WTI Crude Futures - No Reversal Signal Yet

rhboskres

Publish date: Mon, 07 Oct 2019, 10:17 AM

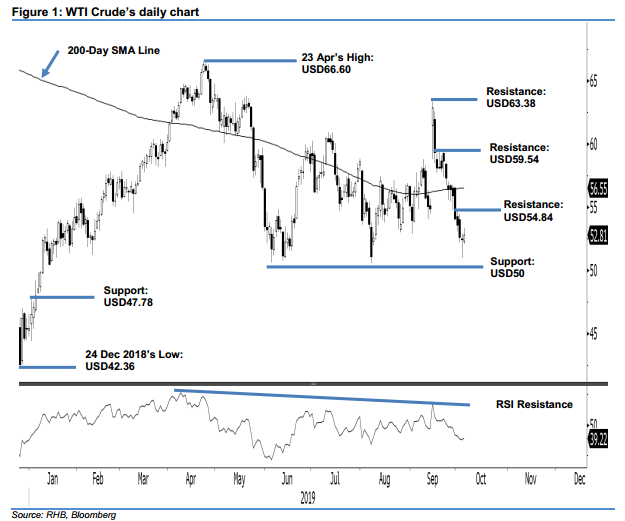

Maintain short positions, as the bulls are still unable to signal a rebound. The WTI Crude settled the latest session USD0.36 better at USD52.81. This was after it ranged between USD52.04 and USD53.35. The positive showing is an encouraging follow-up from the prior session’s sharp intraday reversal from an area near the USD50 support level. However, given that the commodity failed to close above the USD53 mark, this means there is still no price confirmation to suggest that WTI Crude is ready to stage a stronger rebound phase. As such, we keep to our negative trading bias.

Until the bulls are able show a better control over the price trend, traders are advised to stay in short positions. We initiated these at USD56.49, which was the closing level of 25 Sep. For risk-management purposes, a stop loss can now be placed above the USD53 mark.

We are keeping the immediate support at USD50, a round figure. This is followed by USD47.78, which was the high of 2 Jan. On the other hand, the immediate resistance is at USD54.84, or the high of 1 Oct. This is followed by USD59.54, ie the high of 19 Sep.

Source: RHB Securities Research - 7 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024