PEANUTS TO OVERALL SCHEME OF THINGS LOH....!! THE PRICE CAN BE SOLD FOR A SONG MAH..!! THEREFORE THE SENIOR MANAGEMENT HAS POTENTIAL TO PAKAT & OBTAIN PAYOUT BEHIND THE SCENE AS BEING A REWARD LOH.....!!

2016-02-18 13:39

Cost to the buyer oF Shell:

1. The announced sale price.

2. The debt of 1.2 billion

3. The capital expenditure to meet Euro 4 and Euro 5 product specifications.

RAIDER EXPLAIN; LOOKING AT THE CASHFLOW THE RM 1.2 BILLION ABOUT 2.5 YRS OF SHELL CASHFLOW. THUS IT IS VERY CHEAP, EASILY AFFORDABLE LOH.....!! BTW THIS RM 1.2 BILLION IS ALREADY IN THE BOOKS OF SHELL...NO NEED TO FURTHER BORROW FOR THE NEW OWNERS LOH.

THE CAPEX FOR EURO4 AND EURO5...NO PROBLEM...ITS COMPETITOR PETRON AND PET DAG WILL HAVE THE SAME PROBLEM...WHY THEIR SHARE(COMPETITOR) PRICE DID NOT COME DOWN TOO ?

THIS BCOS THE IMPLEMENTATION OF EURO 4 & 5, WILL LIKELY TO BE DELAYED & STAGGERED MAH....!!

EVEN IT IS IMPLEMENTED QUICKLY, THE LIKELY SCENARIO THE REFINERY CAN QUIETLY CHARGE A HIGHER PRICE TO RECOVER THEIR COST AS PETROL IS NO LONGER BEING SUBSIDIZE LIKE THE LAST TIME MAH....!!

IT IS LIKELY THE CAPEX WILL NOT BE THAT HIGH....BEARING IN MIND SHELL REFINERY IS MORE MODERN THAN PETRON, HAVING UPGRADED RECENTLY.

THE NINE MONTHS RESULT OF SHELL EPS IS RM 0.85....THIS MEAN PE 2.2X BASED ON GO 1.80....DIRT CHEAP LOH....!!

2016-02-18 13:40

Can you expect SHELL to dish out dividends in the next year or two?

Given the circumstances, no....!!??

RAIDER THINK ON THE CONTRARY LOH...!!

GIVING MAX 5 YRS SHELL SHOULD BE START PAYING DIVIDEND SOMETHING LIKE 0.40 TO RM 0.50....AS THE RESULTS OF SHELL IS EXTREMELY GOOD.

THIS MEANS DIV YIELD OF 22% PA BASING ON TAKEOVER PRICE OF RM 1.80....A REAL STEAL LOH...!!

2016-02-18 13:41

who say Shell not going to bankrupt? WTH man u dono how to read accounting numbers ar??? the debt so high, the cash created so low... one day when bank don wan to lend them money anymore then u confirm going to bankrupt

u think this is royal dutch shell ar?? this is shell malaysia ok... duno how many corrupt freaks in the unit already...

open ur eyes and see la... the auntie sell fish on the road side also can tell me that...

2016-02-18 13:47

Yes Shell Refinery has Rm 1.3 billion that means bankrupt meh ??

Just look at their latest account 30-9-2015, they generated Rm 550 million free cashflow loh.....!!

If Rm 1.3 billion borrowing bankrupt, then Tenaga, Air asia, Malakoff bankrupt who have more than Rm 20 billion borrowing many time loh....!!

2016-02-18 14:14

time will tell whether Desa or omightcap is correct... first hint will be out by next week (latest) when the FY15 result is out

2016-02-18 14:16

Kyy rule 1...... Don't buy shares you don't understand.......

You think you doing these mambo jumbo.......you or your readers understand the complex world of refining? Fat hopes.

They are things done to impress.....which this piece is.....

And they are things done to understand......which this piece certainly isn't.

Nobody understands the complex world of crude oil hedging, stock valuations, product pricing to a sufficient depth to do a proper forecast.....unless one is an industry insider.

It is pseudo research such as this that take yourself and your readers to holland......especially when the share is trading at it's high.

