FCPO - Tightening Up Trailing Stop

rhboskres

Publish date: Mon, 16 Dec 2019, 10:22 AM

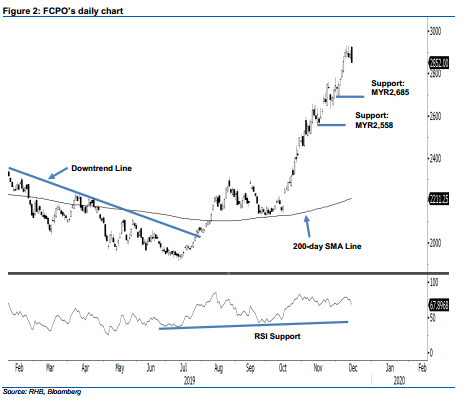

Maintain long positions while tightening risk management. The FCPO ended the latest session on a negative note. At the closing, it shed MYR39 to close at 2,852, the low and high were posted at MYR2,850 and MYR2,928. The negative session pushed the commodity below its recent sessions’ narrow trading range. This could indicate the risk is higher for the commodity to enter into a correction phase, after its recent upward move pushed its RSI into an overbought reading. However, to confirm this, further negative price actions in the coming sessions are needed. Until this happens, we keep to our positive trading bias.

Until the possibility for a correction phase is confirmed, traders should remain in long positions. These were initiated at MYR2,175, the closing level of 9 Oct. To manage risks, a stop-loss can now be placed below MYR2,800.

We are keeping the immediate support at MYR2,685, the low of 2 Dec, followed by MYR2,558, the low of 14 Nov. Meanwhile, the immediate resistance is pegged at MYR2,986, the high of 16 February 2017. This is to be followed by MYR3,075, the high of 15 February 2017.

Source: RHB Securities Research - 16 Dec 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024