[ ALAM ] Following the trail of a savvy investor

NickCarraway

Publish date: Thu, 24 Apr 2014, 05:49 PM

Tan Sri Quek Leng Chan (‘Quek’) has been actively buying Oil & Gas companies since a year ago. Nevertheless, he is no stranger to the Oil & Gas industry when he had previously bought into Kencana Petroleum, Petra Perdana and Singapore listed Mermaid Marine.

So far, the acquisition in past one year amounted to investment sum of around RM 922m in the following Oil & Gas companies:-

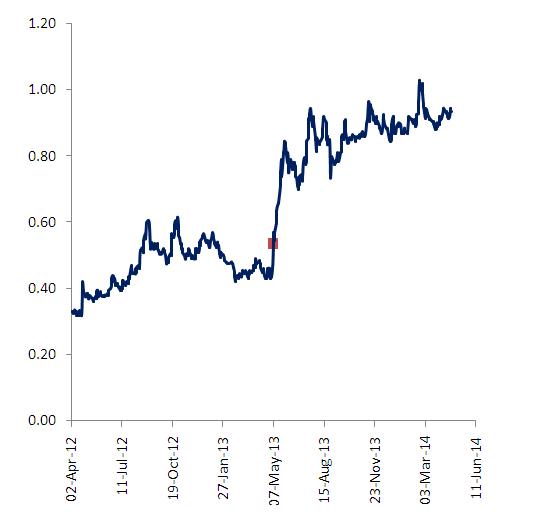

May 2013: Quek acquired 92.8m shares of TH Heavy or 10% stake at RM0.45 per share.

TH Heavy (7206) Share Price: RM 0.94 Market Cap: RM 959m

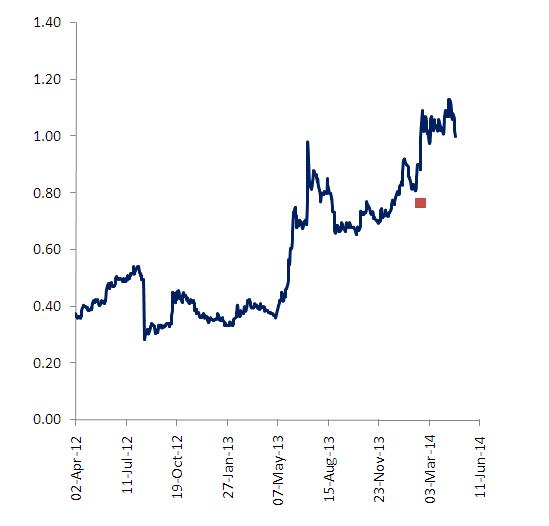

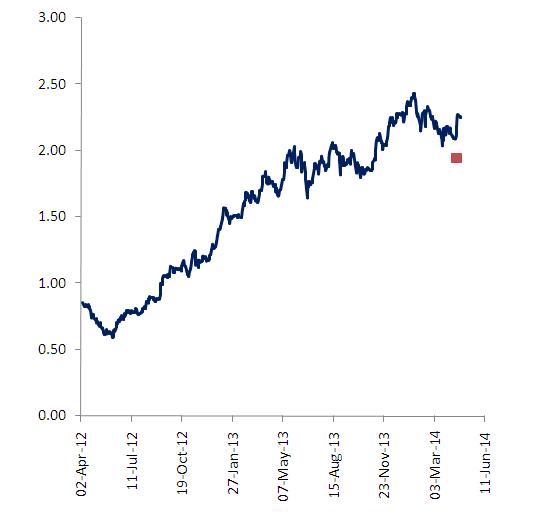

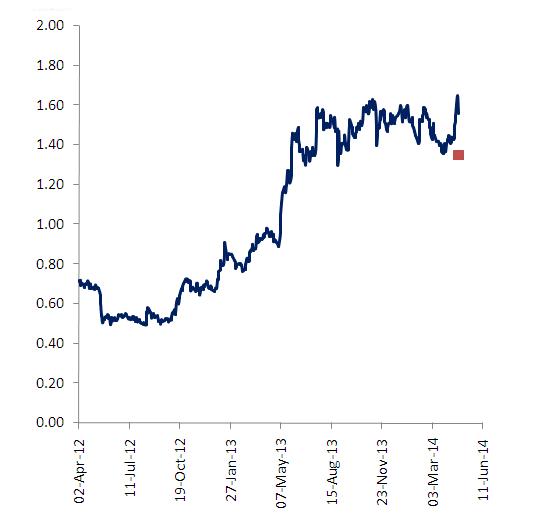

# Red dot represents entry point of Quek

Feb 2014: Quek and his associate Paul Poh acquired 268.8m of Scomi Energy or 11.5% stake at RM0.765 per share. Their stake made them the second largest shareholder of Scomi Energy after Scomi Group which has 65.7% stake. The acquisition is believed to be motivated by the potential win of a risk service contract.

Scomi Energy (7045) Share Price: RM 1.00 Market Cap: RM 2.34b

Apr 2014: Last week, Quek took up 100m new shares of EZION or 7.6% stake at SGD1.94 per share. EZION, the Singapore listed OSV player, shall use the proceeds to acquire offshore and marine assets as well as for general working capital.

EZION Share Price: SGD 2.25 Market Cap: SGD 2.71b

Apr 2014: On latest note, Quek and Paul Poh acquired 123m new shares of ALAM or 15.4% stake at RM1.35 per share. Funds raised by ALAM will be handy for the company to acquire a new OSV vessel and partially repay its debt. Quek & Paul shall collectively be the second largest shareholder after SAR Venture which will have 37.7% stake after dilution. ALAM is in discussions with Barakah Offshore Petroleum, Puncak Oil & Gas and SapuraKencana Petroleum to undertake subcontracting works for the 3-year Pan Malaysian T&I programme.

ALAM Share Price: RM 1.56 Market Cap: RM 1.26b

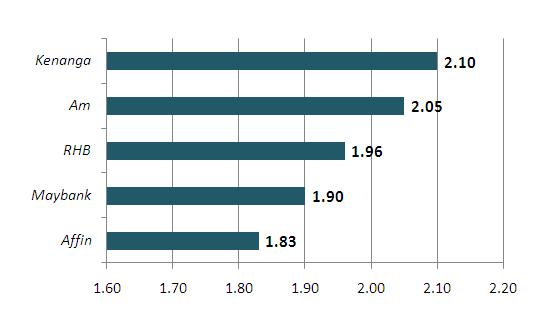

Meanwhile, here are the target prices accorded by various research houses on ALAM following the latest acquisition by Quek.

Quek has done very well in terms of executing a series of well-timed acquisitions in the past. The build-up of this Oil & Gas portfolio in such short span of time obviously displays his confidence in these companies and sector.

More articles on Amazing Race

Discussions

Buying old ships and slow osv should have discount.....no wonder they sell at 1.35 and dont look back.....look at perisai and barakah pricewhich are better....

2014-04-24 20:22

.png)

fortunebullz

Alam is among biggest OSVs in Malaysia! No surprise Quek will dive into Alam! What's not good is he got special discount while the rest of us buying at 20% more! So the drop today is no surprise!

2014-04-24 19:16