The Little-Known Proxy for Genting Recovery

skyturecapital

Publish date: Mon, 30 May 2022, 11:31 AM

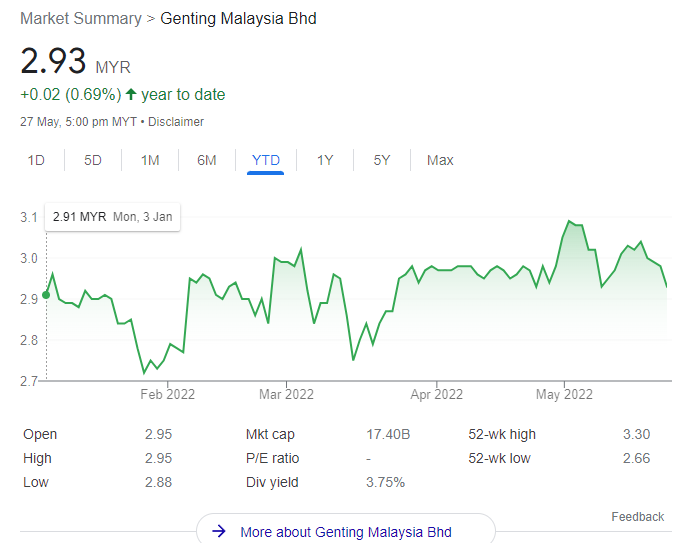

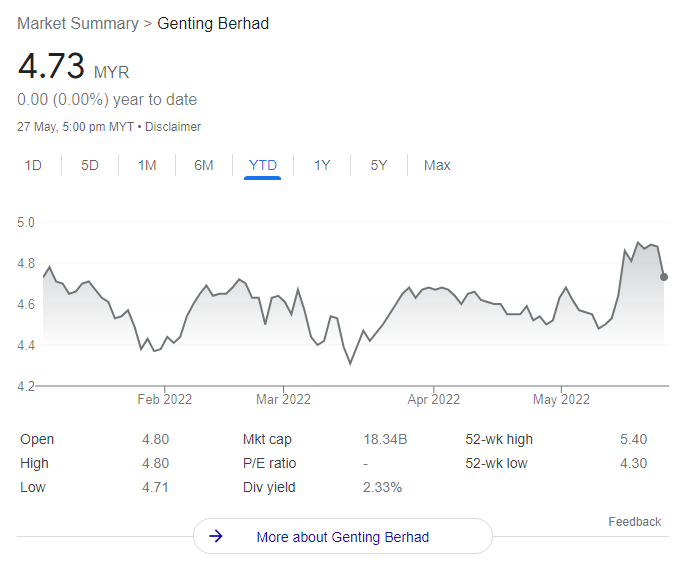

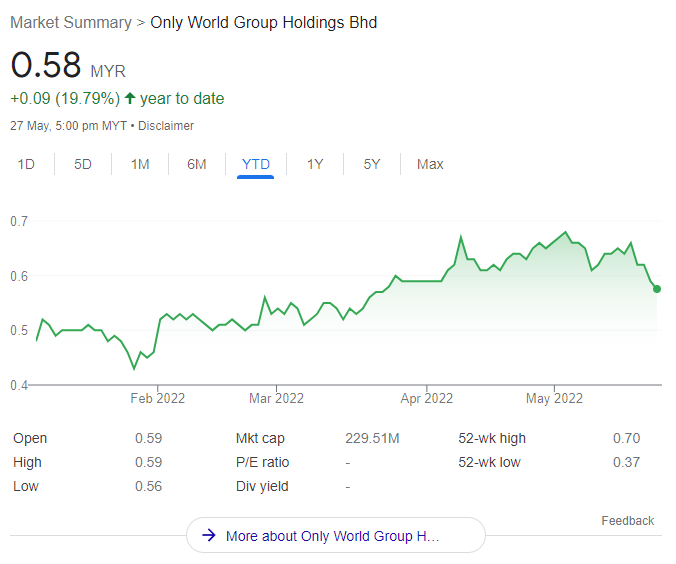

With the craze and mega pent-up demand by Malaysians, it was relatively easy for investors to predict the earnings recovery of the direct beneficiaries such as Genting Malaysia Berhad (KLSE:4715), Genting Berhad (KLSE:3182) and Only World Group Holdings Berhad (KLSE:5260).

However, due to the disappointment in earnings, a retracement in share price was found in both the Lim family owned companies.

For Only World Group Holdings, the story might be a bit different.

Nevertheless, investors are already aware of the recovery and I believe most of the gains were already factored in onto the share price. Hence, a much lower risk-and-reward ratio will be found for investors who buy in to these companies at the current level.

There is one company that majority of the investors would ignore, or they simple were not aware of, and this company is currently deep in value – which is Kanger International Berhad (KLSE:0170).

Back in early 2021, specifically February, the management of Kanger International had made a strategic decision despite the pressure of COVID-19 and various MCOs imposed by the government to invest in RM142.9 million worth of serviced suites in Genting Highland.

Now, our channel check and returned that at least 15% gain had been made from the properties at a retail price. That would mean that these properties, after factoring in the 15% gain, its value would be RM164.3 million.

Meanwhile, if one would look at the current valuation of Kanger International, the market capitalization is at a mere RM30.2 million only. That would mean that without banking in its existing businesses, you are buying the Genting properties at 18.38% of its full value.

This is on top of their recent venture into the construction sector, which is likely to be beneficial from the increased activity on both the private and public projects.

All in all, I think Kanger International is showing a deep value disparity against its share price. Don’t you think so too?

More articles on 潜力股分享区

Created by skyturecapital | Jun 22, 2022

Created by skyturecapital | Nov 30, 2020