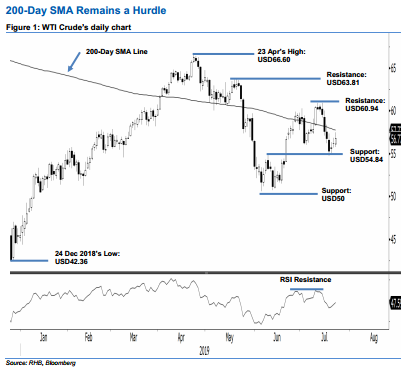

WTI Crude Futures - 200-Day SMA Remains a Hurdle

rhboskres

Publish date: Wed, 24 Jul 2019, 05:09 PM

Maintain short positions as the commodity is still capped by the 200-day SMA. The black gold formed a white candle to advance USD0.55 to USD56.77. This was after it hit a low and high of USD55.74 and USD57.47. The recent sessions’ price actions suggest that a minor rebound is developing after the commodity tested the immediate support of USD54.84 recently. However, at this juncture, provided that the commodity is still capped by the 200-day SMA line, prospects for a stronger rebound are low. Hence, we keep to our negative trading bias.

Until there are clearer price signals to suggest that a stronger rebound is on the cards, we continue to recommend traders to stay in short positions. We initiated these at USD55.30, which was the closing level of 19 Jul. For risk management purposes, a stop-loss can be placed above the USD60.94 mark.

Immediate support is set at USD54.84, which was the high of 10 Jun. This is followed by USD50. Moving up, the immediate resistance is set at USD60.94, which was the high of 1 Jul. This is followed by USD63.81, or the high of 20 May.

Source: RHB Securities Research - 24 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024