[ SURIA ] Dark Horse of Port Counters

NickCarraway

Publish date: Mon, 28 Oct 2013, 12:11 AM

[SURIA] Dark Horse of Port Counters

Last : RM 1.96

SUMMARY

Suria Capital Holdings Bhd (“Suria Capital”) was one of the companies being invited to do a corporate presentation during 2013 Investor Day of iCapital.biz on 26 Oct 2013. The stock is not covered by any broker’s research house.

Using a conservative Sum of Parts (“SOP”) to value its port operations and property developments, the stock is worth RM3.23 per share, implying upside of 65%.

Catalysts are renewed investors interests in the long-term recurring-income of its port operations business and launch of its Kota Kinabalu property development project that is soon expected to contribute to its earnings stream.

BUSINESS OVERVIEW

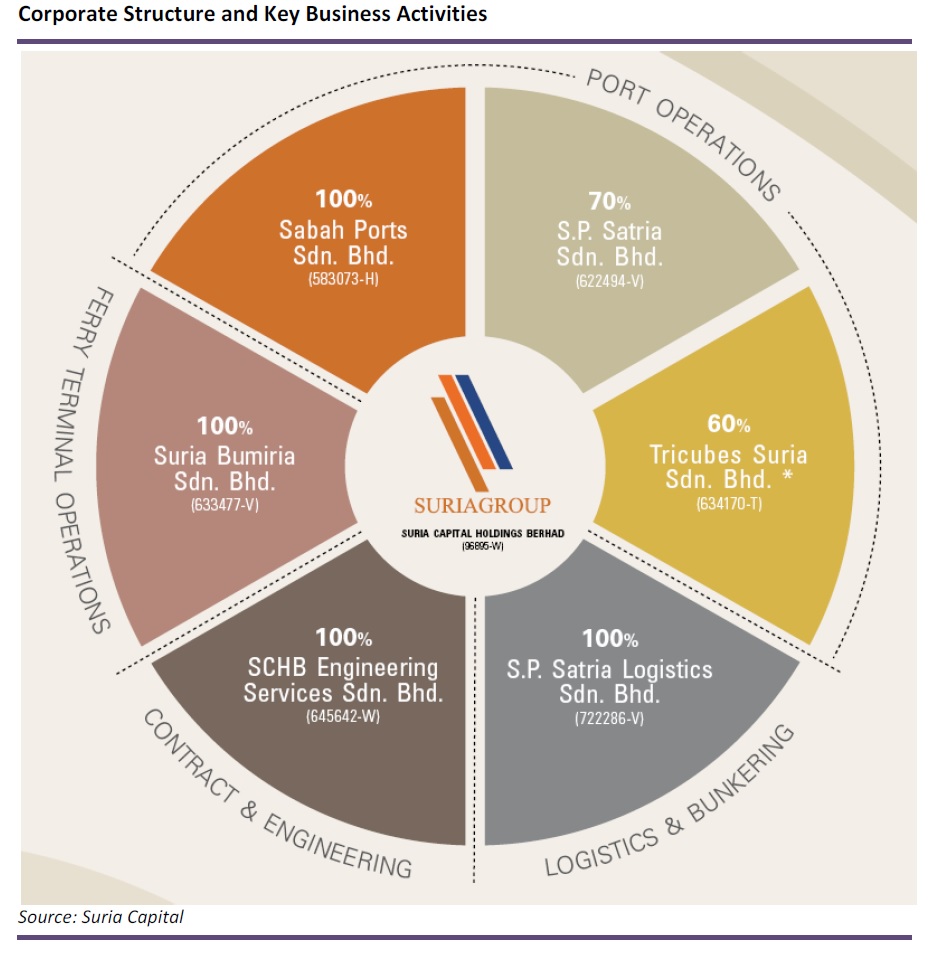

Majority owned by Sabah State Government.

Suria Capital is an investment holding company listed on Bursa in Nov 1996. It is 51.6% owned by Sabah State Government via Warisan Harta Sabah Sdn Bhd, Yayasan Sabah and Chief Minister Inc.

Venture into port operations.

Suria Capital was originally founded as a financial conglomerate. However, following a major corporate restructuring, the company shifted its business focus to port services.

