Hang Seng Index Futures - Taking a Breather

rhboskres

Publish date: Wed, 04 Sep 2019, 11:56 AM

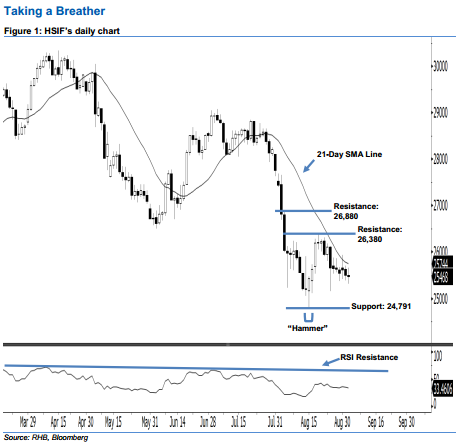

Stay long. The HSIF ended lower to form a black candle yesterday. It settled at 25,468 pts, after oscillating between a high of 25,663 pts and low of 25,313 pts. The formation of yesterday’s candle illustrates that the market may be taking a breather following the recent gains. Still, we maintain our positive view, since the aforementioned black candle did not break below the 24,791-pt support mentioned previously. As the index did not negate the bullishness of 15 Aug’s “Hammer” pattern, this implies that the positive sentiment stays unchanged.

As seen in the chart, we are eyeing the near-term support level at the 25,000-pt round figure. This is followed by 24,791 pts, which was the low of 15 Aug’s “Hammer” pattern. On the other hand, we anticipate the immediate resistance level at 26,380 pts, ie the high of 20 Aug. The next resistance would likely be at 26,880 pts, ie the high of 5 Aug’s long black candle.

Thus, we advise traders to maintain long positions, given that we initially recommended initiating long above the 26,000-pt level on 21 Aug. A stop-loss can be set below the 24,791-pt mark in order to limit the downside risk.

Source: RHB Securities Research - 4 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024