WTI Crude Futures - the Bulls Are Capped

rhboskres

Publish date: Tue, 08 Oct 2019, 10:10 AM

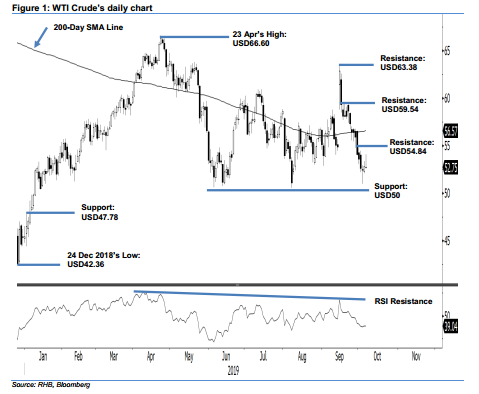

No change to the negative bias; maintain short positions. The WTI Crude failed to sustain its intraday positive posture, as it settled slightly lower by USD0.06 to USD52.75. This was after the black gold hit a high of USD54.06. Despite showing signs of developing a minor rebound over the recent sessions – after it retraced into an area near the USD50.00 support level on 3 Oct – the WTI Crude has not produced enough positive follow-ups to indicate that the retracement from the high of USD63.38 on 16 Sep has reached an end. Towards the upside, an upside breach of USD53.00 at the closing is required to signal prospects for a stronger rebound to develop. Until this happens, we keep to our negative trading bias.

As the bulls are still lacking of strength to reverse the weak trend, traders are advised to stay in short positions. We initiated these at USD56.49, which was the closing level of 25 Sep. For risk-management purposes, a stop loss can now be placed above the USD53.00 mark.

The immediate support is set at USD50.00, a round figure. This is followed by USD47.78, which was the high of 2 Jan. Moving up, the immediate resistance is at USD54.84, or the high of 1 Oct. This is followed by USD59.54, ie the high of 19 Sep.

Source: RHB Securities Research - 8 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024