Suria Capital established a wholly owned subsidiary, Sabah Ports Sdn Bhd (“Sabah Ports”) to take over the operation, maintenance, management and provision of facilities and services at Sabah’s key ports from Sabah Port Authority under a 30-year concession with effect from 1 Sep 2004. It shapes Suria Capital’s business direction today.

Supplement by other businesses.

Apart from port business, Suria Capital has also diversified into the development and management of commercial property, tourism, construction and infrastructure, supply and maintenance of port equipment as well as bunkering services.

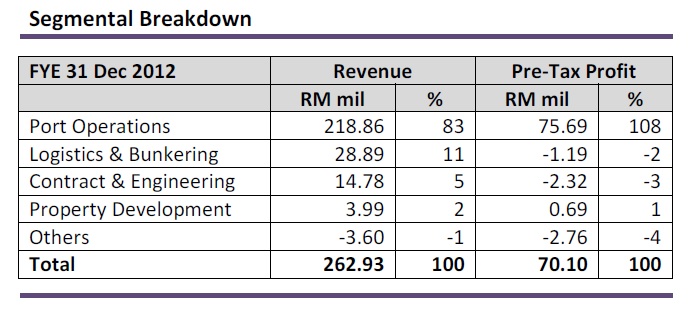

Port operations are the main bread and butter business of Suria Capital.

As shown in the above table, port operations accounted for 83% of Suria Capital’s group revenue and 108% of Suria Capital’s pre-tax profit in FYE Dec 2012.

PORT OPERATIONS

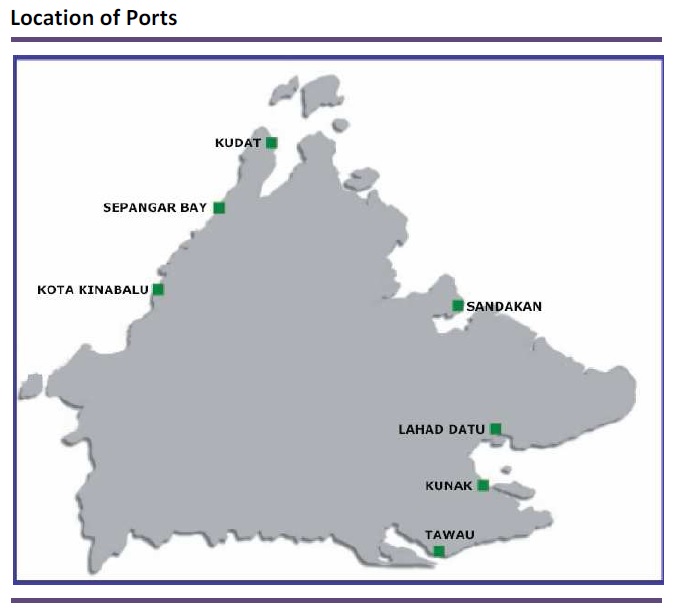

Altogether 8 Ports.

There are at present 8 ports managed by Sabah Ports: Kota Kinabalu (“KK”) Port, Sepangar Bay Container Port, Sepangar Bay Oil Terminal, Kudat Port, Sandakan Port, Tawau Port, Lahad Datu Port and Kunak Port.

Crucial to State Economy.

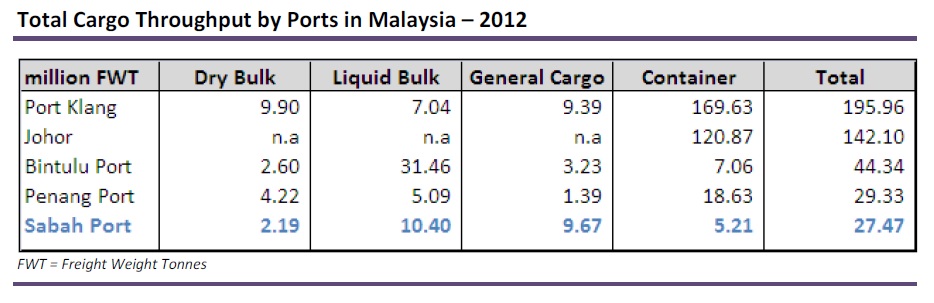

Sabah Ports plays an important role in complementing Sabah state economy as shipping is crucial to facilitate the transport of rich commodities such as CPO, petroleum and goods for Sabah. Thus, liquid bulk and general cargo remains top within Sabah Ports handled cargo.

