FKLI - Stay Bearish

rhboskres

Publish date: Thu, 29 Aug 2019, 09:54 AM

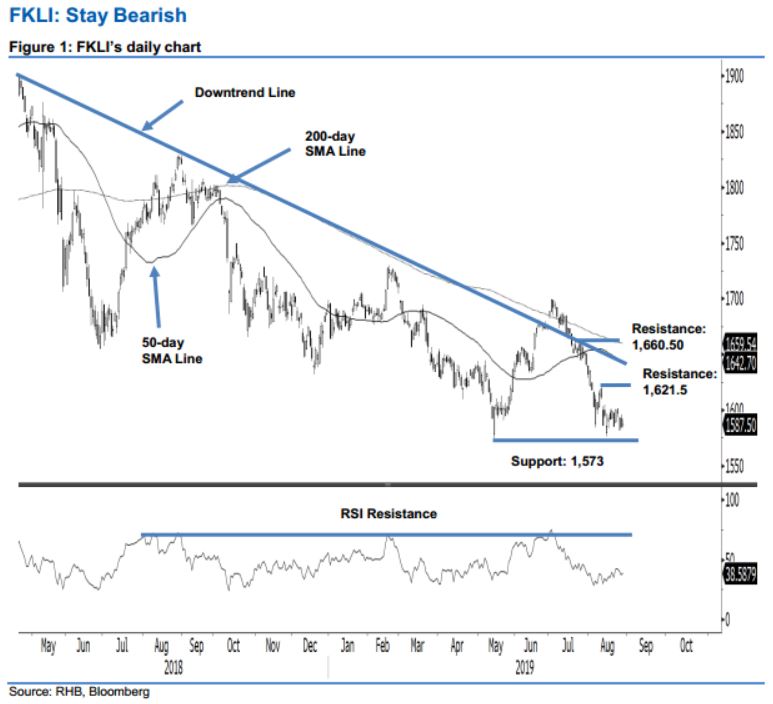

Maintain short positions as the trend is still negative. The FKLI performed positively in the latest trade. It managed to rebound from an intraday low of 1,584 pts to close 2.5 pts higher at 1,587.5 pts. However, from a broad technical picture, the index’s negative bias that resumed from the failed attempt to breach above the 1,700-pt mark on 2 Jul is still firmly in place. Towards the downside, we are still expecting the immediate support of 1,573 pts to be tested. On the other hand, for a stronger rebound to possibly develop, the immediate resistance of 1,621.5 pts needs to be crossed decisively. Based on these, we keep to our negative trading bias.

As the overall trend is still firmly negative, traders are recommended to stay in short positions. We initiated these at 1,668 pts, the closing level of 12 Jul. To manage risks, a stop-loss can now be placed above the 1,621.5-pt mark.

The immediate support is expected to appear at 1,573 pts, the low of 14 May. This is followed by the 1,550-pt mark. Meanwhile, the immediate resistance is set at 1,621.5 pts, the high of 9 Aug. This is followed by 1,660.5 pts, the high of 24 Jul.

Source: RHB Securities Research - 29 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024