FCPO - Above The 50-Day SMA Line

rhboskres

Publish date: Thu, 25 Jul 2019, 10:00 AM

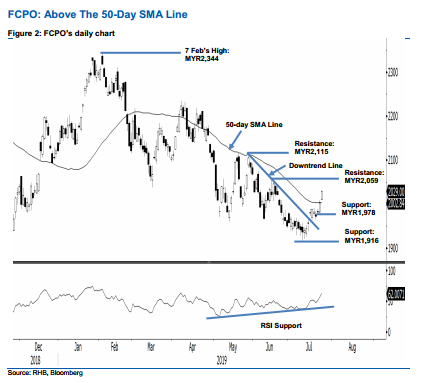

Initiate long positions as the bulls have managed to crack above the 50-day SMA line. The FCPO formed a white candle in the latest session, which, at the closing, breached above the 50-day SMA line. The session’s low and high were posted at MYR2,011 and MYR2,031, before it settled MYR25 higher at MYR2,029. As the commodity has managed to cross the said SMA – which it had struggled to overcome in the recent months – chances are now better for it to stage a stronger counter-trend rebound. Hence, we switch our trading bias to positive.

Our previous short positions initiated at MYR1,951, the closing level of 28 Jun, were closed out at the latest session at MYR2,015. On the bias that a stronger counter-trend rebound is developing, we initiate long positions at the latest closing level. For risk management purposes, a stop-loss can be placed below the MYR1,978 level.

We revised the immediate support to MYR1,978, which was the low of 23 Jul. This is followed by MYR1,916, the low of 10 Jul. On the other hand, the immediate resistance is now pegged at the MYR2,059 threshold, the high of 18 Jun. This is followed by MYR2,115, which was the high of 29 May.

Source: RHB Securities Research - 25 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024