Liquid Bulk cushions economic slowdown.

Although port business is sensitive to economic cycles, the impact of economic weakness towards Sabah Ports is moderated by its cargo profile, where the resilient liquid bulk cargo alone accounts for almost 40% of its cargo throughput.

Long overdue tariff hike.

The last port tariff hike in Sabah was in 1982. The subsequent hike was scheduled for 2009 but deferred till now. The average quantum of increase proposed by management is 30% under new tariff structure.

Heavy capex to be internally funded.

Port operations are capital intensive with continuous investment in capex to shorten turnaround time and avoid congestions. Sabah Ports is obliged to spend RM1.36 bil capex to upgrade its port facilities from 2004-2024 under the concession agreement. It has incurred RM710 mil capex from 2004 upto end 2012 with remaining RM653 mil to be completed by 2024. Nevertheless, the highly profitable port operations shall ensure capital needs for future capex obligations are internally funded.

New competition.

In terms of competition, Sabah State Government has established Palm Oil Industrial Cluster (“POIC”) in Lahad Datu and Sandakan. They shall offer liquid bulk, dry bulk and container terminal to promote downstream palm oil activities. Bulk terminals in Lahad Datu are ready to run whereas POIC Sandakan is expected to complete soonest in 2014.

Cruise Terminal at KK Port.

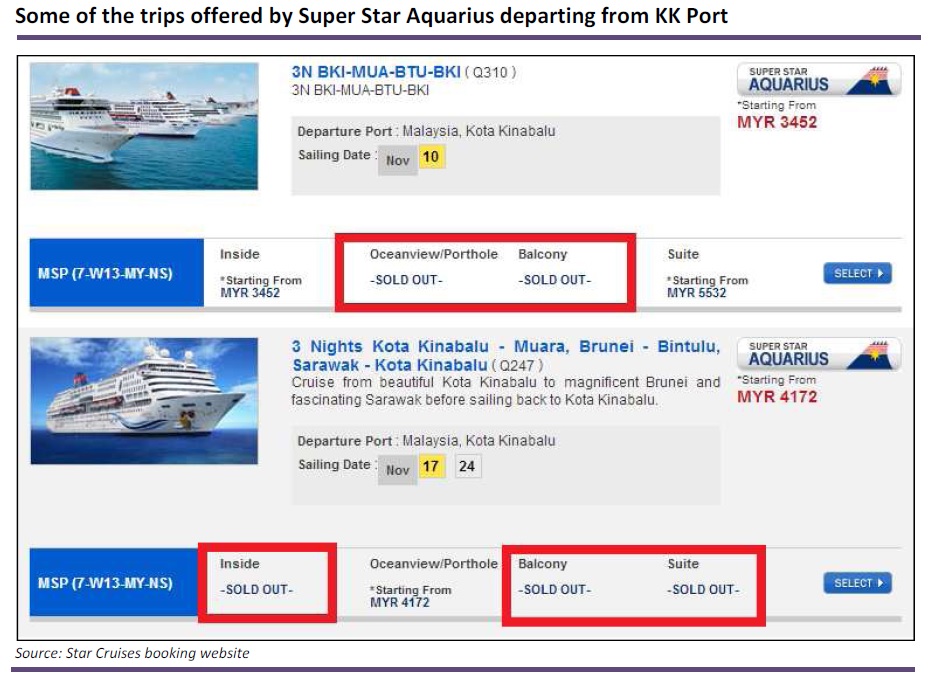

During 2013 iCapital.biz Investors Day, Suria Capital management presented a pleasant good news that Star Cruises will call at KK Port as Home Port effective 6 Nov 2013. To recap, under national ETP, KK Port was identified as a new dedicated international cruise terminal after Port Klang and Penang. The SuperStar Aquarius of Star Cruises has a passenger capacity of 1511 pax and will offer 4D/3N package sailing from KK-Muara-Bintulu-KK and also day trip from KK as a start. The responses for Nov cruise have been overwhelming especially for the 4D/3N package. Revenue will be based on a flat fee collected from each passenger that every cruise vessel calls at KK Port. Based on other cruise terminal experience, the operating margin could hit 40-60%.

