E-mini Dow Futures - Downside Move Expected

rhboskres

Publish date: Wed, 09 Oct 2019, 06:17 PM

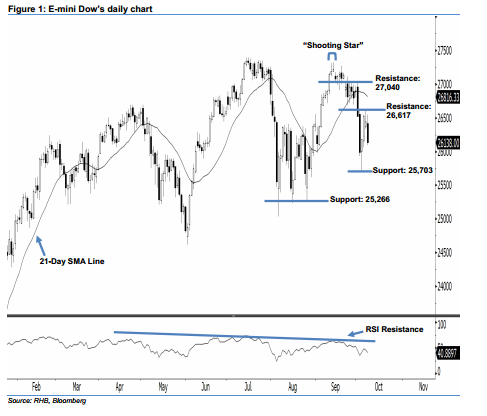

Maintain short positions. The E-mini Dow ended lower to form a black candle last night. It lost 301 pts to close at 26,138 pts, off the session’s high of 26,549 pts and low of 26,092 pts. From a technical viewpoint, the bearish trend is likely to continue. This was after the index erased most of the previous two days’ gains and marked a lower close below the 21-day SMA line. Furthermore, as the 14-day RSI indicator deteriorated to a weaker reading at 40.88 pts as of yesterday, the bearish sentiment has been enhanced. Overall, we stay bearish on the E-mini Dow’s outlook.

Based on the daily chart, the immediate resistance level is seen at 26,617 pts, ie the high of 2 Oct’s long black candle. The next resistance is maintained at 27,040 pts, near the highs of 23 Sep, 26 Sep, and 1 Oct. We are eyeing the immediate support level at 25,703 pts, which was the previous low of 3 Oct. Meanwhile, the next support is seen at 25,266 pts, ie the low of 26 Aug.

Hence, we advise traders to maintain short positions, given that we previously recommended initiating short below the 26,780-pt level on 2 Oct. In the meantime, a trailing-stop can be set above the 26,617-pt threshold to minimise the risk per trade.

Source: RHB Securities Research - 9 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024