WTI Crude Futures - Holding Above 200-Day SMA

rhboskres

Publish date: Tue, 16 Jul 2019, 10:38 AM

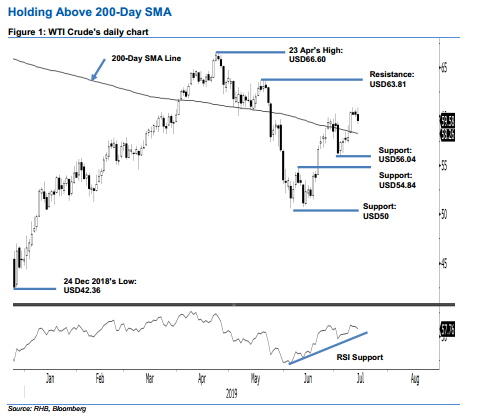

Maintain long positions. The WTI Crude failed to hold onto its earlier session’s positive pace – as it slid lower towards the end of the session to settle USD0.63 weaker at USD59.58. Trading happened in the range of USD59.20-USD60.92. The recent sessions’ price actions can be interpreted as an indication that a minor consolidation phase is developing. This implies that, at this juncture, we are not seeing a significant risk for a deep retracement to develop. Also, the commodity is still holding above the 200-day SMA line – suggesting a still constructive technical picture. Maintain our positive trading bias.

Given that the commodity’s rebound is not showing signs of reaching an end, we recommend traders stay in long positions. We initiated these at USD60.43, the closing level of 11 Jul. For risk-management purposes, a stop-loss can be placed below the USD56.04 mark, which was the low of 3 Jul.

Immediate support is eyed at USD56.04, ie the low of 3 Jul. This is followed by USD54.84, which was the high of 10 Jun. On the other hand, the immediate resistance is set at USD63.81, or the high of 20 May. This is followed by USD66.60, which was the high of 23 Apr.

Source: RHB Securities Research - 16 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024