PROPERTY DEVELOPMENT

Large landbank in KK.

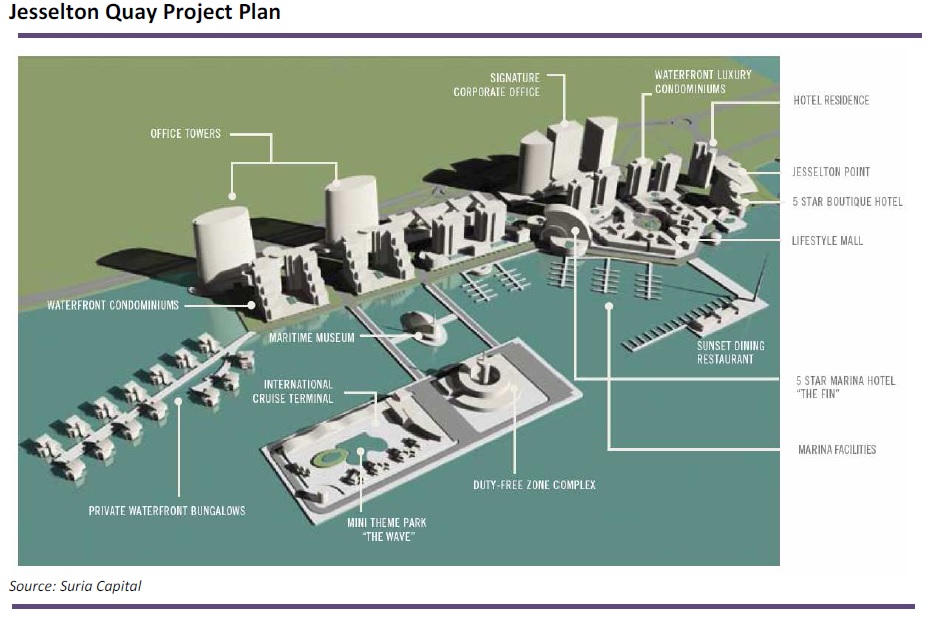

Suria Capital has dedicated 23.25 acres of prime land in KK for mixed property development named Jesselton Quay Project via its subsidiary, Suria Bumuria Sdn Bhd (“Suria Bumiria”).

JV to launch Jesselton Quay Project.

Suria Capital has entered into a joint venture agreement (“JV”) with SBC Bhd to develop 16.25 acres of the land comprising commercial suites, retail mall, retail units, office towers and hotel with GDV of RM1.8 billion. The remaining 7.00 acres of land is not included in the JV.

