E-mini Dow Futures - Sentiment Remains Bullish

rhboskres

Publish date: Thu, 07 Nov 2019, 05:50 PM

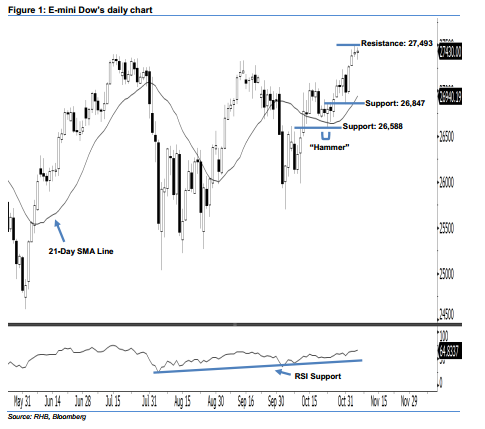

Stay long, with a trailing stop set below the 26,847-pt support. The E-mini Dow formed another “Doji” candle last night. It settled at 27,430 pts, after hovering between a high of 27,470 pts and low of 27,337 pts throughout the session. The formation of 5-6 Nov’s “Doji” candles illustrates that the market may be taking a pause after the recent surge. Still, we maintain our bullish outlook view, since the index has continued to stay above the previously indicated 26,847-pt support. In view of the positive slope of the 21-day SMA line, this also leads us to believe that the rebound from 23 Oct’s “Hammer” pattern will likely persist.

Based on the daily chart, we are eyeing the immediate support level at 26,847 pts, ie 31 Oct’s low. If this level is taken out, look to 26,588 pts – ie the low of 23 Oct’s “Hammer” pattern – as the next support. On the other hand, we now anticipate the near-term resistance level at the 27,493-pt record high. This is followed by the 28,000-pt psychological mark.

Therefore, we advise traders to stay long, in line with our initial recommendation to have long positions above the 26,750-pt level on 16 Oct. A trailing stop can be set below the 26,847-pt mark in order to limit the risk per trade.

Source: RHB Securities Research - 7 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024