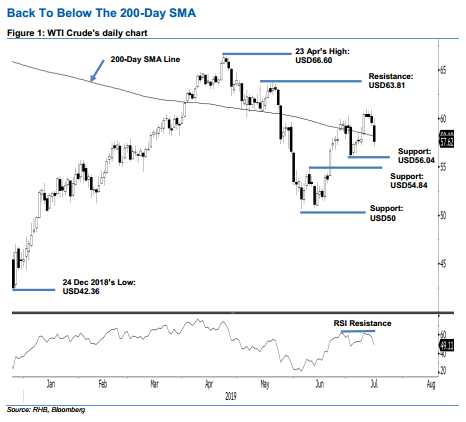

WTI Crude Futures - Back to Below the 200-Day SMA

rhboskres

Publish date: Wed, 17 Jul 2019, 05:51 PM

Maintain long positions until the reversal is confirmed. The WTI Crude performed negatively in the latest session. It settled USD1.96 weaker at USD57.62, while the low and high were recorded at USD57.07 and USD60.06. The weak session also placed the commodity back below the 200-day SMA line. Price actions in the coming session are important to observe. Further negative price actions will likely suggest that the WTI Crude is at risk of experiencing a deeper retracement. For now, we keep to our positive trading bias.

Until there are price confirmations to suggest the commodity’s upward move has reached an end, we recommend traders stay in long positions. We initiated these at USD60.43, or the closing level of 11 Jul. For risk-management purposes, a stop-loss can be placed below the USD56.04 mark, which was the low of 3 Jul.

The immediate support is expected at USD56.04, ie the low of 3 Jul. This is followed by USD54.84, which was the high of 10 Jun. Moving up, the immediate resistance is set at USD63.81, or the high of 20 May. This is followed by USD66.60, which was the high of 23 Apr.

Source: RHB Securities Research - 17 Jul 2019

.png)