[ UPA ] a unique paper products producer

NickCarraway

Publish date: Tue, 01 Apr 2014, 12:13 AM

[ UPA ] a Unique PAper products producer

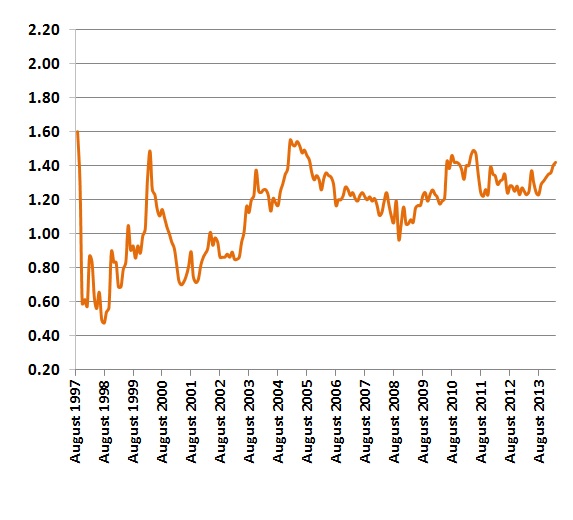

Last Price: RM1.41

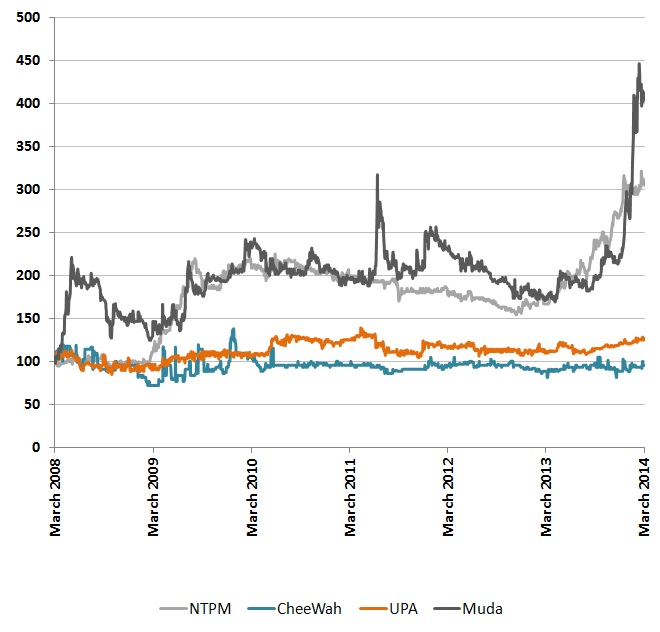

Sector Laggard Since a year ago, there are 2 paper products producers that have outperformed the market. They are Muda Holdings Bhd (‘Muda’) and NTPM Holdings Bhd (‘NTPM’).

In terms of laggard in this segment, UPA Corporation Bhd (‘UPA’) is less known to investors. It has its niche position in terms of stationery market. Besides being the leading printer of diaries in Malaysia, UPA manufactures plastic stationery products, recondition printing and binding machines, produces PET and PVC shrink films.

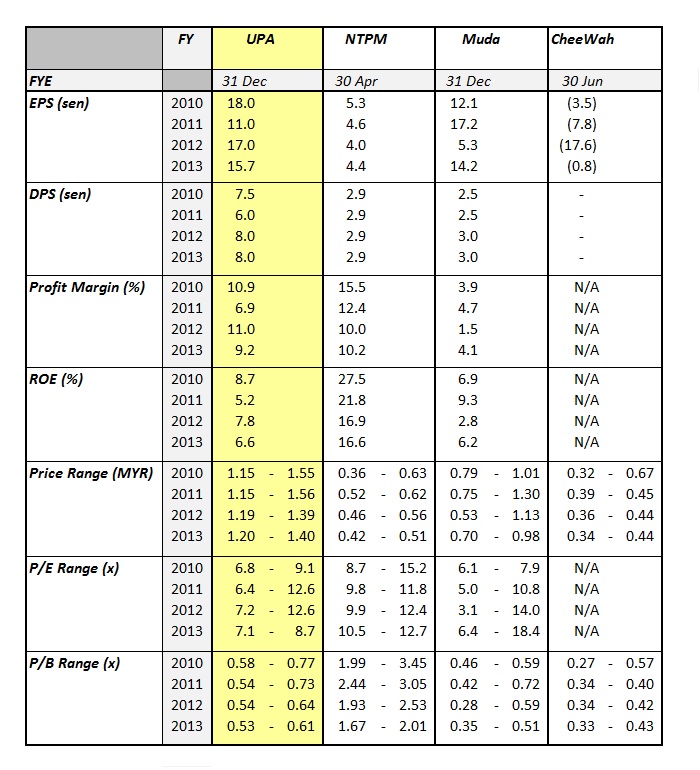

Healthy Earning The earning profile of UPA is comparable to Muda (in terms of ROE) and NTPM (in terms of profit margin). However, despite posting healthy earning, UPA’s share price performance has been flat and investors are treating it like another loss-making paper products producer, Chee Wah Corporation Bhd (‘Chee Wah’).

Attractive Value Based on simple calculation and its historical record, UPA should achieve EPS of 15sen with ease in FY2014.

By pegging at conservative P/E of 10x (which is at 15% discount to Muda’s T12M P/E of 12x and upto 40% discount to NTPM T12M P/E of 16.9x) and adding net cash of 27sen, UPA should be fairly valued at RM1.77 (10 x 15sen plus 27sen) which gives 25% upside from last price of RM1.41.

Current share price also provides attractive dividend yield of 5.7% and trades at nearly 40% discount to its last book value of RM2.32 per share.

Relative Performance of Selective Peers (base 100 at Mar 2008)

Comparative Valuation

Historical Share Price of UPA

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Blue Sky

good write up.. have been holding upa for the dividend too... dy with 6% good return... they are still undervalue.. tp 1.60.. with strong earnings and sales for past 5 years..

2014-04-01 19:09