Hang Seng Index Futures - Downside Move Stays Intact

rhboskres

Publish date: Wed, 13 Nov 2019, 05:17 PM

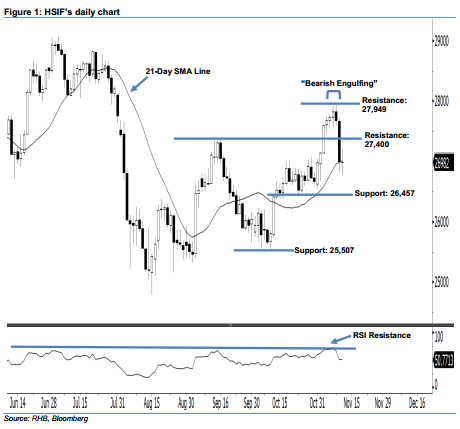

Stay short. After posting a long black candle on 11 Nov, the HSIF formed a “Doji” candle yesterday. It settled at 26,982 pts, after hovering between a high of 27,212 pts and low of 26,776 pts. Still, the bearish sentiment stays unchanged, as this candle can only be viewed as sellers probably taking a pause after the recent plunge. Since the index has dropped below the 21-day SMA line, this indicates that the bearish sentiment remains intact. Overall, we believe the downside swing that started off 8 Nov’s “Bearish Engulfing” pattern should likely continue.

As seen in the chart, the immediate resistance level is seen at 27,400 pts, which is situated near the midpoint of 11 Nov’s long black candle. The next resistance will likely be at 27,949 pts – determined from the high of 8 Nov’s “Bearish Engulfing” pattern. Towards the downside, we are eyeing the immediate support at 26,457 pts, ie the low of 23 Oct. If this level is taken out, look to 25,507 pts – the previous low of 10 Oct – as the next support.

Therefore, we advise traders to maintain short positons, since we initially recommended initiating short below the 27,400-pt level on 12 Nov. Meanwhile, a stop-loss is advisable – set above the 27,949-pt threshold – to limit the risk per trade.

Source: RHB Securities Research - 13 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024