RHB Investment Research Reports

UEM Sunrise - Stay Tuned for More; BUY

rhbinvest

Publish date: Mon, 29 Apr 2024, 10:24 AM

- Maintain BUY and MYR1.60 TP, 51% upside. We were on the road with UEM Sunrise’s senior management team last week, meeting 11 local institutional clients. There are more legs to its share price – management shared its plans for its 3,000 acres of land in Iskandar Puteri, and we believe that the execution of projects should be on track. Along with other proposed railway projects and possible locations for the Johor-Singapore special economic zone, various industrial and data centre players have approached UEMS for development opportunities. Pipeline news flow is expected to be strong.

- Execution is key now. Management admitted that its share price has built in the market expectation of the company’s project delivery going forward. However, it is confident that, with the plans in place – given the location and infrastructure of the land at Gerbang Nusajaya – UEMS will be able to attract the industries that it is targeting. Meanwhile, with UEM Group and ITRAMAS Corp jointly developing a 1GW hybrid solar photovoltaic power plant, UEMS is looking at opportunities to capture supporting or anxiliary industries along the value chain. The company is also exploring potential JVs with local or foreign industrial players to develop the industrial component at Gerbang Nusajaya, which now accounts for 28.3% of the total GDV of MYR45bn. The proposed Kuala Lumpur-Singapore High Speed Rail, Johor Bahru Light Rail Transit and potential upgrade of the Port of Tanjung Pelepas train line will just enhance the overall plan.

- Positive feedback from investors. Many clients were upbeat on the industrial development and infrastructure catalysts in Iskandar Malaysia, and they generally agreed that UEMS has the most strategic landbank to capitalise on the spillover and burgeoning demand. While management’s plan on industrial development is opportunitistic and should underpin the future growth of Gerbang Nusajaya, fund managers were generally hopeful that the plans can be executed promptly.

- Gaining more traction. The conclusion of our series of non-deal roadshows has certainly injected interest in the stock. More investors are now appreciating the direction of UEMS’ immediate strategy to unlock the catalysts within Iskandar Malaysia. The success of Nusajaya TechPark (JV with CapitaLand Development) is a good testament, and should help to form an expectation on UEMS’ future industrial developments in Johor.

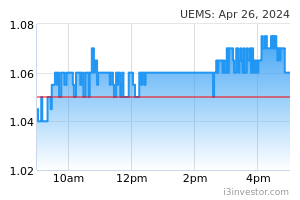

- No change to our TP. The recent correction in UEMS’ share price (due to Middle East geopolitical tensions) brings about a good opportunity for investors, who missed out earlier, to enter the stock. The timely execution of management’s development plans in Johor should provide upside to its share price.

Source: RHB Research - 29 Apr 2024

Related Stocks

More articles on RHB Investment Research Reports

Discussions

Be the first to like this. Showing 0 of 0 comments