[ Barakah-LA ] Lose All ?

NickCarraway

Publish date: Sun, 10 Nov 2013, 05:57 PM

Barakah went through a backdoor listing on Bursa Malaysia, involving share exchange of Vastalux for Barakah shares, new Barakah shares issue and offer of sale with RCULS at 1:3, transfer of listing status to Barakah and subsequently, the disposal of Vastalux.

Upon relisting, its total outstanding shares now enlarges from 485mil to 624mil. Barakah new shares was issued at RM0.65 each and RCULS at RM0.20 each. Based on entitlement of 1:3 and Barakah’s 624mil share base, 208mil RCULS (code: Barakah-LA) was issued. The RCULS raised immediate gross proceeds of RM41.6m.

The 5-years RCULS offers 3.5% coupon rate per annum, payable semi annually. It may be converted into 1 new Barakah shares after 1st anniversary of the issue date until its maturity date. Upon full conversion of RCULS and ex-ESOS, the full share base will expand by 33% to 832mil.

While Barakah is one of the hot contenders to win PETRONAS Pan Malaysia T&I contract worth RM 2 to 3 bil. Relisting of Barakah saw its mother share posted almost 70% gains ended last Friday at RM1.10 per share above its relisting price of RM0.65. Its RCULS followed similar trend where it opened on 6 Nov with high of RM0.81 before hitting a low of RM0.61. It subsequently rebounded to close at RM0.86 on 8 Nov.

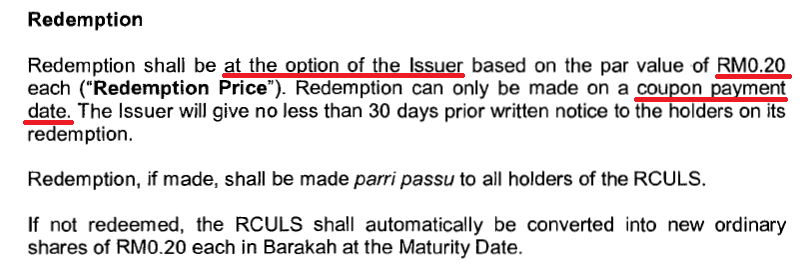

Unfortunately, most RCULS investors may have omitted one important clause under its terms. The terms say the issuer (ie Barakah) can redeem the RCULS at RM0.20 (par value which is also the initial subscription price that primary investors have paid for the RCULS) on a coupon payment date (which is every 6 months).

The prospect of winning PETRONAS Pan Malaysia T&I contract has yet to be factored in most analysts’ reports. However, most of the reports highlighted that Barakah’s earnings could double from current projection. For example, under Maybank Research’s report: -

“In a blue sky scenario, assuming Barakah secures Package A in its entirety, our net profit estimate would rise to RM100m in FY15.”

With such bright earning prospect, Barakah would then be able to redeem the entire RCULS with ease for just RM41.6mil. The risk is high for Barakah to redeem the RCULS at par value of RM0.20 each instead of allowing the conversion of RCULS into ordinary shares to dilute its earnings per share.

Caveat emptor!

Buyers beware!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Amazing Race

Discussions

To clarify, RCULS stands for Redeemable Convertible Unsecured Loan Stock.

It is a type of security that can be used to purchase underlying common shares. It is similar to a warrant except that it is subject to the conversion ratio. In essence, an RCULS provides the benefits of a bond until it is converted to an equity. If the loan stocks are redeemable, then on maturity the holder can either convert the RCULS into shares or redeem the RCULS from the issuing company at their par value. Upon conversion into shares, the Number of Shares Outstanding (NOSH) is increased. [source:investopedia]

In this case, redemption is based on Par Value which is fixed at 20sen. Note Par Value is different from Market Value or Net Asset Value.

The RCULS last traded at 86sen. Of course you could buy/sell in the market as long as it is traded. Question is would you buy an instrument trading at 86sen with risk of getting back just 20sen?

You could convert them into ordinary shares only after 1st year. As stated in the term IF NOT REDEEMED (at the option of the co.) , the RCULS shall be converted into ordinary shares at maturity.

The risk is Barakah decided to redeem it prior to maturity at 20sen upon coupon payment date after issuance(read the article).

2013-11-11 08:49

Nick, no u don't get my explanation. Retail investors are jumping in for short gain. Who cares what is the conversion rate.

Take a logical view on EAH-WA. Premium is over 180%. Why someone in a sane mind would purchase the WA and convert to mother share? WHY?

Doesn't make sense right?

2013-11-11 09:34

In a bullish environment, rationale gets thrown out of the window until the market falls and everyone looks for the exit door. If Barakah can redeem at 0.20 at every coupon payment date, then the listed price is ridiculous and retailers will get hurt badly. Free market at work or irrational exuberance? Bursa should have alerts regarding this.

2014-05-13 23:30

zamsaham

No, I don't see any risk there.

Redemption is based on PAR Value, ie if the PAR value changes, the calculation will be different.

You can even sell the LA at anytime, just like an "ordinary" warrants. So what is the issue here exactly?

If you just keep your LA until the maturity, it will be converted to MOTHER SHARE.

2013-11-11 00:01