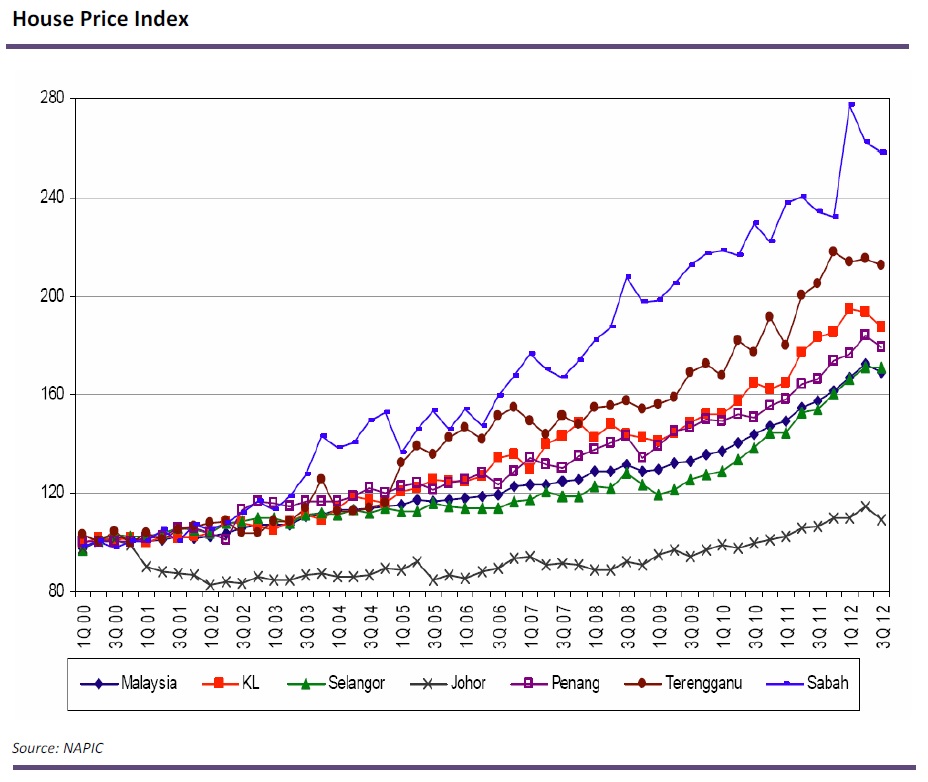

Sabah property market is robust and buoyant.

In terms of residential units, Sabah’s House Price Index has outperformed national average recording 12-year CAGR of 8.3% vs 4.5% national average. Although there is no proper price index available for commercial units, the sentiments are similar to residential units with Sabah’s shop-lot prices doubling over last 4 to 5 years. A report by HwangDBS earlier this year noticed that robust local demand of KK property market is driven by strong cash flows from plantations and rising household income. Foreign demand is mainly from Korea, Japan, Hong Kong and Brunei due to better connectivity.

Close proximity to KK city centre appeals to buyers.

While stricter lending guidelines and RPGT increases may generally limit property growth. Jesselton Quay Project is situated at the waterfront of Kota Kinabalu city centre. Its strategic location (within 5 minutes walk to city) coupled with limited landbank near city and panoramic view of South China Sea is expected to attract both local and international buyers.

Little impact from hike in minimum price of property for foreigners.

Budget 2014 announced the minimum price of property that foreigner may purchase shall increase from RM500k to RM1mil. A check shows that secondary market asking price for luxury condos in KK are above RM1000psf. To be more specific, existing high rises located next to the site of Jesseleton Quay Project reveals that The Peak Vista and Jesselton Residences are fetching resale price of around RM1000psf with unit costs easily above RM1mil each as standard build up areas start from around 1000sf/unit.

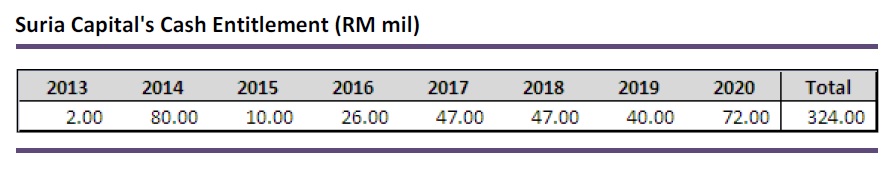

Expected Cashflows.

Under the JV, SBC Bhd shall be responsible for the financing, marketing and completion of the project. Suria Capital, being the passive partner, is entitled to the following cash payments throughout the next 7 years.

VALUATION

Sum of Parts (“SOP”) Valuation.

In computing the valuation for Suria Capital, different methods are applied to its individual businesses:-

(i) Port Operations with predictable earning streams

The more stable and healthy incomes of its port operation shall be valued based on DCF, EV/EBITDA and P/E.

DCF: The DCF factors in an immediate drop of 30% in throughput for its Sandakan Port and Lahad Datu Port due to competition from neighbouring POIC ports. Also, arising from the competition, blended operating margins for the respective 8 ports managed by Sabah Ports have been adjusted downward marginally from average of 55.5% in the past to 53.1% going forward. Meanwhile, potential tariff hike is not factored in the DCF. In addition, the international cruise terminal at KK Port is not factored in the DCF as it is still under evaluation. With WACC at 7.70% and terminal growth set at a low 2%, DCF of its port operations is valued at RM877.12mil or RM3.10 per share.

