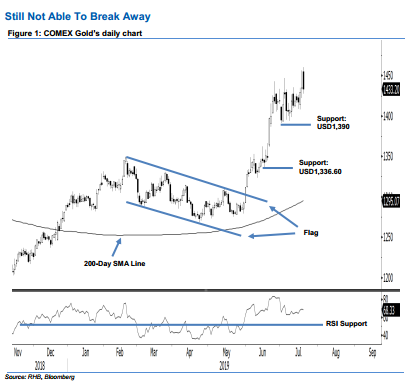

COMEX Gold - Still Not Able to Break Away

rhboskres

Publish date: Mon, 22 Jul 2019, 10:12 AM

Bulls are still attempting a firm breakaway; maintain long positions. The precious metal failed to hold on to its earlier session’s positive performance – as it ended USD1.30 softer at USD1,433.20. Trading range was wide – between USD1,427.60 and USD1,460.30. The session marked the second consecutive attempt by the bulls to decisively break away from its two weeks sideways consolidation phase. Price actions in the coming sessions are critical – if the bulls still unable to push the commodity further to the upside, the risk for the commodity to experience a deeper retracement could increase. For now, we keep to our positive trading bias.

Until there are firm signals to suggest the commodity’s upward move has reached an end, we retain our recommendation for traders to stay in long positions. We opened these positions at USD1,333.60, which was the closing level of 5 Jun. For risk-management purposes, a stop-loss can now be placed below the USD1,390 mark.

The immediate support is set at USD1,390, or near the low of 1 Jul. This is followed by USD1,336.60, which was the low of 17 Jun. On the other hand, the overhead resistance is now pegged at the USD1,500 threshold. This is followed by the USD1,550 level.

Source: RHB Securities Research - 22 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024