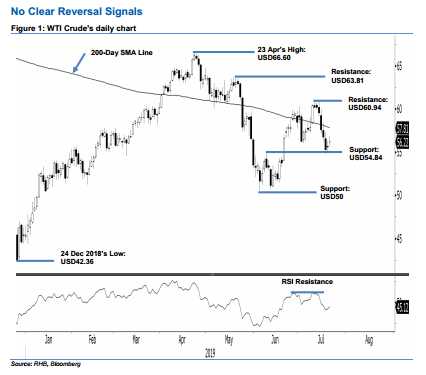

WTI Crude Futures - No Clear Reversal Signals

rhboskres

Publish date: Tue, 23 Jul 2019, 10:28 AM

Maintain short positions as there are no clear reversal signals from the immediate support. The WTI Crude gained USD0.59 to close at USD56.22. This was after it reached a low and high of USD55.72 and USD56.84. The positive session came after the commodity tested the immediate support of USD54.84 in the previous two sessions. Even so, the positive session did not produce sufficient technical signals to suggest that the retracement phase, which started from the high of USD60.94 on 1 Jul, has reached an end. Furthermore, the commodity is still capped by the 200-day SMA line. As such, we keep to our negative trading bias.

Without any clear price reversal signals from the said immediate support, we continue to recommend traders to stay in short positions. We initiated these at USD55.30, which was the closing level of 19 Jul. For risk management purposes, a stop-loss can be placed above the USD60.94 mark.

The immediate support is still expected at USD54.84, which was the high of 10 Jun. This is followed by USD50. On the other hand, the immediate resistance is set at USD60.94, which was the high of 1 Jul. This is followed by USD63.81, or the high of 20 May.

Source: RHB Securities Research - 23 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024