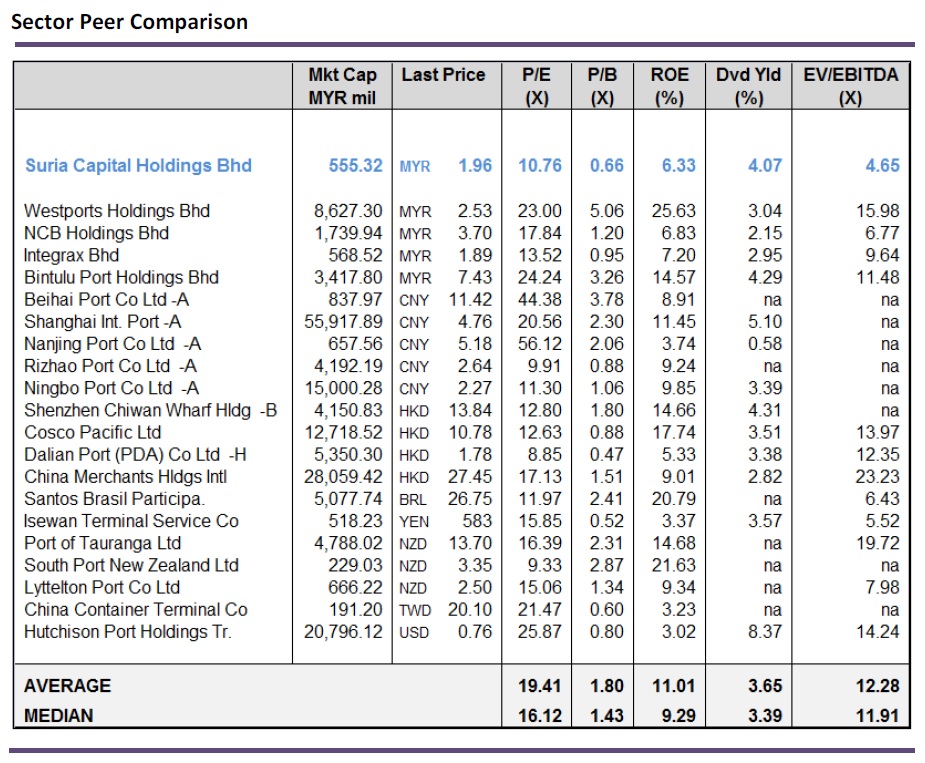

EV/EBITDA: EV/EBITDA method shall focus on the core earnings without being distorted by high depreciation and amortization. The table below illustrates median multiple of 11.9X EV/EBITDA from regional peers. The median multiple is used instead of average multiple to avoid distortion by outliers. With estimated FYE2014 EBITDA of its port operations at RM107.62mil, EV/EBITDA method provides equity value of RM1.28 bil or RM4.53 per share for its port operations.

P/E: P/E method represents earnings multiple accorded by market for the sector. Based on the table below, median regional sector P/E is derived at 16.1X. Ascribing FYE2014 net profit of RM50.55mil from the port operations, its equity value is RM813.94 mil or RM2.88 per share.

(ii) Property Developments with expected upside from Jesselton Quay Project

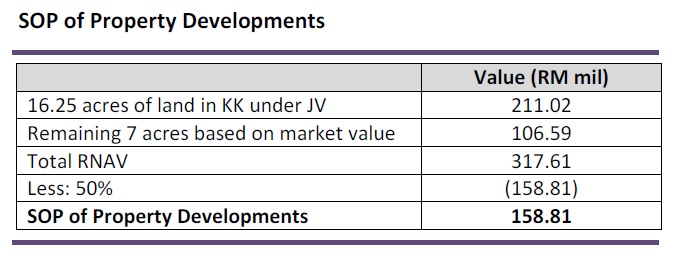

Lastly, the property development unit shall be valued based on a conservative 50% discount to its RNAV that is in line with market practice given its smallish size and also reflecting cautiousness on property measures introduced in Budget 2014. SOP of the property development is valued at RM158.81 million or RM0.56 per share.

