Hang Seng Index Futures - Charts Another White Candle

rhboskres

Publish date: Wed, 06 Nov 2019, 05:16 PM

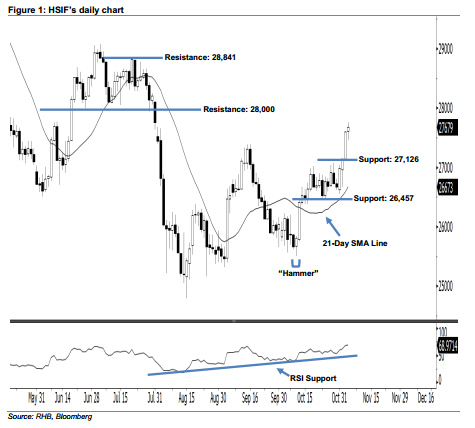

Stay long while setting a new trailing-stop below the 27,126-pt support. The upside strength of the HSIF continued as expected as a white candle was formed yesterday. It settled at 27,679 pts, after hovering between a high of 27,763 pts and low of 27,457 pts. As the HSIF has successfully posted a fourth consecutive white candle above the rising 21-day SMA line, this can be viewed as the bulls extending their upward momentum. Meanwhile, the 14-day RSI indicator is now rising higher without being overbought, this implies a bullish outlook.

Currently, the immediate support level is seen at 27,126 pts, ie the low of 4 Nov’s long white candle. The crucial support is maintained at 26,457 pts, defined from 23 Oct’s low. Towards the upside, we are eyeing the near-term resistance level at the 28,000-pt psychological mark. This is followed by 28,841 pts, which was the high of 19 Jul.

To re-cap, on 16 Oct, we initially recommended traders to initiate long positions above the 26,150-pt level. We continue to advise them to stay long for now, while setting a new trailing-stop below the 27,126-pt threshold. This is in order to lock in part of the profits.

Source: RHB Securities Research - 6 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024