Rakuten Trade Research Reports

Technical View - OCK Group Bhd

rakutentrade

Publish date: Mon, 19 Feb 2024, 12:50 PM

OCK Group Bhd (OCK, 0172)

- Share price has surged 24% since our last technical buy call on 5 Jan 2024.

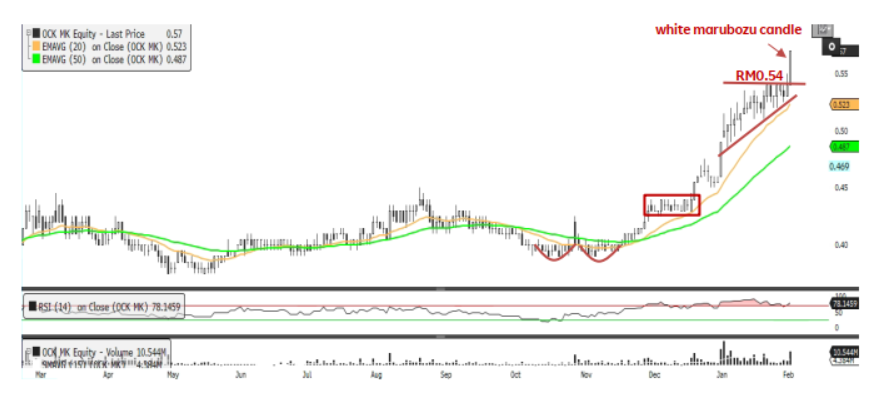

- OCK may trend higher after it hit a new 52-week high last Friday to break out from its one monthascending triangle pattern. With the stock pulling further away from all the EMAs coupled with a white marubozu candlestick formed last Friday, the uptrend may continue in the near term.

- We expect the rising momentum is set to steer the stock to trend higher and test the next level ofresistance of RM0.60 (R1), followed by RM0.64 (R2).

- On the downside, stop-loss is set at RM0.50, below the 5 Feb’s low.

- Fundamentally, we like OCK due to its solid earnings growth, driven by (i) the ongoing 5G rollout inMalaysia, (ii) expansion of tower networks in Vietnam, (iii) higher value contracts in Indonesia, and (iv) interest savings from debt restructuring. As a result, we believe OCK’s prospective earnings should see positive impacts.

Source: Rakuten Research - 19 Feb 2024

To sign up for an account: http://bit.ly/40BNqKI

[Youtube Tutorial] Account Opening & Enable Foreign Equity: http://bit.ly/3I5Jzxo

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Rakuten Trade Research Reports

Discussions

Be the first to like this. Showing 0 of 0 comments