FCPO - Minor Consolidation Taking Place

rhboskres

Publish date: Tue, 19 Nov 2019, 09:59 AM

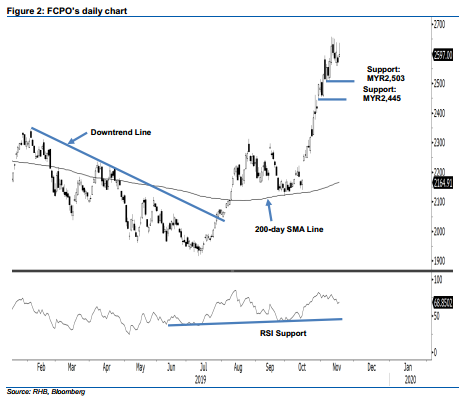

Risk of deeper correction still contained, maintain long positions. The FCPO ended the latest session MYR10 weaker at MYR2,597. This came after it reached a low and high of MYR2,587 and MYR2,636. Despite the weak session, there is still no price confirmation to indicate that the commodity is due for a deeper price correction. Instead, based on the recent sessions’ price actions, chances are still high that the FCPO is merely experiencing a minor pause. This is meant to correct its recent multi-week upward move, which reached an overbought RSI reading. We maintain our positive trading bias until signs of a deeper retracement emerges.

As the correction is still narrow in nature, traders are recommended to remain in long positions. These were initiated at MYR2,175, or the closing level of 9 Sep. To manage risks, a stop-loss can now be placed below MYR2,558.

The immediate support is expected at MYR2,503, ie the low of 6 Nov. This is followed by MYR2,445, or the low of 30 Oct. Meanwhile, the immediate resistance is set at MYR2,683, which was the high of 20 Nov 2017 – this is followed by MYR2,758, or the high of 16 Nov 2017.

Source: RHB Securities Research - 19 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024