Hang Seng Index Futures - Still Bullish

rhboskres

Publish date: Thu, 18 Jul 2019, 04:57 PM

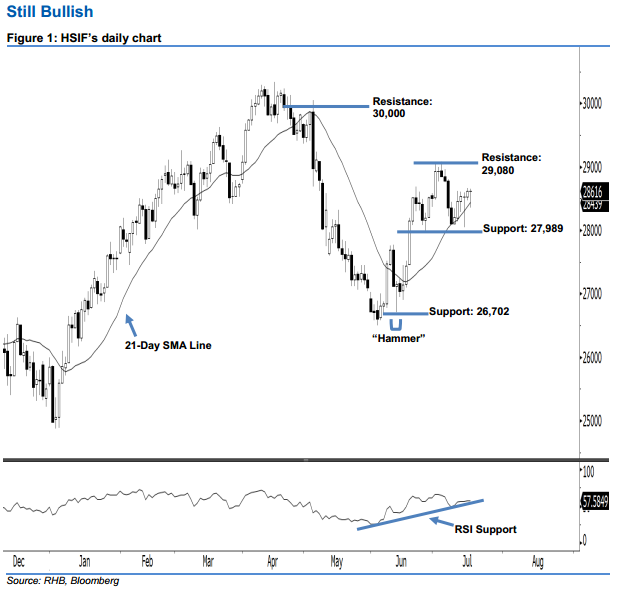

Maintain long positions. The HSIF formed a “Doji” candle yesterday. It closed at 28,616 pts, after hovering between a high of 28,657 pts and low of 28,358 pts throughout the session. Given that the index has managed to stay above the previously-indicated 27,989-pt support for nearly a month, the upside move has not been diminished yet. Moreover, the 21-day SMA line is still pointing upwards, implying that additional buying momentum may be present in the coming sessions. Overall, we keep our bullish view on HSIF’s outlook.

Based on the daily chart, the immediate support is seen at 27,989 pts, ie the low of 26 Jun. If this level is taken out, look to 26,702 pts – which was the low of 13 Jun’s “Hammer” pattern – as the next support. Towards the upside, we maintain the immediate resistance at 29,080 pts, which was the high of 4 Jul. Meanwhile, the next resistance is anticipated at the 30,000-pt round figure, also set near the high of 6 May’s long black candle.

Thus, we advise traders to stay long, given that we initially recommended initiating long above the 27,436-pt level on 12 Jun. A trailing-stop can be set below the 27,989-pt level in order to lock in part of the profits.

Source: RHB Securities Research - 18 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024