Hang Seng Index Futures - Remain in Long Positions

rhboskres

Publish date: Mon, 15 Jul 2019, 10:40 AM

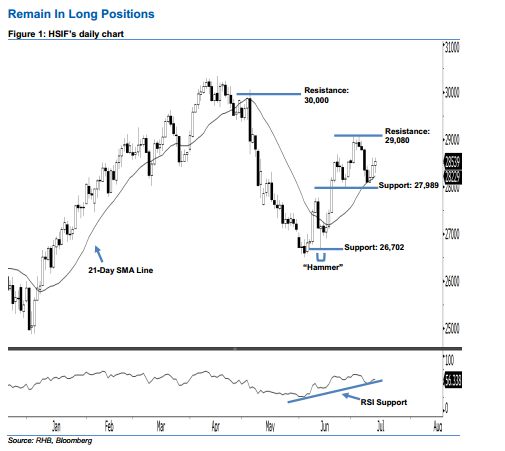

Bullish sentiment remains intact; stay long. Buying momentum in the HSIF continued as expected, as another white candle was formed last Friday. It closed at 28,539 pts, after oscillating between a high of 28,609 pts and low of 28,289 pts. Technically, the index has marked a higher close vis-à-vis the previous sessions since 10 Jul. This indicates that the rebound, which started from 13 Jun’s “Hammer” pattern, may continue. Moreover, the 14-day RSI indicator recovered to a more positive reading of 56.33 pts, improving the bullish sentiment. Overall, we stay bullish on the HSIF’s outlook.

Based on the daily chart, we are eyeing the immediate support at 27,989 pts, determined from the low of 26 Jun. The next support is maintained at 26,702 pts, which was the low of 13 Jun’s “Hammer” pattern. Towards the upside, the immediate resistance is seen at 29,080 pts, ie 4 Jul’s high. If a decisive breakout occurs, the next resistance is anticipated at the 30,000-pt round figure, set near the high of 6 May’s long black candle as well.

Therefore, we advise traders to stay long, following our recommendation to initiate long above the 27,436-pt level on12 Jun. A trailing-stop can be set below the 27,989-pt level in order to lock in part of the profits.

Source: RHB Securities Research - 15 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024