So many shares so much easier to understand, to forecast....you don't want.....

You want to get into this complex world....I see KYY advise as being very useful.

2016-02-18 18:54

u understand what is happening or just pretending?

another story telling cousin?

Icon8888 > Feb 18, 2016 01:48 PM | Report Abuse

Very informative. Well done !!! As usual, buy at own risk

2016-02-18 20:39

kcloh icon888 can bully weak...optimus appear....there he go hide behind coconut tree! LOL!

2016-02-18 22:37

Why gasak icon...when he is telling what is right mah....??!!

Some more quote KYY is an example or benchmak of good investor....from what i see in their posting, they have never ever supported, Uncle KYY method of investment.

Now Quote KYY...i m surprise loh....!! In fact Icon and raider acknowledge Uncle KYY method of investment even more loh....!!

2016-02-18 22:45

after optimus go bed sleeping...icon re-appear looking for desa desa desa desa....LOL! so gay!

2016-02-18 22:45

Just pointing out Icon is no analyst....cannot analyse any thing if his life depended on it. icon is story teller to charm little ladies.

2016-02-18 22:48

LOL! icon8888 whack coconut tree boleh...analyst?? gob part14,15,16,17,18...wahahaha....

2016-02-18 22:51

wah lao eh... i3investor people damn free ar... wth man rather than talking rubbish here plz go download an annual report to analyze la... reli like to waste time here arguing and shit

2016-02-19 10:59

Appreciate your thoughts and effort in the above contribution. Unlike some comments which are baseless and/or not substantianted. Please do continue to update especially on Petronm and Shell.

Had a quick look at Shell myself and noticed that nta has not incorporated substantial tax assets to date. Just unsure about cash call by new shareholder, if any. Kudos.

2016-02-22 10:29

stockmanmy's business sense...proved very well. He missed 100% return opportunity!

Name: Desa, Born: 1956

Posted by Desa20201956 > Feb 18, 2016 06:54 PM | Report Abuse

Kyy rule 1...... Don't buy shares you don't understand.......

You think you doing these mambo jumbo.......you or your readers understand the complex world of refining? Fat hopes.

They are things done to impress.....which this piece is.....

And they are things done to understand......which this piece certainly isn't.

Nobody understands the complex world of crude oil hedging, stock valuations, product pricing to a sufficient depth to do a proper forecast.....unless one is an industry insider.

It is pseudo research such as this that take yourself and your readers to holland......especially when the share is trading at it's high.

So many shares so much easier to understand, to forecast....you don't want.....

You want to get into this complex world....I see KYY advise as being very useful.

Posted by Desa20201956 > Feb 18, 2016 12:40 PM | Report Abuse

just don't take people to holland , that's all.

in an environment of falling crude prices , refineries in the West and in Malaysia are suffering ( Shell refinery is sold for a song, Warren Bufett just bought out a huge but failing refinery)

In China, refineries are having a happy year, so much so they have money to buy Shell Refinery.

You know why?

In Malaysia ( and in the West) product prices are adjusted to the lastest crude prices plus a margin.....but the refined were produced from higher priced raw materials bought several months earlier....How not to die?

In China, they practically fixed the product prices...in an environment of cheaper and cheaper crude prices, how not to make super profits?

ok.....so Petron has petrol stations and a refinery....the petrol stations buffer the losses.....but to call Petron $10........sure you not taking people to Holland?

Looking at chart above, I will say a fair price would be $ 4 - $5.

readers...be warned.

2017-06-13 23:33

no, I not interested in Petron or HRC.....

many reasons for that, amongst which...too low PE never interest me...when you got a share too low PE, it is very likely you are buying a share at its cyclical high point in profits.

its just too obvious for my liking.

2017-06-13 23:39

probability...look at the dates Desa commented...those comments are spot on...........HRC and Petron drop more than 50% after Desa comments.

2017-06-13 23:42

ok...nevermind...im just curious of the fact that a person's thought process...is impossible to change. You have been the same for the last 1 year.. no right or wrong.

2017-06-13 23:46

fayeTan

to the author of this article, good analysis.. but you should have highlighted the Target Price of RM18 in the title.

2016-02-18 12:36