E-mini Dow Futures - Positive Sentiment Stays Intact

rhboskres

Publish date: Tue, 23 Jul 2019, 10:26 AM

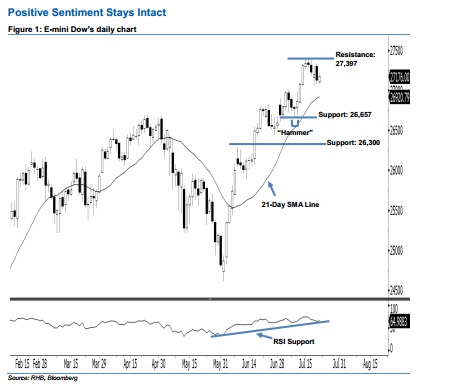

Sentiment remains bullish; stay long. The E-mini Dow ended higher to form a white candle last night. It rose 46 pts to close at 27,176 pts, after oscillating between a high of 27,216 pts and low of 27,078 pts. On a technical basis, we expect the rebound that started from 9 Jul’s “Hammer” pattern to likely continue. This is because the E-mini Dow has stayed above the 26,657-pt support mentioned previously, and the rising 21-day SMA line – this implies that the market sentiment is bullish. Overall, we keep our bullish view on the E-mini Dow’s outlook.

Based on the daily chart, we anticipate the immediate support at 26,657 pts, ie the low of 9 Jul’s “Hammer” pattern. The next support would likely be at 26,300 pts, situated near the midpoint of 18 Jun’s long white candle. Towards the upside, the near-term resistance is seen at the 27,397-pt historical high. This is followed by the 28,000-pt psychological mark.

Hence, we advise traders to stay long, following our recommendation to initiate long above the 25,437-pt level on 7 Jun. At the same time, a trailing-stop is preferably set below the 26,657-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 23 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024