E-mini Dow Futures - Taking a Breather

rhboskres

Publish date: Fri, 22 Nov 2019, 10:06 AM

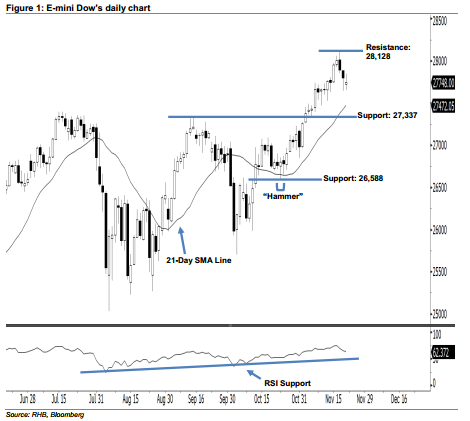

Maintain long positions. The E-mini Dow formed a “Doji” candle last night. It dropped 52 pts to close at 27,748 pts, off its high of 27,846 pts and low of 27,654 pts. However, the bullish sentiment stays unchanged, as this candle can only be viewed as buyers probably taking a breather after the recent gains. Since the index is still trading above the rising 21-day SMA line, this indicates that the upside momentum is not diminished so far. Overall, we believe the rebound that started off 23 Oct’s “Hammer” pattern will likely persist in the coming sessions.

As shown in the chart, we anticipate the immediate support level at 27,337 pts – this was determined from the low of 6 Nov. The next support will likely be at 26,588 pts, ie the low of 23 Oct’s “Hammer” pattern. On the other hand, the immediate resistance level is now seen at the 28,128-pt record high. If a breakout occurs, the next resistance is situated at the 28,500-pt round figure.

Therefore, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 26,750-pt level on 16 Oct. In the meantime, a trailing-stop can be set below the 27,337-pt threshold to lock in part of the profits.

Source: RHB Securities Research - 22 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024