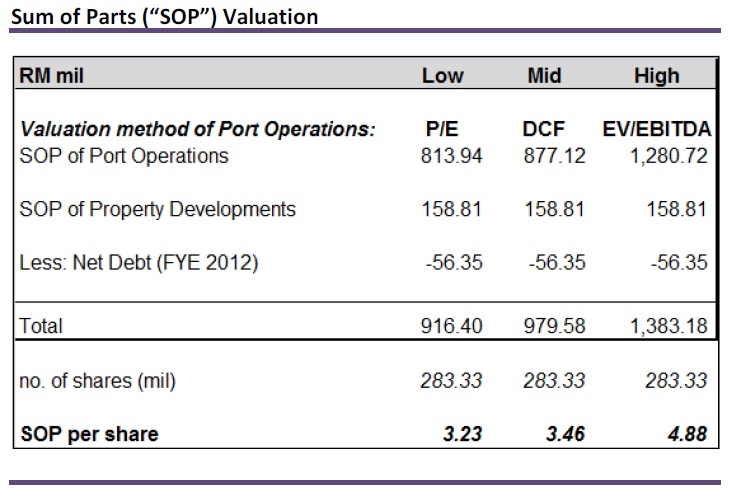

More than 65% upside.

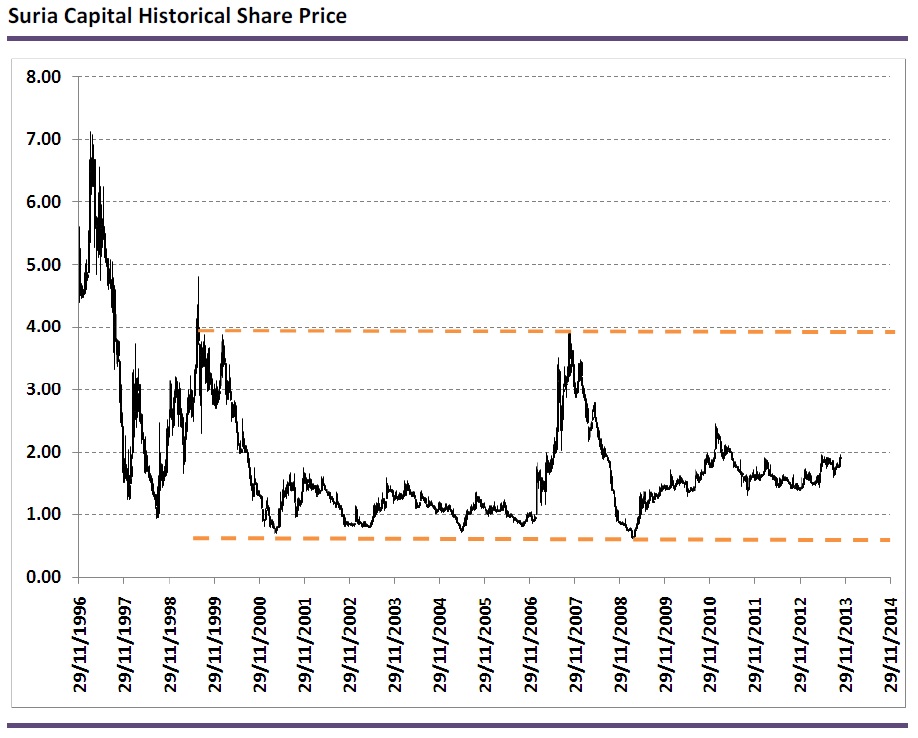

The SOP value ranges between RM3.23 to RM4.88 per share. The target price is set at lowest SOP of RM3.23 per share. It is still conservatively priced at P/B of 1.1x (Jun 2013 NA per share of RM2.93) which is at low end of local peer valuation. That offers 65% upside from current share price of RM1.96.

Share price doesn’t fully value port operations, property for free.

Investors interests are expected to gather steam on this stock as the soon-to-launch Jesselton Quay Project will allow Suria Capital to realize its property development earnings potential while enjoying stable recurring income from its port operations.

Upsides:

- Tariff hike approved for port operations

- Strong tourist arrivals or departures via International Cruise Terminal in KK

- Upward revision of GDV for Jesselton Quay Project

Risk:

- Worse than expected impact of POIC Lahad Datu and Sandakan towards Sabah Ports

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Anthony Chew

Great analysis. Thanks for sharing

2013-10-28 09:00