FCPO - Rally Still In Motion

rhboskres

Publish date: Wed, 30 Oct 2019, 05:16 PM

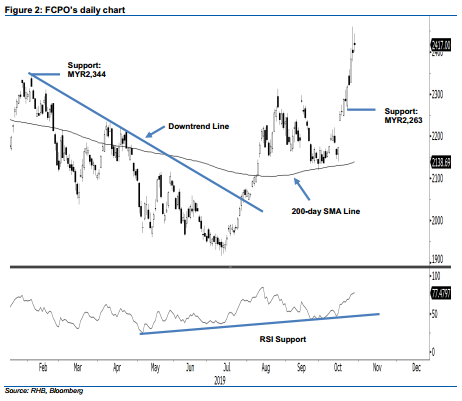

Upward move still intact; maintain long positions. The FCPO formed a white candle to settle MYR19 higher, at MYR2,417, yesterday – crossing above the previous immediate resistance of MYR2,400. During the intraday, the commodity reached a high and low of MYR2,444 and MYR2,400. We note the RSI reading is indicating that the uptick, which resumed after the 200-day SMA line was retested in end-September, has reached an overbought reading. However, in the absence of negative price actions, the commodity’s multi-month upward move is still considered intact. This is further supported by the 200-day SMA line, which continues to curve upwards. Premised on this, we keep to our positive trading bias.

As the bulls still firmly control the price trend, traders are recommended to stay in long positions. These were initiated at MYR2,175, the closing level of 9 Sep. To manage risks, a stop loss can now be placed below MYR2,328.

The immediate support is pegged at MYR2,344, which was the high of 7 Feb. This is followed by MYR2,263, the low of 22 Oct. On the other hand, immediate resistance is now pegged at MYR2,457, the high of 4 June 2018. This is followed by MYR2,500.

Source: RHB Securities Research - 30 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024