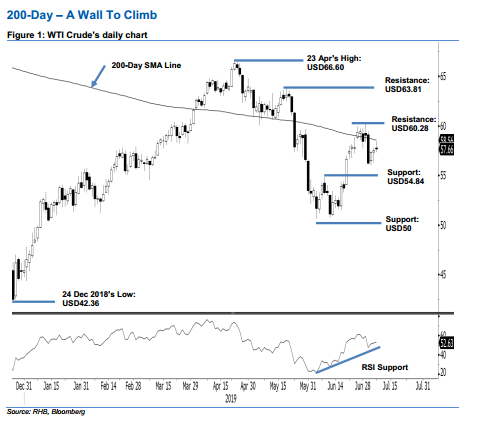

WTI Crude Futures - 200-Day – a Wall to Climb

rhboskres

Publish date: Tue, 09 Jul 2019, 09:42 AM

Maintain short positions as the retracement is still incomplete. The WTI Crude came near to test the 200-day SMA line with an intraday high of USD58.46. This was before it slid back to close at USD57.66, indicating a gain of USD0.15. Overall, the negative bias that started from the failed attempt to breach above the USD60.28 immediate resistance is still in place. Supporting this was the fact that the commodity is still capped by the said SMA line. Based on this, we keep to our negative trading bias.

As the retracement leg may still be able to extend further in the coming sessions, we continue to recommend traders stay in short positions. We initiated these at USD56.25, which was the closing level of 2 Jul. For risk-management purposes, a stop loss can be placed above the USD60.28 mark.

We continue to expect the immediate support to emerge at USD54.84, which was the high of 10 Jun. This is to be followed by USD50, a round figure. Moving up, the immediate resistance is set at USD60.28, which was the high of 1 Jul. This is followed by USD63.81, or the high of 20 May.

Source: RHB Securities Research - 9 Jul 2019