Hang Seng Index Futures - Outlook Still Positive

rhboskres

Publish date: Wed, 24 Jul 2019, 05:11 PM

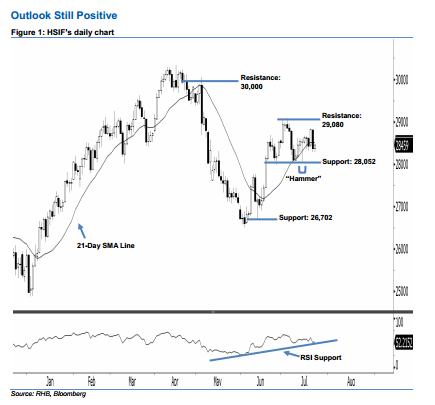

Maintain long positions. The HSIF ended higher to form a white candle yesterday. It settled at 28,459 pts, after oscillating between a high of 28,489 pts and low of 28,290 pts. Still, the upward momentum is not diminished as the index continues to stay above the 28,052-pt support mentioned previously. On a technical basis, as long as the HSIF does not negate the bullishness of the “Hammer” pattern created on 15 Jul, there is a possibility that the rebound would continue.

Currently, the immediate support is seen at 28,052 pts, ie the low of 15 Jul’s “Hammer” pattern. If a decisive breakdown arises, look to 26,702 pts – which was the previous low of 13 Jun – as the next support. To the upside, we are eyeing the immediate resistance at 29,080 pts, defined from 4 Jul’s high. The next resistance is anticipated at the 30,000-pt psychological mark, also set near the high of 6 May’s long black candle.

Hence, we advise traders to maintain long positions, since we initially recommended initiating long above the 27,436-pt level on 12 Jun. A trailing-stop can be set below the 28,052-pt mark in order to secure part of the gains.

Source: RHB Securities Research - 24 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024